American Airlines said fourth quarter revenues would remain well below pre-pandemic levels, but should come in firmly ahead of their autumn forecasts.

American Airline (AAL) – Get American Airlines Group, Inc. Report shares moved higher Tuesday after the biggest U.S. carrier said fourth quarter revenues came in firmer than expected while noting improving profit margins and increased liquidity.

The impact was muted, however, by comments from United Airlines (UAL) – Get United Airlines Holdings, Inc. Report CEO Scott Kirby, who said around 3,000 employees who have tested positive for Covid, resulting in a near-term paring of the carrier’s schedules.

In an investor update filed with the U.S. Securities and Exchange Commission, American said fourth quarter revenues would still be down around 17% from pre-pandemic levels recorded in 2019, but that figure is a 3 percentage point improvement from its October forecast. Pre-tax profit margins, the carrier said, would be between -12% and -13%, again improving from the October estimate of -16% to -18%.

Cost per available seat mile, however, an industry benchmark for efficiency, will likely increase between 13% and 14% from 2019 levels as jet fuel prices rose to an average of $2.36 per gallon.

American will publish its formal fourth quarter earnings on January 27.

Stock Market Today: Stocks Edge Higher Ahead of Powell Testimony; Tesla, AMD Pace Gainers

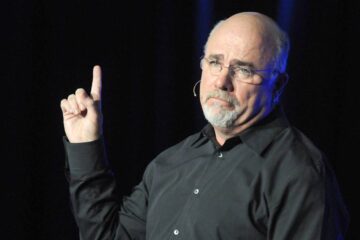

Airline stocks have struggled to maintain any momentum over the past six months, as government support — which American CEO Doug Parker told Senate lawmakers “saved the industry” — faded and infections rates linked to both the Delta and Omicron variants affected travel demand, staffing levels and triggered travel restrictions in major markets around the world.

A series of winter storms over the Christmas holidays also lead to the cancellation of thousands of domestic flights, sparking anger from stranded passengers, while concerns over the impact of 5G network deployments on flight communications systems has added to industry uncertainty.

American shares were marked 0.5% higher in pre-market trading Tuesday to indicate an opening bell price of $18.88 each.

Last month, American said longtime CEO Parker will stand down on March 31, with current president Robert Isom tabbed as his successor.

Reports that Parker, who was appointed CEO in 2013, may be moving on from his role began to surface earlier this year, when an executive search firm posting a listing for a “chief human resources officer” that would report to a “new CEO”.

“We are well-positioned to take full advantage of our industry’s recovery, and now is the right time for a handoff we have planned and prepared for,” Parker said on December 7. “I feel extremely fortunate to hand the reins to this clear and capable leader.”