To legally register a limited liability company (LLC) at the state level you must file articles of organization. It’s one of the most important steps in the formation of an LLC.

After you file your articles of organization your company is bound by the state laws under which your LLC was formed. The articles outline vital information such as the purpose of your LLC, its members, and further key details depending on the state you file in.

Therefore it’s safe to say you need to get it right. So in this guide, we’ll take you through everything you need to know about filing articles of organization.

The Easy Parts of Filing Articles of Organization

In some states, the process of filing articles of organization is straightforward. They have online forms you can use to input all of the right information. This means you don’t have to worry about leaving out anything important.

Furthermore, some of the processes you need to carry out to file articles of organization sound more complex than they actually are. For instance, one thing you’ll need to do is appoint a registered agent. This is just a fancy way of saying a person the state or public can contact about any legal or official matters.

Another good thing about filing articles of organization is that it serves to register your business name. So you don’t need to file a separate form.

The Difficult Parts of Filing Articles of Organization

What’s required when you file articles of organization depends on the state in which you form the LLC. As mentioned above, sometimes it’s a straightforward process. But, in some cases, you have to create articles of organization from scratch.

This of course means careful research as to what your state requires of you, more paperwork, and perhaps even getting an attorney on board to make sure you do everything by the book.

There will also likely be extra steps you need to carry out to maintain your LLC, such as filing an annual report. Staying on top of these elements can be a hassle. What’s more, if you miss a deadline, you may be charged a fee.

If you’re concerned about late fees, legal fees, and compliance, you can seek out the help of a business formation service. We put together a detailed guide on the best business formation services to help you choose a service that meets your needs.

In this case, you’ll want a company that offers LLC services, such as ZenBusiness.

For just $49 per year (plus state filing fees), they’ll file your articles of organization, take care of annual reports, and create an operating agreement.

Their more advanced packages can even help you expedite the process and include further key services, such as federal tax registration.

Step 1: Prepare to File Articles of Organization

Before you file your articles of organization, you’ll need to do some research and preparation.

Then when it comes to filing you have everything ready and are less likely to make mistakes that require amendments down the line.

Find Out Your State’s Requirements

Some aspects of filing articles of organization vary from state to state. Therefore, it’s important you visit your Secretary of State or business filing agency’s website and carefully research what’s required.

In certain states, these documents even have another name. In Alabama, Maine, New Hampshire, and others they’re known as a certificate of formation, and in Connecticut, Massachusetts, and others they’re known as a certificate of organization.

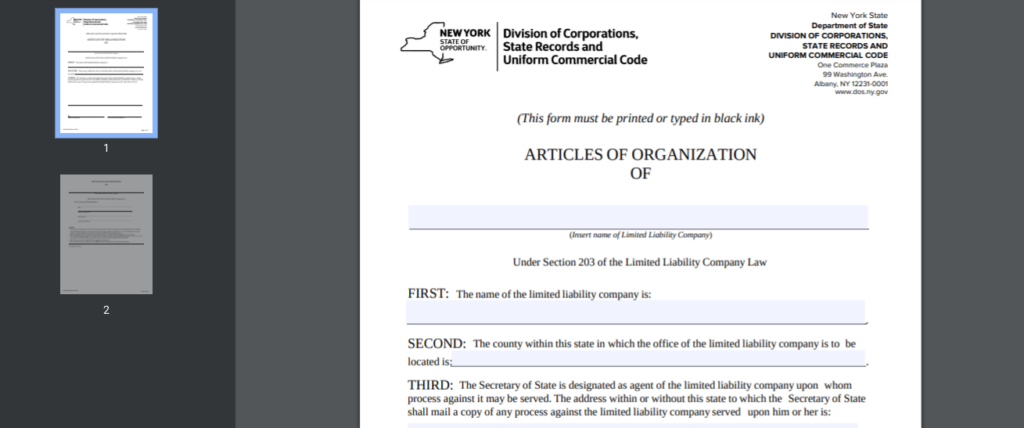

The way you file your articles of organization might differ from other areas. Some states require you to create articles of organization from scratch, while others have a ready-made form for you to fill out. New York state, for example, has a simple two-page template you can use:

The filing fee also varies from state to state but should be somewhere between $50 and $200.

Furthermore, all states require similar basic information as part of the articles of organization. Yet, some states require certain extras such as the names and addresses of LLC members.

Gather the Required Information

It’s a good idea to gather the information you need to file in your state in advance.

First, you’ll need to choose your business name. Note that it must end with “LLC”, “L.L.C”, or “Limited Liability Company”.

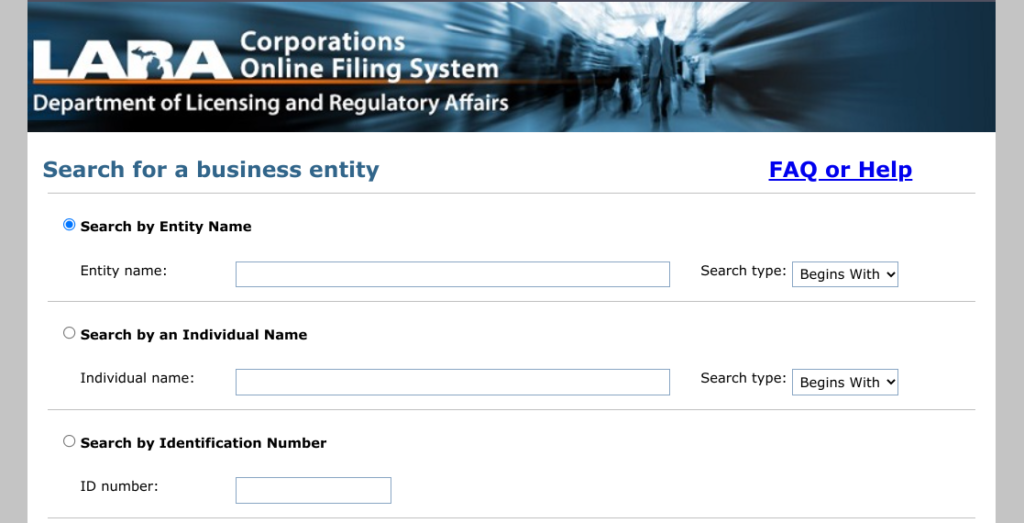

Before filing your application you must check that there isn’t another LLC operating under the same name. The business filing agency website for most states has an online tool you can use to carry out your search.

Here’s an example from the Department of Licensing and Regulatory Affairs for Michigan:

Furthermore, you must provide the address of the LLC, as well as your registered agent’s details which we’ll talk about in just a moment. Note that the address must be the principal place of business rather than a PO box.

Another piece of information your articles of organization should include is the effective start date of the LLC. Some states will give you the option of choosing your own start date or making it the date when the filing is accepted.

Depending on your state, you may need to provide details of the organizers of the LLC, i.e. those filing the articles of organization.

Also, you need to know whether you’ll file as a professional LLC or not. Certain states may have separate forms for licensed professionals that own an LLC, such as dentists, accountants, or lawyers, etc.

Appoint a Registered Agent

Including the name and address of your registered agent, sometimes known as a resident agent, is mandatory. The registered agent is simply the contact for any official or legal matters.

You or another member of the LLC can be named as the registered agent if you have a registered business address. Alternatively, you can appoint your business attorney as the registered agent. It’s also worth noting that many business formation services offer a registered agent service.

If at any point your registered agent changes then you need to inform the filing agency.

Step 2: File the Articles of Organization

Actually filing your articles of organization should be straightforward as long as you’ve done your due diligence. It’s just a matter of ticking all the right boxes and paying your filing fee.

Fill in Your Information

Naturally, you’ll need to present all of the details you gathered in the appropriate sections of your articles of organization.

When it’s time to fill out the form you’ll also need to include the purpose of the LLC. Some states allow you to simply put “for all legal purposes”.

In others, you must describe your product or service in more detail. For example, “The purpose of O’Hara’s LLC is to purchase, own, and sell real estate within the state of California, and all other legal acts permitted by limited liability companies in the state of California.”

Some states also ask for organizational and operational details. This may include details of the LLC members. Also, regarding the structure of the business, whether the members or a paid manager will manage the LLC.

Finally, make sure the articles of organization have been signed by the organizer. Depending on your state’s requirements you’ll send your articles of organization to the Secretary of State either online or by mail.

If it all starts to feel a bit overwhelming and you’re finding it hard to figure out exactly what’s required of you, don’t forget you can have a business formation service file the documents on your behalf.

Pay the Filing Fee

Some states use an online payment processor to accept your fee. Others require a check or money order sent to the Secretary of State. Include your check with your articles of organization if you’re sending them by mail.

It’s worth noting that the fee may be non-refundable even if your filing is rejected.

Get Accepted

When your filing is accepted, the state returns your articles of organization along with a certificate of formation. Of course, your state will also keep copies.

You can expect your articles to be processed within 14 to 21 days. Though the time it takes to process your filing varies from state to state.

If you form an LLC in the states of New York or Arizona, you also need to publish a notice of formation in a local newspaper.

In Arizona, for example, the notice must be in a newspaper in your local county that’s approved by the Arizona Corporation Commission. Moreover, the ad must run in three consecutive publications.

Step 3: Complete Further LLC Requirements

There are a few key processes you need to take care of after you’ve filed your articles of organization. These are things that’ll help you and the other members of the LLC out legally as you move forward.

Draft an LLC Operating Agreement

An operating agreement goes into much more detail about the structure of your business. It covers, for example, member contributions, voting rights, dissolution procedures, as well as any other special agreements between members.

There are five states that require an LLC operating agreement before the company is able to sell goods or services: California, Delaware, Maine, Missouri, and New York.

But even if it’s not a legal requirement in your state, creating an operating agreement can be extremely beneficial. It can prevent conflicts and legal issues down the line.

Moreover, there are certain default state regulations that come into action when you file articles of organization. These may regulate the admission of new members, management, dissolution of the LLC, and so on.

But an LLC operating agreement overrides these regulations. So if you don’t agree with the regulations or they aren’t appropriate for your business, you can, in essence, customize the way your business is governed by creating an operating agreement.

Open a Business Bank Account

When you legally form an LLC by filing articles of organization, all members receive personal liability protection.

This means that the LLC is responsible for any debts the business or its employees incur. So creditors can only recover debts from business assets and not personal assets.

For this reason, you need to separate your business finances from your personal finances by opening a business bank account for the LLC.

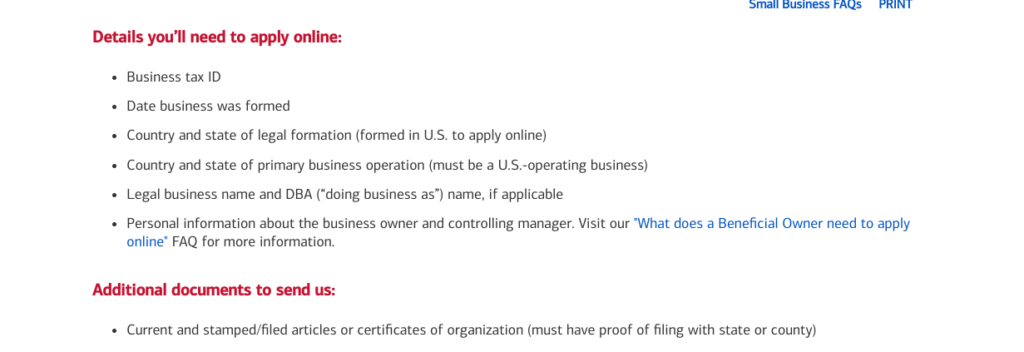

To do this you’ll need to submit legal documents, such as your articles of organization, and other important information to the bank. Here’s what Bank of America requires, for example:

Find Out if There Are Ongoing Requirements

LLCs are usually required to file an annual or biennial report and pay further fees to the state agency it used to file articles of organization. The purpose is to make sure all of your company details are up to date.

Check with your local government’s website to see if and when you need to file an annual report. If you miss the deadline, you may be charged an extra fee. And, often, this annual report is required to keep your LLC active.

You’ll likely need to include similar information to the articles of organization, such as member details, the business type, and registered agent details.

On top of this, you may have to include financial documents, for example, a balance sheet summary and auditor’s report.

Amend Articles of Organization

If your LLC makes changes to its basic information, such as the company name, duration, or contact address, you may need to file articles of amendment or restatement.

As part of the articles of amendment, you must state the date of the amendment, which article is being amended, and naturally the amendment itself. The document must also state that the rest of your articles of organization remain in effect.

In some states, however, there are separate forms for specific amendments. So, again, you need to check with the relevant agency to find out what’s most appropriate for your circumstances.

It’s definitely worth researching as sometimes these forms are less expensive. For example, in Maryland, it costs $25 to change the principal office but $100 to file articles of amendment.