Hey, you looking for a place on Manhattan’s Upper West Side?

Well, if you’ve got $20 million, Bill Ackman might be able to help you.

Related: Billionaire Bill Ackman buys 3 million shares of battered consumer stock

The billionaire hedge fund manager has listed two neighboring apartments for a total of $19.9 million, seven years after reportedly spending $22 million to buy them, according to New York Magazine’s Curbed website.

The properties located on Central Park West between West 81st and 82nd Streets share a landing and include a combined six bedrooms and seven bathrooms across nearly 6,000 square feet.

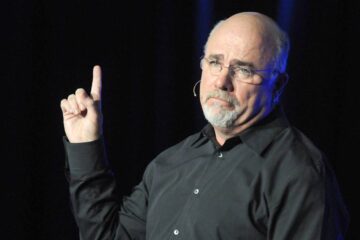

Bill Ackman, CEO of Pershing Square Capital Management, speaks at the WSJ D.Live global technology conference in Laguna Beach, Calif., on Oct. 17, 2017. Photo: Patrick T. Fallon/Bloomberg via Getty Images

The founder and CEO of Pershing Square Capital Management has been doing a lot of buying and selling over the years.

🐂 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 🐻

A 1992 graduate of Harvard Business School, Ackman started the hedge fund management company in 2004 with $54 million from his personal funds and former business partner. Today, the fund has roughly $18.3 billion in assets under management.

Ackman: volatility is investors’ long-term friend

Ackman noted in the company’s June 30 interim report that markets have been exhibiting “an enormous amount of volatility when macro data surprises occur.”

“Greater stock market volatility is the long-term friend of the active investor with permanent capital who seeks to identify high quality companies which are not dependent on the capital markets to implement their business strategies,” Ackman told shareholders.

Pershing Square has been a large long-term beneficiary of market overreactions to short term bad news, he said, “as they can drive business valuations to levels well below long-term intrinsic value, and create buying opportunities coupled with a high degree of liquidity.”

Related: Billionaire Bill Ackman’s fund dealt an unexpected blow

The company recently filed a Securities and Exchange Commission Form 13F that details Pershing Square’s holdings as of Sept. 30.

The fund’s one new buy during the third quarter, made in late July, was Seaport Entertainment SEG, an owner and operator of entertainment-based real estate, including Manhattan’s South Street Seaport.

Pershing increased in real estate investor Brookfield Asset Management (BAM) , but reduced its stakes in hotel giant Hilton Worldwide (HLT) , and in Restaurant Brands (QSR) , which owns the Burger King, Tim Hortons, Popeyes, and Firehouse Subs fast food brands.

The fund’s top holdings as of Sept. 30, in order of size, were Brookfield, Hilton, Restaurant Brands, Chipotle (CMG) , and real estate investment company Howard Hughes Holdings HHH. Seaport Entertainment is a spinoff from HHH, having started trading July 30, according to Yahoo Finance data.

Pershing also significantly boosted its stake in athletic footwear and apparel maker Nike (NKE) , to $1.4 billion from around $220 million at the end of June.

Nike has hit a rough patch

Ackman is no stranger to the sports-outfit brand.

Pershing Square held about 5.8 million shares at the end of 2017 and sold it for a profit of around $100 million after several weeks when Nike’s stock price climbed 32%, according to The Wall Street Journal.

Nike has been going through a challenging period for quite a while. The company’s shares are down almost 30% year-to-date and have fallen about 28% from a year ago.

In February Nike said it would cut 2%, or more than 1,500 of its jobs as part of a broader restructuring.

In September, Nike said CEO John Donahoe would step down and company veteran Elliott Hill, who began his career at Nike as an intern in 1988, would take over the top spot.

Nike missed Wall Street’s fiscal-first-quarter-revenue expectations on Oct. 1 but beat analysts’ earnings estimates.

The company earned 70 cents a share on $11.59 billion in sales, while analysts were looking for earnings of 52 cents per share on $11.65 billion in revenue.

“We are moving aggressively to shift our product portfolio, create better balance in our business, and reenergize brand momentum through sport,” Chief Financial Officer Matthew Friend told analysts during the company’s earnings call.

“That said, a comeback at this scale takes time,” he added. “And while there are some early wins, we have yet to turn the corner.”

Nike is scheduled to report second-quarter results on Dec. 19.

Investment firms tweak Nike price targets

Investment firms have recently adjust their price targets for Nike’s stock.

TD Cowen lowered its price target on the company to $73 from $78 and affirmed a hold rating on the shares.

Fund manager buys and sells:

Cathie Wood buys $38 million of surging tech stockCathie Wood sells $48 million of battered tech stockCathie Wood sold $12.8 million of soaring fintech stock

The investment firm said in a Nov. 18 research note that its meetings with channel contacts and field work leave it more cautious on the state of Nike’s business.

TD Cowen’s analysts said Wall Street’s potential to again reset its fiscal 2026 earnings expectations for Nike are higher than the consensus expects.

Tariffs — a centerpiece of new Trump administration’s policy proposals — and China’s potential retaliation are a rising risk, the firm said.

Nike has ceded share in specialty running, tennis and more recently in lifestyle, while smaller competitors, such as Hika, On, Asics and Saucony continue to perform well in both lifestyle and performance running, TD Cowen said.

The firm also sees “Jordan retro fatigue” along with other over-distributed franchises that Nike management is currently involved in managing down.

Basketball superstar Michael Jordan signed a five-year, $2.5 million deal with Nike in 1984.

Nike released the Air Jordan sneaker line in April 1985 with the goal of making $3 million in the first three years, but sales skyrocketed to $126 million in the first year alone.

The film “Air,” released last year, is based on events about the origin of the iconic sneaker brand.

On Nov. 7 RBC Capital analyst Piral Dadhania lowered the firm’s price target on Nike to $80 from $82 while maintaining a sector-perform (effectively neutral) rating on the shares.

The company’s investment story is “fairly balanced,” with plenty of work to do across most aspects of the organization and stubbornly elevated valuation, offset by “modest” fiscal 2026 consensus estimates offering potential upside, the analyst said.

Related: Veteran fund manager sees world of pain coming for stocks