Starting a new business is exciting.

But in many cases, you’ll need a business license or permit to operate legally.

License requirements vary by state, city, county, region, industry, business type, and more.

This makes it challenging for businesses to understand compliance requirements and ultimately obtain proper licensing.

That’s why we created this guide. By the end of this post, you’ll know which licenses or permits to obtain and how to register for them.

The Easy Parts of Registering a Business License

Registering a business license can feel like a daunting task, especially if you’re a beginner that hasn’t been through this process before.

What types of licenses do you need? How do you register? Are you forgetting anything?

Rather than doing this yourself, it’s in your best interest to partner with a business licensing specialist. Harbor Compliance can accommodate your needs.

Harbor Compliance will save you countless hours researching license requirements, preparing applications, and filing with the appropriate government agencies. They’ll prepare and file all of the paperwork on your behalf.

You’ll also benefit from proactive management to ensure your licenses remain active. They offer solutions for tracking deadlines and managing renewals as well.

The great part about Harbor Compliance is that they offer two separate business licensing solutions. In addition to the licensing services mentioned above, they also have a business license manager tool built into their compliance software.

So whether you want to pass off the licensing responsibilities to someone else, manage everything on your own, or a combination of both, Harbor Compliance has you covered.

The Difficult Parts of Registering a Business License

Compliance is the biggest challenge with registering a business license. That’s because there isn’t just one licensing jurisdiction that you’ll be dealing with.

In addition to state and federal business licenses, there are also different requirements at the city and county levels.

If your business expands or operates in multiple locations, you’ll need to get the license requirements sorted out in each area. In theory, a single company with locations in three cities throughout the same state could need different permits for each site.

Failing to register for your licenses or keep them up to date can lead to big problems for your business. You could be forced to shut down or face serious penalties. In some cases, you may not be able to apply for insurance coverage without proper licensing. Or worse, your insurance may not cover a claim if your license lapses.

So your job doesn’t end after you register. There’s still plenty of work to be done to ensure compliance.

Step 1 – Register Your Business With the State

Many first-time entrepreneurs make the mistake of trying to register for a license too early. Before applying for a business license, you need to register your business with the state.

So if you haven’t officially formed your business yet, hold off on the license until you complete this step. For those who have already gone through the business formation process, go ahead and skip to step two. If you haven’t, check out our in-depth guide to the best business formation services.

Choose an Entity Structure

The first thing you need to do is determine what entity structure you want to form. Options include:

- Sole proprietorship

- Partnership

- Limited liability company (LLC)

- C corporation

- S corporation

- B corporation

- Nonprofit corporation

There are additional subcategories within some of these structures, like series LLCs or restricted LLCs.

Sole proprietors don’t need to register with the state. But that doesn’t exempt them from certain licensing requirements. If you’re currently operating as a sole proprietor, it’s likely in your best interest to form a legal business entity with the state. This can make it easier for you to obtain licenses, and it limits your personal liability.

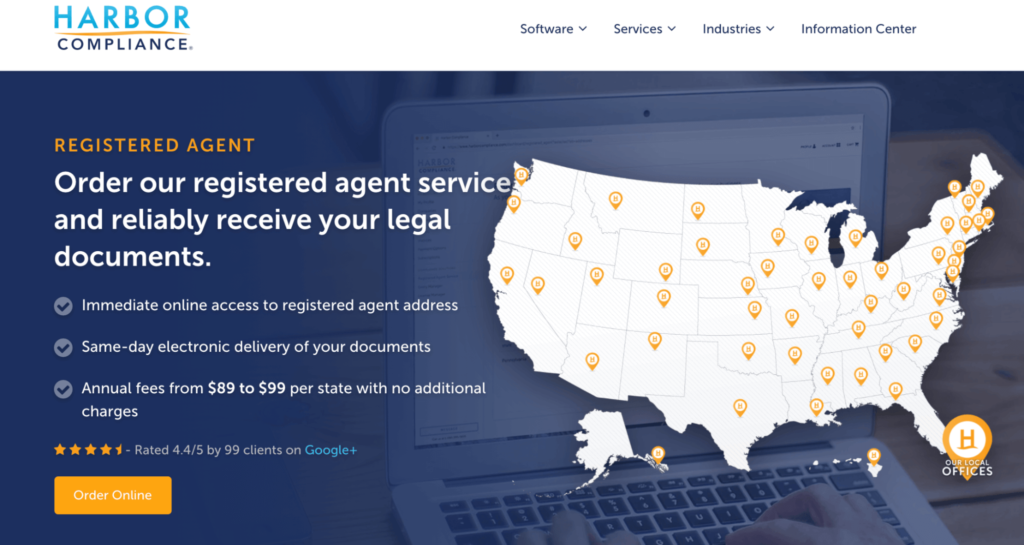

Appoint a Registered Agent

Every state requires businesses to name a registered agent during the formation process. Registered agents are responsible for accepting service of process and formal government correspondence on behalf of your business.

To do so, the agent must maintain a physical address in the state. They must also be available during regular business hours to accept document delivery in person.

Rather than doing this on your own or appointing a business partner, it’s much easier to use a registered agent service, such as those Harbor Compliance offers.

The service is available in all 50 states, and the cost starts as low as $89 per year. If you’re planning to use Harbor Compliance to help you with business licensing, it makes sense to use them as your registered agent as well.

File Your Formation Documents

Next, you need to file your formation paperwork with your secretary of state’s office. The exact documents required will vary depending on your entity type and state. Examples include:

- Articles of organization

- Articles of incorporation

- Certificate of incorporation

- Name reservation forms

- DBA registration

You’ll also need to prepare things like an operating agreement (for LLCs) and corporate bylaws (for corporations), even though these documents typically won’t be filed with the state.

It can take anywhere from a few days to a few weeks before your filing gets processed and the state formally recognizes your business.

Get an EIN

An employer identification number (EIN) is a requirement for some business types and optional for others. If you’re planning on hiring any employees, you’ll need to get one.

This will be the official tax identification number used by the IRS and state agencies for tax purposes. But there are other use cases for an EIN, such as opening a business-specific bank account.

For some business licenses, you’ll need to put your EIN on the application. If you don’t have an EIN, you’ll be forced to use your social security number.

Step 2 – Research Different Licensing Jurisdictions

Now it’s time to figure out where you’ll be getting potential licenses from. There are tens of thousands of licensing agencies nationwide. But these can be segmented into three main categories—state, local, and federal.

That’s why it’s so helpful to work with the licensing experts at Harbor Compliance. They’ll handle the difficult parts of this process on your behalf.

Below is a quick overview of those three main jurisdictions.

State Business Licenses

Each state has different licensing requirements. During the initial formation process, you may be given information on where to find and apply for each license.

Many states require an operating license, which essentially permits you to operate a company within the state.

Depending on your business structure, you might need to register licenses in multiple states. Let’s say you only have one location, but you have employees working in other states, and a significant portion of your revenue comes from another state. Both of these would be examples where an additional license could be required.

Your secretary of state’s office or business bureau can clarify the state requirements for you.

Local Business Licenses

While you won’t need to register with city or county government offices to form your business, you’ll likely need to contact them for licenses and permits.

Things like zoning permits, health permits, building permits, and seller’s permits commonly fall into this category. You may also need to obtain a permit from your local fire marshal if you have a physical location.

Other local offices that issue permits and licenses include:

- Chamber of commerce

- Department of public health

- Assessor or tax collector

- Zoning department

- Small business commission

- Local trade associations

So do your due diligence and contact these local offices to inquire about licenses.

Federal Business Licenses

The federal government typically doesn’t handle many licenses. But you’ll need to register with the IRS for tax purposes.

Getting an EIN for your business would be the main step here. If you want to register a tax exemption status for your business, you’d need to do that with the IRS as well. For example, if you are an LLC or a corporation that wants to be taxed as an S corp, you’d need to file form 2553 with the IRS.

If your industry is overseen by the federal government, a specific federal agency may need to approve the license—even if you’re applying for something at the state or local level. Examples include agriculture, fishing, firearms, aviation, transportation, mining, and tobacco.

Step 3 – Determine What Types of Licenses and Permits You Need

There are hundreds of different business licenses out there. But here’s a quick overview of some common license types and permit categories:

Operating Licenses

These are city and state-issued licensing permits giving your company legal permission to operate. Since each jurisdiction has unique requirements, you’ll likely need to apply for these separately at both the state and city levels.

Planning and Zoning Permits

Every jurisdiction has different rules for which types of businesses can operate and where they’re allowed to do so. These are the laws that prevent your neighbor from turning their house into an industrial waste disposal location.

You need to make sure that your location is legally zoned for the type of business you want to operate. If not, you’ll need to apply for a zoning variance to prove your operation won’t disrupt the community.

Building Permits and Home Occupation Permits

A building permit ensures that the physical structure you’re operating out of is up to code. The roof won’t collapse, and the electrical work isn’t a fire hazard.

Home occupation permits do allow some businesses to operate out of a residential home. But these are only granted if the operation doesn’t create additional traffic or add noise to the neighborhood.

Environmental Licenses

Some industries and locations must obtain a government-mandated environmental license. These commonly cover ecological elements like water and air quality.

For example, a car wash company might need to project water runoff that could create pollution in local water sources. These businesses would need to provide additional paperwork in the license application to ensure compliance.

Health Permits

Companies in the food and beverage industry typically need a health license or permit. A local inspector assesses them to ensure the operation is up to health code standards.

Your business will also need to comply with additional safety regulations, like those imposed by OSHA (Occupational Safety and Health Organization).

Industry-Specific Business Licenses

Examples of industries with unique licensing requirements include:

- Tobacco

- Healthcare

- Food and alcohol

- Electrical

- Construction

- Child care

- Pharmaceuticals

- Plumbing

- Landscaping

- Pest control

- Construction

Since these requirements vary by location, it’s best to work with a business license specialist to ensure you’ve covered all of the bases.

Step 4 – Register for the Licenses and Permits Required

Once you’ve narrowed down the exact licenses required for your business, it’s time to go through the official registration process.

Compile Documents for the Application

Every license will have its own unique application. So pay close attention to the instructions on each one. Examples of documents that might be required on a license application include:

- Copies of corporate records

- Proof of state or local tax status

- List of owners and managers

- Proof of insurance

- Surety bonds

- Audited proof of financial statements

- Filing fees

Most applications will likely ask for a description of the business and its activities as well.

Apply

Now that your documents are organized, it’s time to fill out the application and apply. You can do this on your own or work with a professional licensing specialist at Harbor Compliance to walk you through this process.

The specialists will prepare and file the applications for you. They’ll also communicate with the appropriate agencies on your behalf.

After you apply, it’s a bit of a waiting game. Depending on the license type and agency you’ve applied with, this process can take anywhere from days to months.

Some industries can expect a longer timeline for license issuance. Construction businesses, restaurants, farming, and dry cleaners are examples of business types that face a bit more scrutiny during the application approval process.

You might be able to expedite the licensing process by paying an additional fee with the application.

Step 5 – Keep Up With Business License Renewal Requirements

Your work isn’t done after the applications are approved, and the licenses are issued. The vast majority of business licenses require renewal at some point.

Since your licenses get issued at different times, they’ll likely each have different renewal dates. So it’s not like you can just renew all of your licenses at the same time each year. You’ll have to note when each one expires and set a reminder to follow the appropriate renewal steps.

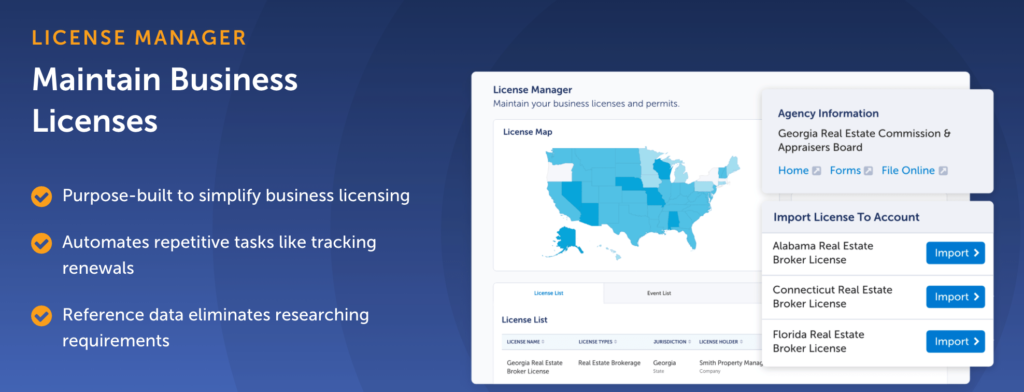

The license manager software from Harbor Compliance simplifies this step.

The software automates the renewal tracking process and gives you a complete overview of every license for your business. You’ll get a notification ahead of the renewal deadline to ensure the license doesn’t lapse.

You can customize the notification frequency and assign specific licensing tasks to different team members. You can manage all of this from a simple dashboard.

The tool also gives you access to all up-to-date requirements from the Harbor Compliance reference database. So if anything changed between when you first applied and now, the tool will provide you with an update.