For those looking to start a small business in Nevada, an LLC, or limited liability company, is a popular type of business structure.

Setting up some types of business structures can result in a time-consuming, daunting process, but the stress level reduces quite a bit with an LLC.

Nevada’s Secretary of State oversees the formation and management of LLCs in the state, and this office makes the process easier than you may think.

In most cases, all of the work can occur online, including the completion of forms and payment of fees.

When you are ready to start the process of creating an LLC in Nevada, you can be up and running in a short amount of time.

The Easy Parts of Starting an LLC in Nevada

Starting an LLC in Nevada is a relatively easy process. The majority of business owners, even those new to running a business, often can complete the process on their own without any help.

Filing Online

Nevada offers all of the forms required to set up an LLC on the Secretary of State’s website. Business owners are able to submit all of the information online, if desired, by filling in digital forms.

This greatly simplifies the process of submitting the information, while also allowing the state to process it faster than with paper documents. (New business owners still have the ability to print and file paper forms with the required information, if desired.)

Easy to Find Help

Even though filing the documents required for starting the LLC should be easy for most new business owners, some people may not want to do this themselves.

Multiple business entities exist in Nevada that can handle the entire process of completing the forms for the LLC. Some of these entities even will provide advice on starting the business.

You can expect to pay anywhere from a couple of hundred dollars to several hundred dollars per year for this type of work, depending on the number of services desired.

Simple Business Structure

Compared to some other business structures, the LLC does not have complex requirements.

Corporations often must hire extra personnel to be able to manage all of the different legal requirements for that type of business structure. Corporations often have limitations on the types of owners and on the ownership structure they can have as well.

With the LLC, the ownership structure has no limitations on the number of owners. The owners are able to structure the profit-sharing in any way they desire. Even if one owner has a 50% share in the business, that owner does not have to receive 50% of the profits.

Simple Tax Structure

When running an LLC, the profits for the business transfer directly to the owners of the LLC. The owners then will report these profits as personal income on their own income tax forms. There’s no need to file an income tax form for the LLC, which simplifies filing taxes.

With this type of business structure, the profits of the company only receive one level of taxation, which is a major benefit. In a corporation, the business will pay taxes on its income. When it issues dividends from those profits to its stakeholders, those people will pay taxes on the dividends, meaning the money receives two levels of taxation.

The Difficult Parts of Starting an LLC in Nevada

Although the LLC will work nicely for quite a few types of small businesses, it isn’t perfect in every situation, especially in Nevada.

Higher Fees in Nevada

When starting an LLC in Nevada, business owners will pay higher than average fees versus other states in the initial filing. They then will have to pay larger than average annual fees to keep the business active in the state. This can be a source of frustration for someone who owned an LLC in another state and now is starting one in Nevada.

Nevada requires a minimum fee of $425 at the initial time of filing. This cost is two to three times higher than an average state’s cost.

Additionally, Nevada requires fees for an annual state business license and an annual management filing, which costs another $350 per year. Some states require annual fees, but most of them are much lower than Nevada’s annual cost. Some states have no annual fees for LLCs.

Taxable Employee Benefits

Running an LLC with employees may present some challenges for the business that don’t exist with other types of business structures.

For example, if you give your employees benefits, such as health insurance coverage, the employees must claim this as income on their personal income taxes. For a corporation, such benefits are not taxable for the employees. This can create some hard feelings among employees and may make it a little tougher to hire people.

Step 1: Select a Name for the LLC

For some new business owners, selecting a creative name for the business is one of the most enjoyable parts of the process. Selecting a name allows the owner to set the business apart from others in a similar physical location or in a similar area of the market.

However, when forming an LLC in Nevada, the business owner cannot just pick any name. The limited liability company’s name has to adhere to certain requirements. Selecting a name that does not meet the state’s rules for LLCs could result in the Secretary of State’s office rejecting the application.

Understand the Naming Rules

With any Nevada LLC, the name must include words or letters in the name that clearly identify the business as an LLC. Some examples that would fit this requirement include:

- LLC

- L.L.C.

- Limited Liability Co.

- Limited Liability Company

Typically, a company will create the main name it wants and then use “LLC” after a comma at the end of the main name.

Check the Availability of the Desired Name

With the desired name in mind, the business owner should always check with the Secretary of State’s office to see if the name is available. All limited liability companies must have a unique name in Nevada. It does not cost anything to check for an available name.

You will apply for this name formally at the time you submit the Articles of Organization (in Step 3).

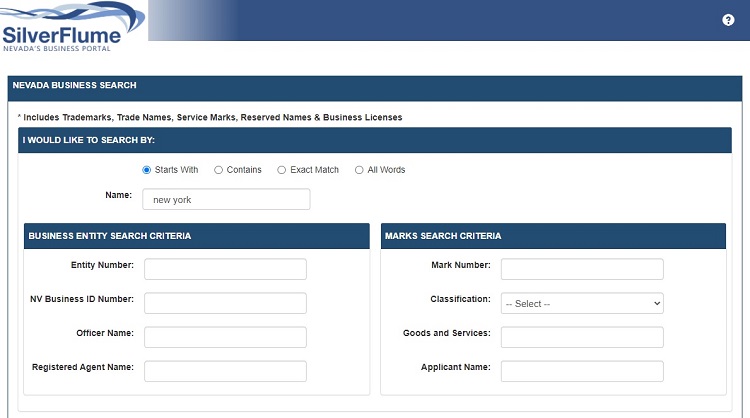

Nevada has a searchable database, called SilverFlume, that allows business owners to see if the desired name is available. You can search for existing business names that have a particular word in them, or you can search for only exact matches.

Because of the way some LLCs structure their names, it sometimes is easier to search for a particular word versus an exact match. You then can see all potential matches, so you don’t end up selecting a name that is highly similar to an existing name.

If another business owner already has the desired name, you will have to select a different name.

Reserve a Business Name

Some business owners may suddenly come up with a great idea for a business, including a name. But the prospective owner may not be ready to begin the process of filing an LLC in Nevada.

In a case like this, the state allows people to file a form for a name reservation. By completing this form online or on paper, the business owner can gain the right to control the name for up to 90 days from the state’s acceptance of the form.

To complete this process, the business owner will need to pay a $25 fee.

Another reason to reserve a name would occur when the business owner wants to also reserve a website domain name that matches the new business name. The owner can reserve the business name and then can complete the process of obtaining the desired website name. Once the owner secures both names, he or she can go ahead with the official LLC paperwork.

Step 2: Select a Registered Agent

When starting an LLC in Nevada, the business owner must select a registered agent. The state gives businesses a few different options for completing this step.

What a Registered Agent Does

A registered agent is a person who serves as the contact point for the limited liability company for legal purposes. When other people and entities want to send your business legal forms or notices, the registered agent is the person who accepts these items. The items may include notices of lawsuits, tax forms, and correspondence from the government.

The public information about your LLC that will appear on the Nevada Secretary of State’s website will include the contact information for the registered agent.

Options for Finding a Registered Agent

A registered agent can be an individual person. It also can be an entity that has a license to operate in the state of Nevada as a registered agent.

The person or entity serving as the registered agent must have a physical address in Nevada. This address gives others a location to deliver legal forms. The registered agent should be available at the listed address during normal business hours.

Sometimes, a business owner will choose to serve as his or her own registered agent. This is perfectly legal under Nevada state law. If you as the owner will be available during normal business hours at the business address, it may be convenient to serve as your own registered agent. You also could pick an employee to serve as the registered agent.

Another option is to hire a third-party entity to serve as the registered agent. For business owners who do not want their contact information listed publicly or who rarely will work in a physical office, hiring another entity is a nice option.

The state of Nevada maintains a list of registered agent entities that can operate in the state. The cost of hiring an entity to serve as a registered agent can run from around $50 annually to around $200.

Step 3: File the Proper Forms and Pay Fees

When filing the information about the LLC with the Secretary of State in Nevada, business owners must complete three different forms. The total fee for filing these forms is $425.

When filing online, these forms may require a few business days for verification. When filing by paper, these forms may require a couple of weeks for verification. Nevada also offers an expedited option, meaning the state will review the paperwork faster, for a price starting at $125.

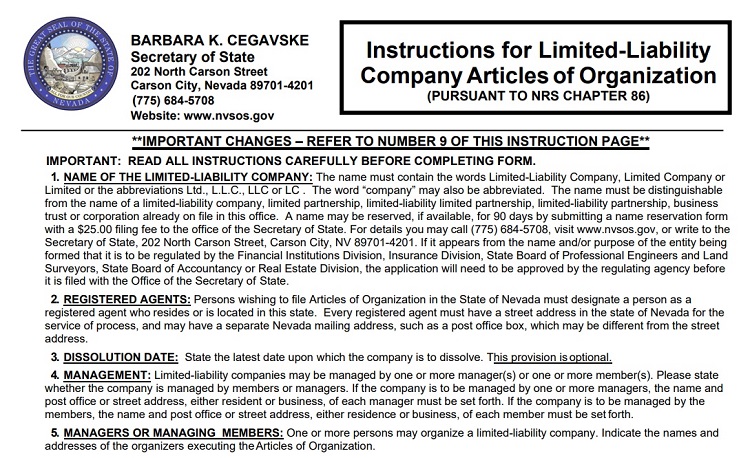

Articles of Organization

For starters, the new LLC must create an Articles of Organization. In Nevada, the business owner can file this document online through SilverFlume or by paper and postal mail.

Within the Articles of Organization, the business will need to provide the Secretary of State with a number of pieces of information, including:

- Application for the LLC’s name

- Information about the registered agent

- Date of dissolution for the LLC (if applicable)

- Management structure

- Name and address of the organizer (or the person who fills out the form)

- Signatures of organizer and registered agent

Annual State Business License

In the state of Nevada, LLCs must pay for a state business license at the time of applying for the LLC. The business license is something the LLC will have to renew each year for a fee of $200. (In the initial filing for the LLC, the state business license fee rolls into the fees for all of the forms mentioned here in Step 3.)

A business can file the form for the business license online or by paper. The business license form and the managing members form, which we’ll discuss next, are on the same form.

The business owner must include basic information about the business, including the business name and physical address, on the license form. This form is easy to fill out in a few minutes.

Some cities in Nevada also require businesses to apply for and pay for a separate annual city-based business license.

Initial Managing Members Form

The LLC will have one or more managing members. The state of Nevada requires the business to submit a list of these people at the time of filing the Articles of Organization and the state business license. This is the initial list of managing members.

Each managing member’s mailing address and name will be part of the form. Only one manager needs to sign the form.

Annually, the LLC will have to file an updated form listing the managing member or members. The state then calls it the annual list of managing members. Businesses will have to pay $150 each year to file this list, even if nothing changes on the form from year to year. (The initial fee for this form is part of the $425 fee for all of these forms together that we mentioned earlier.)

Step 4: Optional Steps

The first three steps are all the state of Nevada requires. However, many LLCs will want to complete a couple of other steps, just to simplify the process of running the business.

Create an LLC Operating Agreement

Nevada does not require limited liability companies operating in the state to create and submit an LLC operating agreement. However, many LLCs do create and use this document for their own purposes.

The operating agreement lays out the structure of the owner or owners in the business. It also describes the procedures by which the business will operate.

By having all of these items in an official document, everyone involved in the business will have a clear understanding of the way the business will operate. If conflicts arise later, the ownership group can refer back to this document to resolve the issues.

File for an Employer Identification Number

For tax purposes, businesses need an Employer Identification Number, or EIN. Businesses need an EIN to be able to open a business banking account, file taxes at both the state and federal level, and hire employees.

Some small businesses that started as sole proprietorships and are now migrating to LLCs may have EINs already. However, the IRS requires the businesses to obtain a new EIN when migrating to LLC status.

The IRS will issue a business an EIN for free. This EIN works for both federal and state taxes.