In 1965 the legendary investor Warren Buffett bought control of Berkshire Hathaway. (BRK.A) . He gradually sold off the textile businesses and invested heavily in insurance, utilities, and retail.

Nearly two decades later, a 20-year-old Bill Ackman first heard about Buffett and his investment group and something clicked. “I was inspired to become an investor,” the hedge-fund manager recalled.

After another three decades, Ackman is putting that inspiration into action, planning to build his version of Berkshire Hathaway.

On May 5 Ackman’s Pershing Square Capital Management announced a $900 million deal to acquire 9 million shares of Howard Hughes Holdings (HHH) , a company Ackman wants to turn into a “modern-day version of Berkshire.”

“We will adopt similar, long-term, shareholder-oriented principles to Berkshire, (BRK.B) and we intend to hold the stock forever,” he said.

That principle — buy great businesses and hold them — is showing up elsewhere in his portfolio, too.

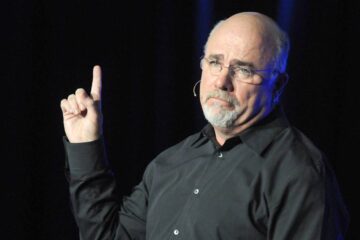

Bill Ackman made some notable moves in the first quarter.

Image source: Jared Siskin/Getty Images

What is Bill Ackman buying?

Ackman’s Pershing Square oversees a highly concentrated portfolio of just 11 stock holdings.

The fund has delivered strong returns over time. It has returned 42.17% over the past three years and 149.55% over the past decade, according to data from Stockcircle.

Related: Billionaire Bill Ackman delivers frank 3-word message on tariff war

The billionaire investor made some notable moves in the first quarter.

According to a 13F filing Ackman invested nearly 18% of Pershing Square’s capital in ride-share group Uber Technologies (UBER) . The investment totaled more than 30.3 million shares, now valued at $2.8 billion. He first disclosed the position in February.

“We believe that Uber is one of the best managed and highest quality businesses in the world,” Ackman wrote in an X post.

“Remarkably, it can still be purchased at a massive discount to its intrinsic value. This favorable combination of attributes is extremely rare, particularly for a large-cap company,” he added.

Alongside the Uber buy, Ackman added to his stakes in Brookfield Corp., Howard Hughes and Hertz (HTZ) . At the same time, he trimmed positions in Chipotle (CMG) , Canadian Pacific (CP) , Hilton (HLT) , and Alphabet’s Class C shares, while boosting his stake in the Class A (GOOGL) . He fully exited his position in Nike (NKE) , selling all 18.8 million shares.

Uber stock jumps on self-driving momentum

Uber’s shares are up 52% in 2025 to date and 22% in the past month. They touched a 52-week high $93.60 on May 20.

On May 7, Uber posted first-quarter earnings that topped Wall Street estimates.

Related: Billionaire Stanley Druckenmiller quintuples stake in top semiconductor stock

The San Francisco ride-sharing company reported earnings per share of 83 cents, ahead of the 50 cents Wall Street analysts had expected. Revenue came in at $11.53 billion, up 14% year over year, under the $11.62 billion forecast.

Total trips rose 18% from a year earlier to 3 billion, driven by a 14% increase in monthly active platform consumers and a 3% rise in trips per user, the company said in a news release.

Looking ahead, Uber expects second-quarter gross bookings of $45.75 billion to $47.25 billion, indicating a 16% to 20% year-over-year increase. Adjusted earnings before interest, taxes, depreciation and amortization are projected at $2.02 billion to $2.12 billion, representing growth of 29% to 35%.

The company continues to push forward in autonomous vehicles. In Austin Uber users can already hail a robotaxi directly through the Uber app. The program is a partnership with Google’s (GOOGL) Waymo.

In addition to Waymo, Uber is working with Volkswagen, Avride, May Mobility and autonomous-trucking firm Aurora to expand its self-driving initiatives. Outside the U.S., it has partnered with WeRide and Pony.AI.

Uber’s CEO, Dara Khosrowshahi, said the company had reached an annual run rate of 1.5 million autonomous vehicle trips.

More Automotive:

American car company takes drastic action in response to tariffsHow Elon Musk could send Tesla stock soaringCar buyers rejoice — you just got great news about tariffs

“We think that the AV technology at maturity is going to be very good for the industry. It will be great for Uber,” Khosrowshahi said during the May earnings call. “At the same time, we think that the technology is going to take a lot of time to develop.”

JP Morgan analysts raised their price target on Uber to $105 from $92 and affirmed an overweight rating, citing the company’s potential in self-driving tech.

“Uber is becoming an increasingly valuable partner to AV tech providers,” the analysts said in a recent research report.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast