You’ve finally registered your LLC and are ready to do business.

But a few questions still linger.

How do you distinguish the business owners from the business for liability purposes?

How do members vote on important issues?

What do you do when a member wants to leave the company?

What happens if one of the owners dies?

You won’t find these answers in your Articles of Organization, but an operating agreement can help you cover your blind spots.

The Easy Parts of Getting a Free Operating Agreement Template

Getting your hands on an operating agreement is a lot easier than most people think. While always recommended, you don’t necessarily need a lawyer or experience in business law to draft an operating agreement. A quick Google search will unearth countless operating agreement templates to choose from.

You also get your choice of free single-member LLC operating agreement templates, multi-member LLC operating agreements templates, and everything in between. There are even industry-specific agreement templates to make drafting a copy even easier.

Operating agreement templates are also standard across industries. Again, you don’t need any specialized experience or knowledge to draft a copy. You only need to know what to include in the agreement. Some of the critical areas your operating agreement should cover include:

- Organization

- Operational requirements

- Funding and capital investments

- Management and voting rights

- Profit and loss distribution

- Procedure for adding or removing members

- Dissolution

Most states also don’t require that you get your operating agreement notarized. This exception makes drafting an agreement between LLC members even more straightforward. Even so, it is always a good idea to get your legal documents notarized. It’s a formality that cements the agreement and can work in your favor in case of litigation.

Finally, you don’t need to file your operating agreement with the state. Most corporate governance documents require you to jump through hoops to file correctly. Instead, you can simply file your signed and notarized operating agreement with your other crucial documents.

TRUiC is a great tool that makes getting your free operating agreement template even easier. This website was founded by a group of entrepreneurs to offer free business guides to entrepreneurs. TRUiC estimates that its resources help form about 10,000 new businesses every month.

The website’s free operating agreement template is handy. You’ll be prompted to enter various details about your company and its membership. The result is you get a customized template specifically for your business. This won’t be just some random template that you pulled off the internet.

The Difficult Parts of Drafting an Operating Agreement Template

Getting your hands on a free operating agreement template is the easy part. The hard part will be drafting the actual agreement. The process is straightforward in theory. However, it will involve having difficult conversations with your partners about finances, voting, management, and other operational details.

Most multi-member LLCs are formed by friends, acquaintances, and/or married couples. As a result, it is easy to gloss over some of the more difficult sections of the agreement to avoid conflict. But, this strategy can spell doom for the company in the future.

Another common problem when drafting an LLC operating agreement is ambiguity. This ambiguity may or may not be intentional. Nevertheless, the primary idea behind the agreement is to ensure all members are on the same page. An ambiguous agreement can be exploited and will be useless at resolving possible contentions or conflicts.

It is worth having a lawyer go through the final agreement and suggest changes in light of the pitfalls mentioned above. Also, it is equally crucial that all LLC members are comfortable with the final document and agree to maintain its integrity.

With the potential challenges out of the way, here’s how you go about obtaining and drafting a free operating agreement template.

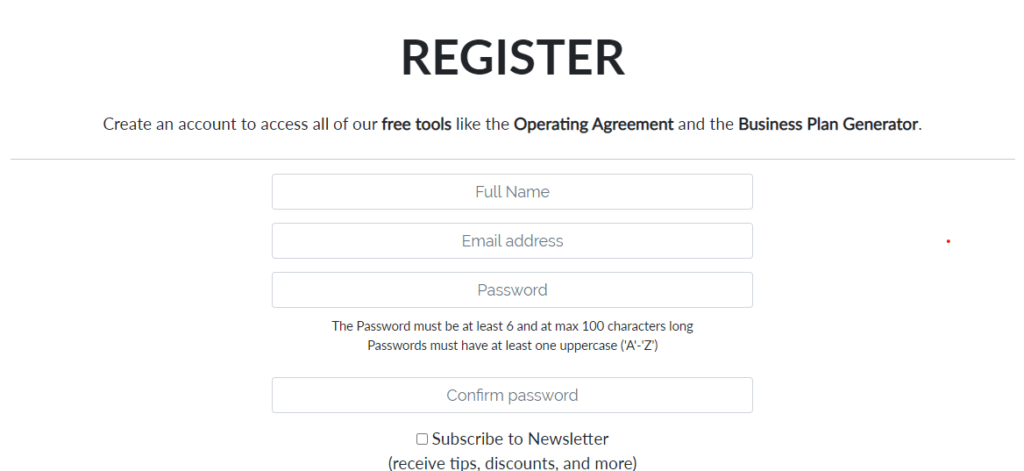

Step 1 – Sign Up For TRUiC

Signing up for TRUiC is very easy. You don’t need to provide any financial information or any sensitive personal information. Any information you’ll have to provide after creating your account is only used to draft your free operating agreement template.

Signing up for TRUiC also gives you free access to other crucial business resources available in the website’s Business Center. These resources include:

- Free legal forms like hiring documents and LLC Resolutions

- Listings of the best business resources in your state

- Formal business planning tool

- Business model canvas tool

Create Your Account

You only need your full name and email address to create your free TRUiC account. You can sign up for your free account here.

You will receive a confirmation email at the address provided. Simply follow the verification link to complete the signup. You will be prompted to enter your login information, including your username and password.

Click Log In to continue.

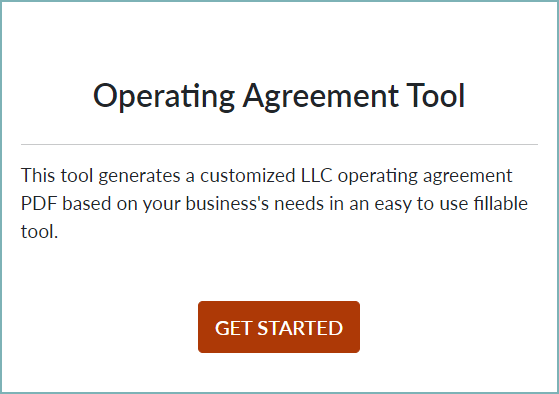

Select the Operating Agreement Tool

Once you’re signing into your TRUiC account, click the Operating Agreement Tool. Your account also comes with a free Business Planning Tool that you can check out at your leisure. This tool helps you create an effective business plan for your LLC.

For now, we’ll stick with the operating agreement tool.

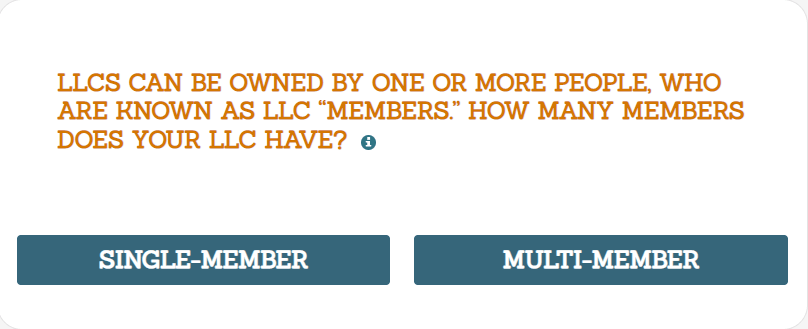

Choose Your Type of LLC

To get an accurate operating agreement template for your business, you’ll need to specify your type of LLC. The options are single-member LLC and multi-member LLC.

A single-member LLC is where you are the sole owner and have complete control over the company’s affairs. This also means that there are no other entities or individuals who have ownership of the company. Conversely, multi-member LLC implies multiple individuals own the company.

Choose your LLC and Click Save & Continue at the bottom of the page to proceed to the next step.

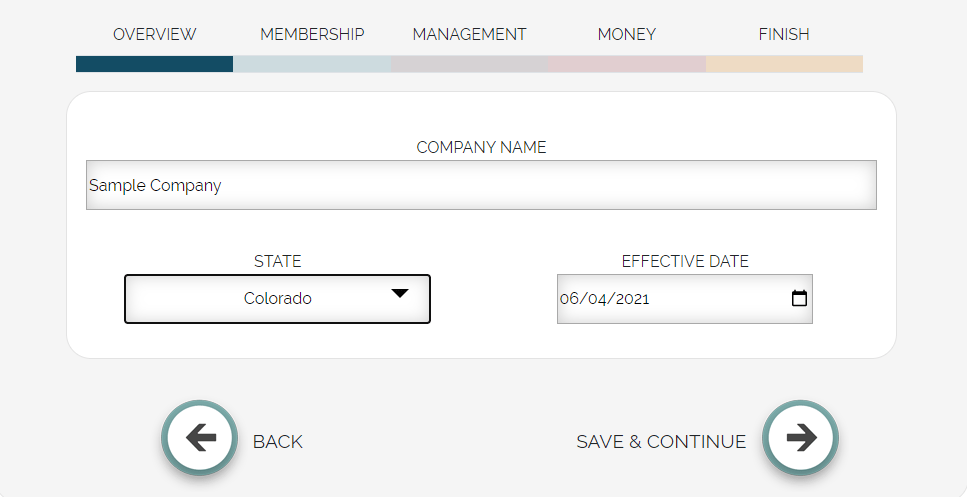

Step 2 – Fill In Your Company Details

Another great perk of using TRUiC for your operating agreement template is its customization. This isn’t just another boiler-plate template used by thousands of other businesses.

Enter Your Company Name

Enter the exact company name that you used to register your LLC. This is a legal document, so you need to ensure everything matches what is registered with the state.

Choose Your State

Once again, you’ll be getting a customized free operating agreement template. Choose the state where your company is registered from the dropdown menu.

Enter The Effective Date

Your effective date is when your LLC went into existence. Typically, this will be the date printed on your Certificate of Organization or Certificate of Formation, depending on your location. This is also the same date your LLC was approved by the state. Please refer to the acceptance stamp on your acceptance certificate to confirm the date.

Step 3 – Enter the Company Membership Details

You’ll now need to provide your company membership details. This will help to develop a template that all the members agree with. Again, you may need to consult with your partners when filling in this section.

Specify the Company Owners

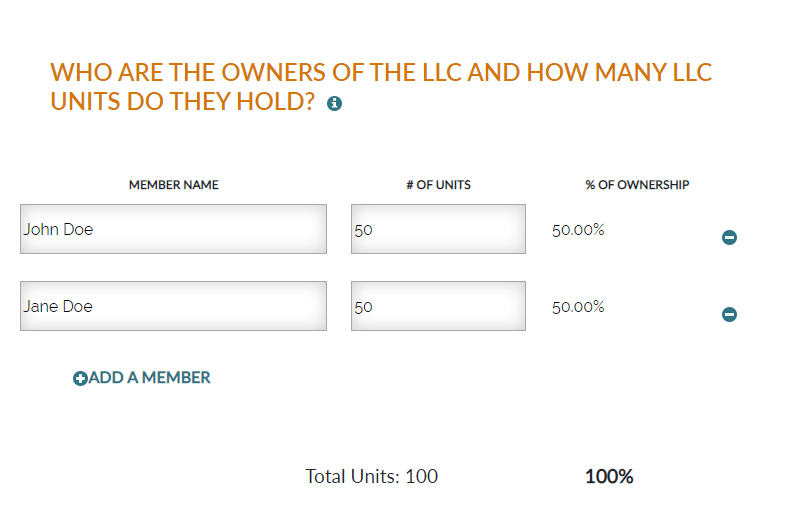

This step will look a little different if you are a single-member LLC. However, if you have multiple members, you will need to fill in their details, including the number of units or the percentage they own. There’s also the option to add more members if your company has more than two owners.

Please note that limited liability companies and corporations aren’t subject to the same rules. Percentage ownership of a corporation is determined based on the amount of money or property each shareholder contributes. There is a little more flexibility with LLCs.

For example, one member may contribute $20,000, and another contributes $2000, but the latter handles more managerial duties. In this case, members could still elect to share the business interests 50-50.

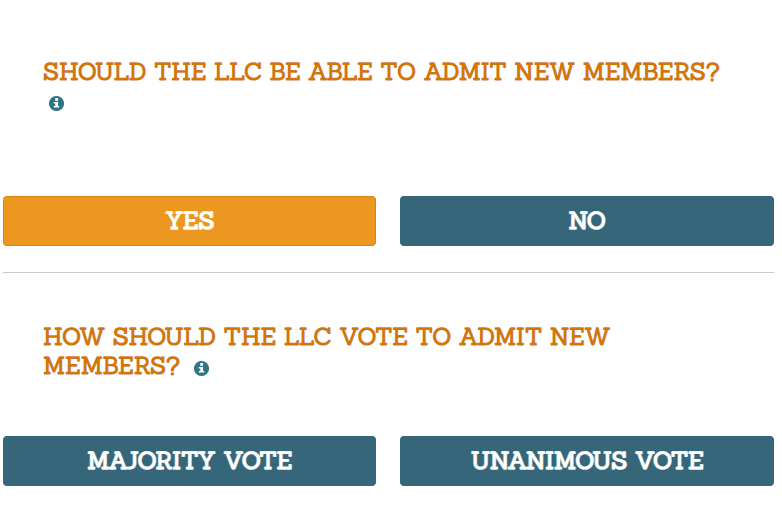

Finally, choose whether your company will be able to admit new members in the future. You’ll also need to specify how the members vote. The two most common options are majority vote and unanimous vote.

Click Save & Continue to proceed to the next step.

Specify Membership Transfer

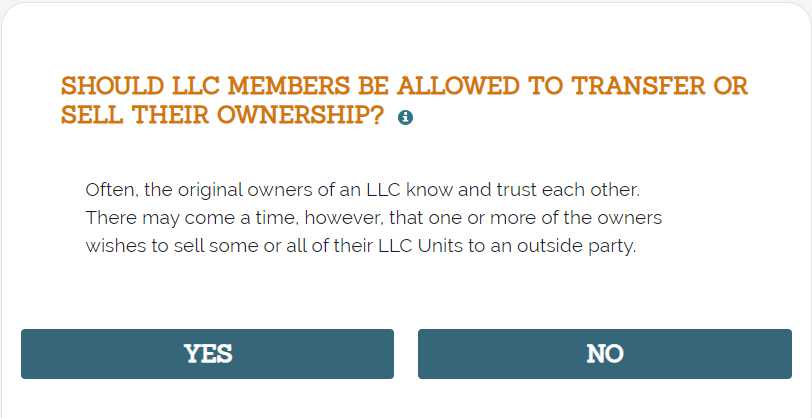

While your partner owners may be in for the long haul, things may change in the future. Think about whether it will be possible for owners to sell their stake to outside parties in the future.

Specify Members Leaving the Company

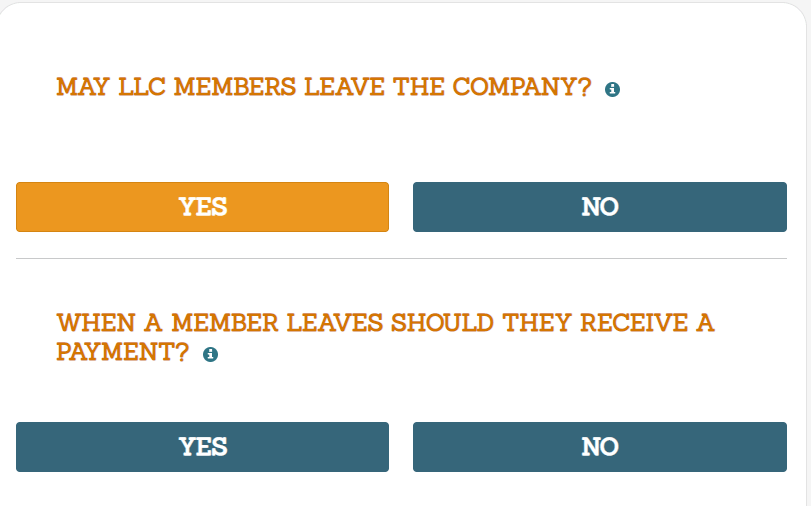

Depending on the agreement you have with other members, determine what happens if a member wants to leave the company. This is a crucial detail to include in your operating agreement. It is wise to give members the option to leave the company to avoid a lengthy legal battle in disputes.

Step 3 – Decide How The Company Is Managed

It’s now time to provide details for the company’s management type. If you haven’t already, discuss this section with your partners. It will prevent you from redoing this section of the operating agreement if members aren’t happy with the setup.

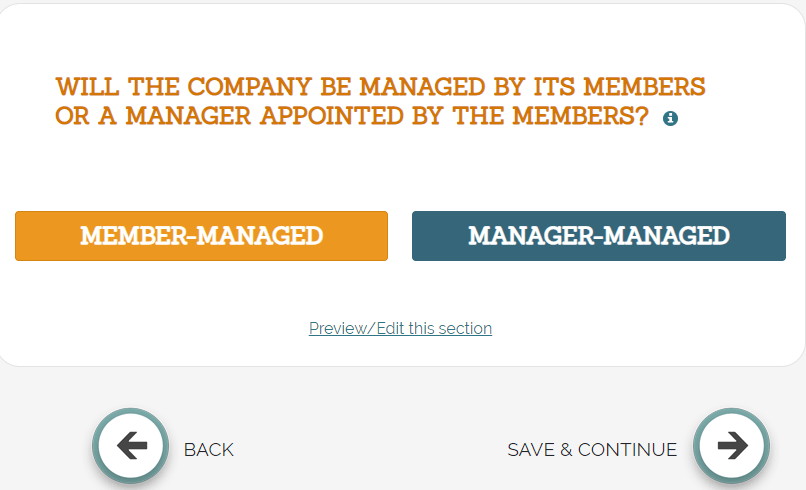

Member-Managed vs. Manager-Managed

Decide whether you will appoint a manager or if its members will manage the LLC. In most cases, LLCs choose the member-managed option. It is cheaper and allows the members to be involved in the company’s day-to-day operations. This is crucial during the initial stages of a business.

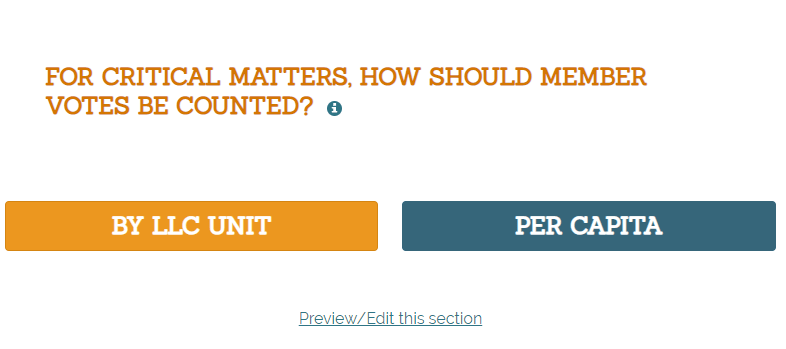

Counting Member Votes

There are specific issues that’ll require member votes. These scenarios include company mergers, conversions, or dissolution. You might also need to vote if the operating agreement needs amendment or when there are changes to the company’s membership.

There are two main ways to count votes in these situations. The first is a per capita vote, where each member gets one vote. The other option is per LLC Unit. Here, each member’s LLC units count as a vote. Some members will have more voting power depending on their ownership status.

Step 4 – Work Out Money Matters

Discussing finances with your close partners may not always be the easiest subject. But, an operating agreement is meant to protect all of your interests. It might even be good enough to save your relationships in the off-chance things go south.

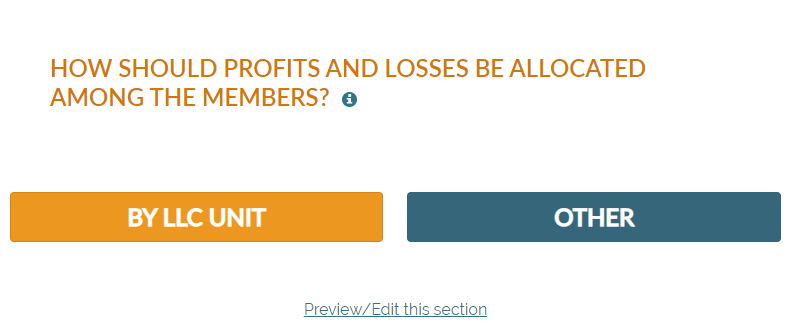

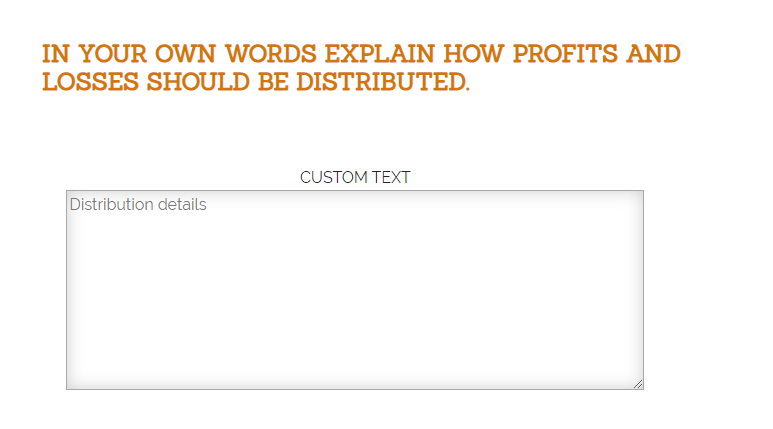

Profit and Loss Allocation

Decide how profits and losses will be allocated. This is an important section for the sake of accounting. It will also prevent unnecessary conflicts, especially in losses, credit, and other income items.

The simplest way is to divvy up profits and losses by LLC unit. If not, TRUiC allows you to specify precisely how you intend to allocate your income items. This custom section will be built into your template.

Tax Liability Requirements

Finally, specify if the company will need to make payments to members specifically to cover tax liabilities. Remember that a limited liability company is a pass-through entity. This designation means that members are required to pay taxes on the company’s profit.

You can elect to have the company payments cover the member’s tax liability.

Step 5 – Download Your Free Operating Agreement Template

You can always go back and review any information you provided before completing the process. Otherwise, you are now ready to take a look at your operating agreement template. But, again, this is just a template. Feel free to revise it any time you wish.

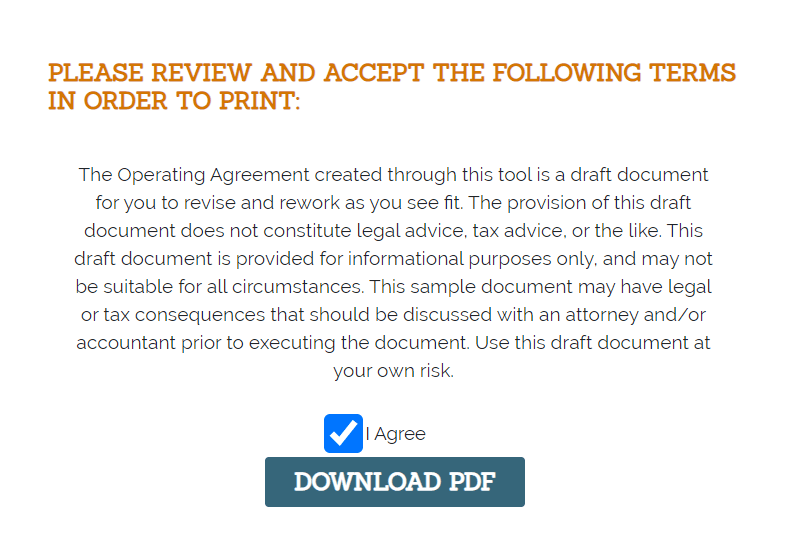

Agree to TRUiC Terms

Naturally, TRUiC has a disclaimer to protect itself from liability. Read through the disclaimer and tick the I Agree box to complete the process.

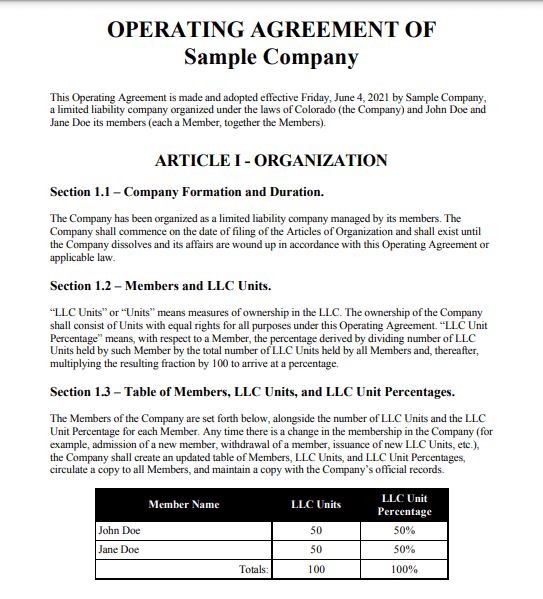

Download Your Free Operating Agreement

Click Download PDF to get your free operating agreement template. The template will be a few pages long and ready to use unless you’d like to make changes. The first page of the document will look something like this:

Review and Sign the Operating Agreement

Distribute copies of the operating agreement to all members, including the manager. Discuss the details of the document and make amendments as you see fit.

Finally, get all the members to sign the agreement. Each member of the company will need to sign for themselves and the company.

Be sure to get the manager’s signature as well.

Get the Agreement Notarized (Optional)

Having an operating agreement notarized isn’t a legal requirement. This document becomes legally enforceable as soon as all the members sign it. Still, it’s a good idea to get it notarized, even if it’s just a formality.

This is especially the case for a single-member LLC. Getting the operating agreement notarized can make it difficult for lawyers to pierce the corporate veil. This document is one of many records that can be used to prove that you didn’t create the company for the sole purpose of avoiding personal liability.

File the Agreement

Your operating agreement is now a crucial corporate governance document. Be sure to file it with other critical business documentation. You can refer to it in case of any disputes or if you need to make changes to the document.