Stocks were hard hit after President Trump announced broad-based tariffs on April 2nd, the so-called “Liberation Day.” The announcement included tariff rates much higher than expected, causing investors to rethink their outlooks for the U.S. economy and corporate earnings.

The stock market hit came amid recent data already showing that the U.S. economy is slowing, increasing the possibility that higher inflation caused by tariffs may push us into recession.

Related: Veteran analyst who predicted gold prices would rally offers a blunt new forecast

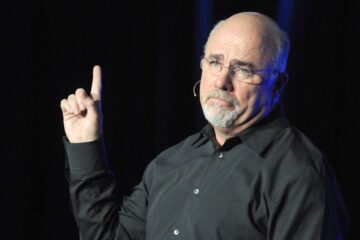

The potential that the U.S. economy could deliver a blow to corporate America’s revenue and profit has caught the attention of veteran Wall Street fund manager Ken Fisher, the billionaire founder of Fisher Investments, a money management firm with $295 billion in assets under management.

Fisher recently updated his recession outlook for this year.

His opinion is worth considering because he’s been navigating the stock market professionally since the 1970s, giving him a front-row seat to the S&L crisis, internet bust, Great Financial Crisis, Covid meltdown, and 2022’s bear market.

The stock market is struggling as recession worry grows in 2025.

Image source: Michael M. Santiago/Getty Images

Will the Federal Reserve be wrong on interest rates again?

The Federal Reserve may soon find itself behind the curve yet again. In 2021, Federal Reserve Chairman Jerome Powell made the mistake of thinking that sparks of inflation were “transitory,” only to be forced to embrace the most restrictive monetary policy since the 1980s in 2022.

Related: Billionaire fund manager delivers blunt message on U.S. vs. Europe

Now, Powell and other Fed members similarly describe the impact of tariffs on inflation as “transitory.” It will be a while before we know if that’s true, but there’s little doubt among economists that, transitory or not, inflation is heading higher because of Trump’s tariff plans.

Given that inflation is cumulative, the impact over the past three years is still being felt. Inflation has slowed below 3%, far below its 8% peak in 2022, but since inflation stacks on top of past increases, pressure on consumers is high.

Unfortunately, the Fed finds itself backed into a corner. Its dual mandate is low inflation and unemployment, and those two goals often contradict each other. Raising interest rates to fight inflation increases unemployment, and cutting rates is inflationary.

Since unemployment is rising and economic data suggests GDP is slowing, the Fed may be inclined to cut rates. However, because tariffs already risk igniting inflation, the Fed appears hesitant to add more fuel to the inflationary fire.

Last week, Fed chairman Powell admitted as much when he said the impact of tariffs appears more severe than he initially thought. He also opened the door to the possibility of raising rather than lowering rates if inflation gets out of control — something consumers and the stock market don’t want to hear.

Is a recession coming in 2025?

So far, the data suggests a weaker economy, but not an outright recession.

Unemployment has risen to 4.2% from its 3.4% low in April 2023, but it’s still historically low. Similarly, while GDP will likely come in far south of the 3.1% levels seen last summer, most still expect first-quarter GDP to be positive (the textbook definition of recession is two consecutive quarters of negative GDP growth).

Related: Rare event could send S&P 500 tumbling again

The likelihood is that we’re not yet in a recession.

Still, the Conference Board’s Expectations Index is just 65, well below the 80 level that suggests a recession is coming. And ISM’s Manufacturing and Services PMI readings of 49 and 50.8, respectively, are below and near the 50 level associated with contraction.

Fisher weighed in on the likelihood of a recession this year, offering a discouraging outlook if tariffs aren’t rolled back following the 90-day pause in reciprocal tariffs implemented on April 9.

“If it does not resolve that President Trump and crew have negotiated some deals and then put all of this nonsense behind us, or 90% of all this nonsense behind us, you’ll see a very bad economic effect that will cause a recession, and it will be recession before the end of the year,” said Fisher on YouTube.

Fisher thinks it’s too early to declare a recession, given that the stock market usually falls for three to four months before a recession takes hold and that we’re only about two months from the peak.

“We never get a recession unless the U.S. stock market and global stock market have peaked from an all-time high and gone down for three or fourth months,” said Fisher. “It won’t start any sooner than that.”

Read more:

Billionaire Michael Bloomberg sends hard-nosed message on economyJim Cramer offers blunt one-word reaction to 20% tariffsLegendary fund manager sends blunt 9-word message on stock market tumble

Therefore, Fisher thinks two things must happen to avoid a recession: stocks must find their footing, and the trade war must end.

“What President Trump is doing in tariffs is terribly destructive,” said Fisher. “But the tariffs that he would impose, if they’re sustained…any and all of that is bad. None of it accomplishes what he thinks it will accomplish. None of it.”

“He somehow, on this matter, and all the advisers that he hand-picked around him as people that already agreed with him on all this stuff, don’t actually know what they’re talking about,” said Fisher. “I’ve never seen a circumstance like this ever.”

Fisher, a long-time Republican and major donor to Senate and House races “for a long time,” offered a very blunt opinion on President Donald Trump’s tariff plan.

“Saying all this stuff is not something I’m really happy about,” said Fisher. “But the fact of the matter is, all this trade stuff is right down my wheelhouse. I understand exactly how it works. If they keep doing this back and forth, on and off…it begins to look like some version of amateur hour or a variation of the three stooges with another five stooges thrown in.”

“If they keep going down this path…they will turn us into recession,” added Fisher. “Tariffs always hurt the country that imposes them more than they hurt the country that they’re imposed upon.”

Related: Veteran fund manager unveils eye-popping S&P 500 forecast