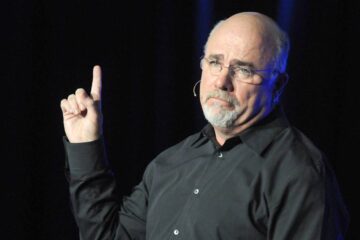

Real Money’s Stephen ‘Sarge’ Guilfoyle sees longer term appreciation as EV business expands.

The stock of Ford Motor Co. (F) – Get Ford Motor Company Report has the potential for more growth even after a stellar run in 2021, argues Stephen “Sarge” Guilfoyle.

Part of Ford’s potential lies in its leadership – with Jim Farley at the helm serving as CEO, he understands the needs of consumers, according to Guilfoyle.

“Farley is just a car guy,” Guilfoyle wrote recently on Real Money. “It is what he eats and sleeps. While many investors were tentatively invested in Ford because of the limited downside risk, Farley saw opportunity in a brand that still had a little something, that still meant something to the American consumer, and most of all… because he is a car guy, Farley understood that both legacy and electric automobile manufacturers had forgotten to build cars that regular people like.”

The company recently said it plans to nearly double the production of the F-150 Lightning electric pickup due to heavy demand from drivers.

TheStreet Recommends: Resource Transition: An Investor’s Playbook for 2022 (Webinar Preview)

Investor Playbook: How to Play the Resource Transition – FREE Webinar (TV-G; 1:06:35)

“What is perhaps most interesting is that Ford is on the verge of winning market share,” Guilfoyle wrote, adding “75% of these reservations are not from Ford loyalists, but from individuals new to the Ford brand.”

Ford is planning to further ramp up production of EVs — the company said it plans to invest over $30 billion in EV production facilities through 2025 alone.

With the entire auto industry running behind Tesla (TSLA) – Get Tesla Inc Report in developing EV and battery technology, “the goal for now is to emerge as a clear cut number two North American electric vehicle manufacturer, and then ultimately take a run at the top spot,” Guilfoyle wrote. “Within two years, Ford expects to have the capacity to produce 600,000 battery electric vehicles per annum.”

Investors should be patient, Guilfoyle noted.

“Readers will see Ford attempting a breakout past a pivot created by a flat basing period of consolidation that came after a sharp rise in price,” he wrote. “I would then look for a more gradual appreciation in price that the name experienced this past autumn.”