Cash is slowly becoming obsolete. The cashless trend is forcing more and more businesses to start accepting credit credits.

A recent survey found that just 16% of Americans say they always carry cash. 58% of respondents plan to stop using cash altogether in the near future.

Whether you’re launching a startup or you’ve been in business for decades, accepting credit card payments has become crucial in today’s day and age. For online businesses and ecommerce stores, credit cards are the only reasonable way to get paid.

Ready to get started? I’ll teach you how to start accepting credit card payments for your business in just a few simple steps.

What to Expect When Accepting Credit Card Payments

Accepting credit cards is easy. The bulk of the effort will be spent choosing a processor and setting up your equipment.

The Good

The best part about accepting credit cards is convenience. As previously mentioned, consumers are carrying less cash (if any). By taking credit cards, you’ll appeal to far more customers.

Credit cards improve efficiency as well, especially for in-person payments. They can help eliminate long lines and reduce the time each customer spends at the register. A quick swipe, dip, or tap is much easier than counting cash and making change.

It also helps minimize human error, such as incorrect change counted. Card payments help prevent cash theft by employees as well.

Recent world events have also increased the demand for touchless payments. Consumers often use smartphones, wearables, digital wallets, and tap-to-pay credit cards to purchase goods and services. This helps prevent the spread of germs during checkout.

Modern credit card processing systems make life easier from a bookkeeping standpoint as well. The majority of these solutions sync with accounting software to minimize manual journal entries. These systems can even integrate with software for things like inventory tracking and more.

The Bad

The most frustrating part about accepting credit cards is the fees. Between the card network, processor, issuing bank (cardholder’s bank), and acquiring bank (your bank), there are many players associated with each credit card transaction.

Each party charges a small fee for their role in the process, which is ultimately paid by the merchant.

Depending on your contract’s pricing structure, you could be paying different fees for each transaction, which makes it tough to predict your total processing costs. For example, an ecommerce purchase paid with an American Express card could be more expensive than an in-person payment with a Visa—even if the two customers had the exact same transaction total.

Corporate credit cards, consumer cards, and debit cards could all have different fees.

Credit card processing requires updated and stable hardware and software. If you have problems with a terminal or your internet connection is unstable, you might be unable to process certain transactions. Setting up specific hardware can be a time-consuming task as well.

Chargebacks are another paint point associated with accepting credit cards. A chargeback occurs when a cardholder disputes a charge directly with their card network or bank. Credit card companies and banks are more likely to side with a cardholder during a dispute, which can be expensive and frustrating for businesses.

Certain types of businesses might have trouble getting approved to accept credit cards. This is known as “high-risk credit card processing.” High-risk industries include tobacco, gambling, drug paraphernalia, vitamins and supplements, weapons, multi-level marketing, life coaching, adult services, marijuana dispensaries, and more. Even business owners with poor credit could be considered a higher risk.

If approved, merchants that fall into those categories are typically imposed with higher credit card processing fees.

Step 1 – Find a Payment Processor

There are many ways to start accepting credit cards. Each method has its fair share of pros and cons. To get started, you need to find a payment processor that accommodates your needs.

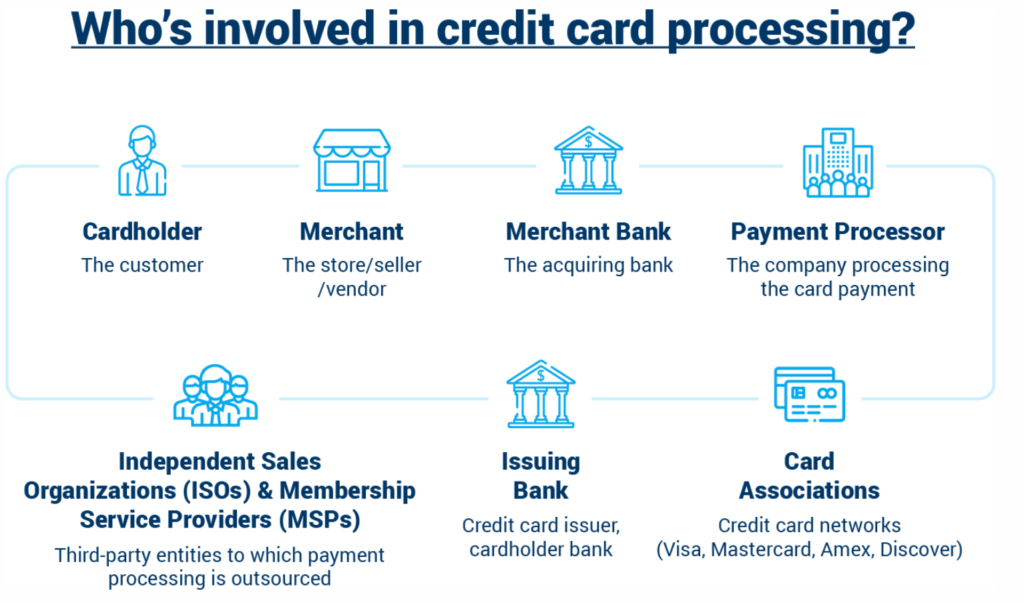

Payment processors facilitate credit card transactions. They act as a mediator between the business and other financial institutions involved with a transaction. Here’s a brief overview explaining the different roles associated with credit card processing.

Processors authorize transactions and facilitate the transfer of funds from the issuing bank to the merchant.

But payment processors come in different shapes and sizes. Let’s take a closer look at the types of payment processing companies you can choose from.

Payment Service Providers (PSPs)

Using a PSP is the easiest way for your business to start accepting credit cards. These are typically considered “all-in-one” solutions, as they offer everything you need to get started.

Companies like Square and PayPal all fall into the payment service provider category.

PSPs have revolutionized the credit card processing industry in recent years. They allow businesses to accept credit cards without setting up a merchant account. They typically offer month-to-month contracts and flat-rate pricing.

Flat-rate processing is easy to comprehend, but it’s not always the cheapest option. Rates typically cost around 2.9% + $0.30 per transaction. There’s not a ton of room for negotiation here unless you’re a high-volume merchant.

But PSPs are really easy to set up and have become increasingly popular for startups and businesses new to accepting credit cards.

Merchant Account Providers

Merchant account providers are ideal for businesses that want to get the best possible processing rates. Payment Depot and Fattmerchant are two popular solutions in this category.

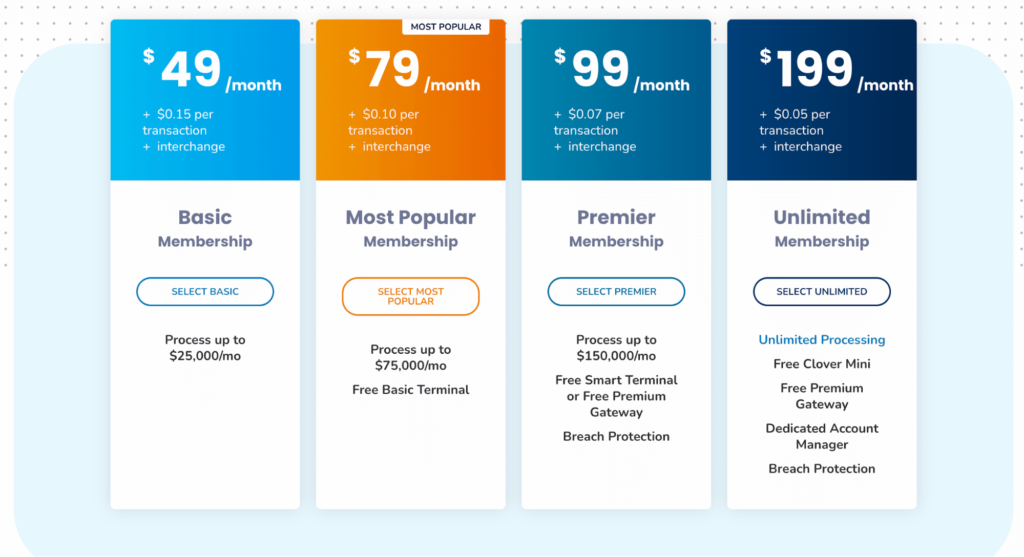

Both of these companies offer membership-style pricing. For a monthly fee, transaction fee, and interchange, businesses have access to “wholesale” credit card processing rates. Here’s an example from Payment Depot’s pricing page so you can see what I mean:

An interchange is the cost imposed by the card networks. So you could pay as little as $0.05 + interchange per transaction with a merchant account provider, compared to nearly 3% per transaction with a PSP.

Ecommerce Platforms

Businesses with an online store should consider using an ecommerce platform for credit card processing. Like PSPs, this type of processor can become a one-stop-shop or an all-in-one solution for your processing needs.

Shopify is an industry leader in this space. In recent years they’ve essentially become the gold standard for managing an ecommerce website.

I like Shopify because they offer integrated payment processing with every plan. So, you won’t have to worry about using third-party shopping cart software to accept payments on your ecommerce site. Shopify even has POS (point-of-sale) solutions for ecommerce sites that also have a physical retail presence.

This ecommerce platform integrates with 100+ additional payment providers as well. So, if you find another processor in the future, you could always switch without having to change your online store.

Step 2 – Negotiate Your Terms

Once you’ve narrowed down the type of processor you want to use, shop around for the best rate. Believe it or not, credit card processing fees can actually be negotiated. This is especially true if you’re getting competitive quotes from multiple processors. You can use those quotes as leverage to get the best possible deal.

To negotiate successfully, you need to understand where credit card processing fees come from. Generally speaking, there are three main components to credit card processing rates:

- Interchange – Imposed by the credit card network and issuing bank.

- Assessment – Smaller fee paid directly to the card network.

- Markup – Charged by the processor.

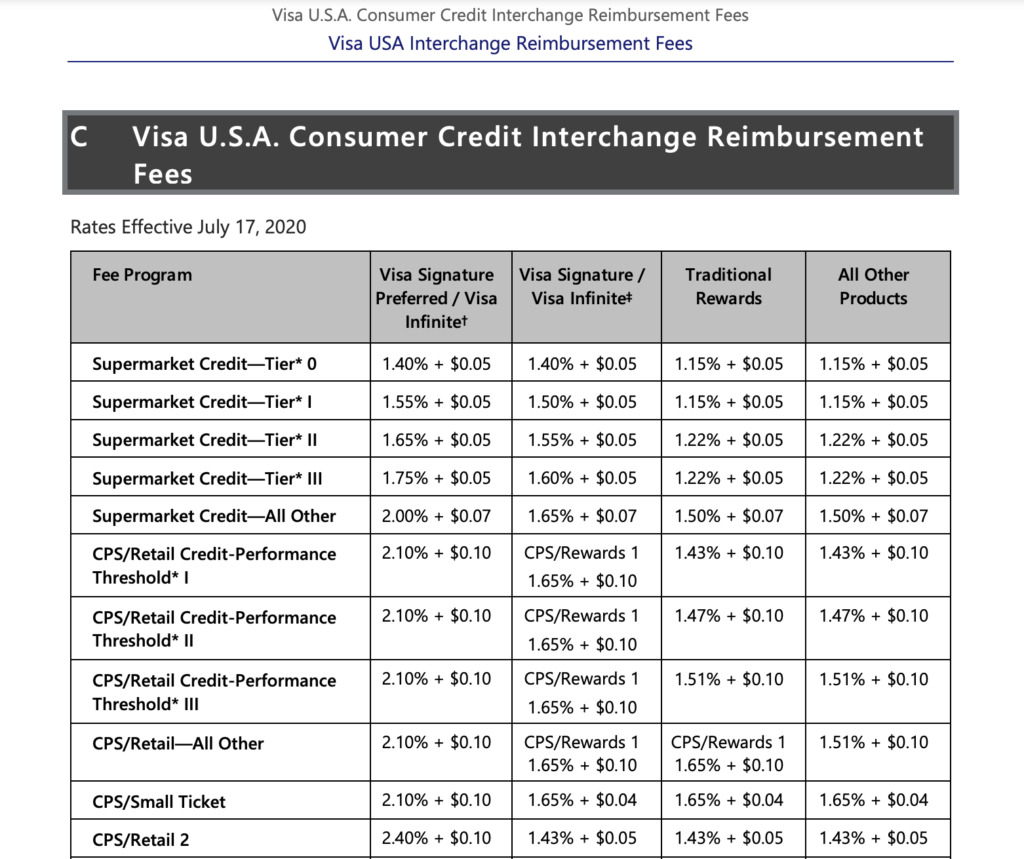

Interchange and assessments are non-negotiable. But processors might be willing to negotiate their markup. Interchange fees vary by card network and transaction. For example, here’s a snippet of Visa’s interchange rates:

The type of card that a customer uses will impact the fees. Keep this in mind as we discuss the types of credit card processing structures shortly.

In addition to the direct costs of credit card processing, you should also consider factors like:

- Contract length

- Setup fees

- Early termination fees

- PCI compliance fees

- Statement fees

- Terminal fees

- Gateway fees

The list goes on and on. Some processors will try to sneak these extra costs into your contract. Review everything in detail before you commit. That’s why negotiating your terms is so important.

Now let’s take a closer look at the different contract structures in the world of credit card processing:

Flat Rate Pricing

Flat-rate credit card processing is the easiest to understand. This is the most common pricing model offered by PSPs.

With this structure, the interchange rates imposed by the card network are irrelevant. You’ll pay the same cost per transaction, regardless of the interchange category being used. The only factor that would impact the rate here would be how the card is processed (online vs. in-person).

Interchange Plus Pricing

Interchange plus processing is typically more cost-effective than flat-rate pricing. As the name implies, this contract structure involves paying the interchange rates plus the processor markup.

As previously mentioned, processors might be willing to negotiate their rates, which potentially gives you access to lower credit card processing fees.

Subscription or Membership Pricing

Subscription pricing can best be described as a hybrid between flat-rate and interchange pricing. Businesses pay a monthly fee to merchant account providers for access to lower flat-rates.

For example, a $99 monthly subscription fee could give you access to a $0.07 plus interchange fee per transaction. The processor charges a lower markup but still collects a monthly membership fee.

Tiered Pricing

Tiered pricing is the worst. Stay away from this at all costs.

With this pricing structure, the processor charges three different rates—qualified, mid-qualified, and non-qualified. Each category has a different processing rate (qualified being the cheapest, and non-qualified being the most expensive).

However, the processor determines which category each transaction falls under, based on relatively unknown criteria. So businesses typically end up paying mid-qualified and non-qualified transactions more often than they initially thought.

Step 3 – Get Your Equipment

If you’re processing transactions in-person, you’ll need to get the appropriate equipment. Lots of processors out there advertise free equipment, but these are rarely actually free.

Don’t rent equipment. It might seem like a cost-effective solution in the short-term, but it’s always more expensive for the lifetime of your equipment.

It’s worth noting that some equipment is proprietary to specific processors. For example, let’s say you’re using Square as your processor. If you decide to switch processors in a year or two, you’ll no longer be able to use any Square equipment.

Here are the different types of equipment you might need to accept credit card payments.

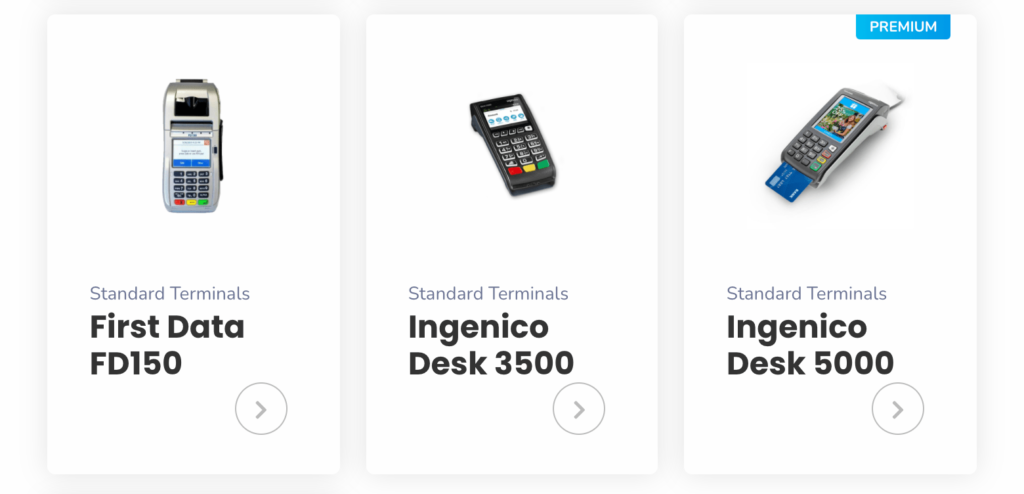

Credit Card Terminals

This is a traditional countertop piece of hardware used for accepting credit cards. They are standalone pieces of equipment, separate from registers or POS stations.

Credit card terminals typically look like this:

Make sure you choose a terminal that’s modern and compatible with multiple payment options. For example, legacy terminals and outdated hardware won’t accept chip payments, tap-to-pay, or mobile wallets.

Integrated POS Terminals

POS systems with built-in credit card terminals are becoming increasingly popular. Clover has some of the best POS equipment on the market today.

These are useful in quick-serve restaurants and retail shops. Integrated POS terminals are a bit more expensive than a traditional standalone terminal, but they are user-friendly and offer more functionality.

Mobile Card Readers

For businesses that operate on-the-go, a mobile carder is an absolute must-have. They’re really useful for food trucks or field-service jobs where technicians can accept payments directly at a customer’s home or job site.

Square offers free mobile card readers that can turn any smartphone or tablet into a POS station.

Mobile readers can even be used within retail stores so customers can pay without having to visit a checkout counter.

Software

In addition to the hardware requirements of accepting credit cards, you’ll likely need to get the appropriate software as well. For example, to use the Square mobile reader (mentioned above), you’d need to download the Square POS app.

Online credit card processing requires shopping cart software. But if you’re using an all-in-one ecommerce platform like Shopify, this will come included with your plan.

Virtual terminals are software designed to turn computers into payment processors. This software is perfect for processing credit card information over the phone.

Step 4 – Accept Payments

Now that you’ve chosen a processor, agreed to terms, and have your equipment set up, it’s time to start accepting credit card payments.

Depending on the solution you chose, customers should be able to swipe, dip, tap, use mobile wallets, pay online, or pay over the phone for your goods and services.

But you don’t technically receive payment at the time of the sale. There’s an extra step in this process.

Settle Your Transactions

“Settling” or “batching” is the final stage of accepting credit card payments. The initial swipe, chip, or keyed entry is known as the authorization stage. This is only to approve or deny a transaction.

But the sale isn’t fully processed until the settlement.

Once per day (typically at the end of the business day), those authorizations must be sent to your processor. The exact steps to complete this process will vary based on the equipment you’re using and the processor.

If you don’t settle transactions within 24 hours of a sale, the transaction could be subject to higher interchange rates.

Monitor Your Bank Account and Statements

Finally, you want to verify that you’ve been paid. Funds typically appear in your bank anywhere from 24 to 72+ hours after the settlement.

Always make sure that your statements match the deposit amount in your account.

As previously mentioned, some credit card processors are notorious for imposing extra and unnecessary fees. So, make a habit of reviewing your statements each month for any irregularities. If you’re unsure about a charge, call the processor and find out what it’s for.

This will help keep your credit card processing costs as low as possible.