Have no fear: Manoj is here.

Retail investors put their money where their futures are. They’re not part of some massive investment firm putting billions of dollars into the stock market.

These people are using their hard-earned money to make their lives — and the lives of their loved ones — better.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💵

In 2024, 62% of U.S. adults, about 162 million people, owned stock, according to a Gallup survey. That’s up 1% from the prior year and the highest percentage observed by the analytics company since 2008.

But who can retail investors turn to when they need expert advice on what to do with their money?

That’s where Manoj Bhargava comes in.

The billionaire, entrepreneur and philanthropist recently launched The Business of Everything, a podcast that dives deep into the realities of business and investments.

Bhargava, founder of the 5-hour Energy drink, gave the lowdown on his latest venture in an exclusive interview with Loren Torres, head of social and video for sports at The Arena Group (AREN) , TheStreet’s parent.

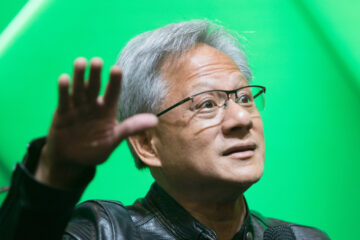

The billionaire entrepreneur and philanthropist Manoj Bhargava is reaching out to retail investors to share the investment lessons he’s learned over the years.

Jacqui Frank

Wall Street predictions are mostly wrong

“It’s actually for the investors, retail investors who buy stocks and whatever,” said Bhargava, Arena Group’s principal shareholder.

“They don’t really understand investing because nobody really taught them,” he explained. “And all you’ve got is Wall Street speak, which is, really, a lot of nonsense.”

More 2025 stock market forecasts

Veteran trader who correctly picked Palantir as top stock in ‘24 reveals best stock for ‘255 quantum computing stocks investors are targeting in 2025Goldman Sachs picks top sectors to own in 2025Every major Wall Street analyst’s S&P 500 forecast for 2025

The way Bhargava sees it, some people out there are just constantly predicting stuff.

“Predictions are wrong almost all the time, and yet we keep listening to the same prediction,” he said. “So somebody’s got to really say, ‘OK, how do you actually do this to make sense?'”

You want examples? How about 1929, when a famed economist declared that “stock prices have reached ‘what looks like a permanently high plateau’?” That was just days before the stock market crashed and helped kick off the Great Depression.

There was the dot-com bubble of the late 1990s and early aughts when those in the know said the value of stocks would increase fourfold. Only it didn’t.

And then came 2008, when the experts knew about problems with subprime mortgages but downplayed them, leading the housing market to collapse and a global financial crisis to take hold.

“There’s some parts of investing that are broken out into several pieces — one is gambling, where you say, oh, the stock’s going to go to the moon, right; or speculation, where you’re putting money in a company that makes no money,” Bhargava said.

“Then there’s investing in companies that make money,” he added. “And then, you look at them and say, ‘What’s the risk here? Right? I don’t want to lose my money.'”

Another kind of investing, Bhargava said, involves putting your money in the bank and watching inflation eat away at it.

“So you’ve got to understand all of them,” he said. “Because if you don’t understand it, you can’t do it.”

Investors are younger and tech-savvy

Younger people have been increasingly engaged with investing in recent years, at least in terms of putting after-tax discretionary money to work in financial markets, according to JP Morgan Chase.

Related: 5-hour Energy billionaire launches podcast for the average investor

Following the global financial crisis, the share of adults investing was about the same among working-age adults above and below 40 years old, the investment firm said.

A retail investor in 2025 is also likely to be more tech-savvy and bullish on sectors like artificial intelligence and the Magnificent 7 tech giants: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

The influx of new and younger investors means many people are looking for candid insight.

Bhargava, who has founded a number of billion-dollar businesses, sees a lot of nonsense out there in the investing world.

“It’s taught by people who’ve never done business,” he said. “You’ve got professors, you’ve got consultants, you’ve got all of these people, and they teach you this stuff which is just wrong.”

With the podcast, Bhargava said he’s going to give “everybody a different perspective as to how we disagree — how I disagree.”

“They can take it or don’t take it, but definitely it’ll be fun,” he said. “And it’ll be funny because some of this stuff you can’t make up.”