‘Eventually, we believe inflation will cause a recession, regardless of what the Fed chooses to do,’ he wrote to his investors.

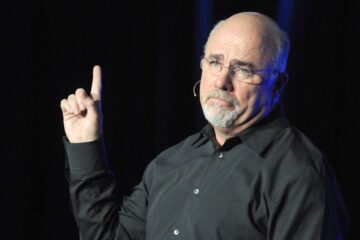

Hedge fund heavyweight David Einhorn, founder of Greenlight Capital, says raging inflation will push the economy into recession, despite the Federal Reserve’s tightening of monetary policy.

“Eventually, we believe inflation will cause a recession, regardless of what the Fed chooses to do,” He wrote in a letter obtained by CNBC.

“The higher prices of necessities will ultimately cause low-income consumers to cut back on other things. There are signs this is already happening.” Consumer prices soared 7% last year, the biggest 12-month increase in 39 years.

“We believe that the inflation problem is so embedded that to successfully fight it, the Fed would have to sacrifice the primacy of the financial markets,” Einhorn said.

He said he has begun positioning his fund to take that scenario into account.

The fund added a new large long position in Global Payments GPN during the fourth quarter, Einhorn said, as cited by CNBC.

“GPN benefits from ongoing consumer preference shifts to electronic payments,” he wrote. It also “benefits from inflation, since it generally charges a percentage of merchant dollar volume,” Einhorn said.

The stock stumbled 46% between from April to December amid investor concern about competition from new financial technology companies. But Einhorn maintains that the threat is limited.

The fund also took new positions in Germany’s Rheinmetall, which makes military vehicles and automotive components, in addition to Dutch biotech company Galapagos.

Greenlight’s fund generated a total return of 12% last year, lagging the 29% gain of the S&P 500, but it soared 19% in the fourth quarter, CNBC reported.