Whether you’re starting a side hustle on your own or launching a full-time business with employees, operating remotely is appealing to many entrepreneurs for various reasons.

But taking your idea and turning it into a reality is a challenging step.

You still need to legally register your business, file paperwork with the state, and take steps to separate your personal assets from the company—even for a remote business.

Once you get these initial steps out of the way, you can fulfill your dreams of working from anywhere without ever stepping foot into an office.

This guide will walk you through the step-by-step process of starting a remote business.

The Easy Parts of Starting a Remote Business

The legal aspects of starting a remote business can be intimidating for new entrepreneurs. Registering your business with the state, filing the appropriate papers, preparing for how you’ll be taxed by the IRS, maintaining compliance—the list goes on and on.

Historically, business owners only had two options:

- Handle everything on their own and risk making costly errors.

- Hire a lawyer to set up your business and pay outrageous fees.

But today, there’s another option—business formation services.

By using an online business formation service to start your remote business, you can get 90% of your needs covered by a single provider. You just need to answer some simple questions about your company, and the formation service handles everything else on your behalf.

There are lots of great online business formation services to consider, but Incfile is an excellent option for remote startups.

Incfile lets you set up a wide range of remote business entities, including LLCs, corporations, and nonprofits. You can use them to obtain an EIN (employer identification number), register your business name, file the articles of organization, articles of incorporation, IRS forms, and so much more.

The base business formation services from Incfile start as low as $0 plus state filing fees. All packages include free registered agent services for the first year, too.

Using platforms like Incfile for starting a remote business will eliminate countless headaches and hours of filing paperwork. It takes less than five minutes to answer some questions and choose your preferences online. Then it’s just a matter of waiting for things to get finalized with the state—the service handles everything on your behalf.

The Difficult Parts of a Starting a Remote Business

Officially registering the business and getting yourself ready to start operating is the easy part. But then, you’ll face challenges that aren’t solved so quickly—running a profitable business.

Even remote businesses with low overhead struggle at first when it comes to making money. Getting your name out there, driving traffic to your website, landing customers, and retaining customers are all easier said than done.

Regardless of your industry, business model, or niche, you’re likely competing with hundreds if not thousands of other people doing the exact same thing.

It can take years to generate sustainable income that you can use to grow the business and pay yourself.

If you plan to start hiring employees as you scale, this presents other unique challenges as well. You’ll have to worry about managing talent, running payroll, additional tax compliance regulations, labor laws, and more.

Running a remote business doesn’t exempt you from these challenges.

But don’t let this discourage you. As someone who has successfully started multiple remote businesses, I can confidently say that the rewards far outweigh the challenges if you stick with your plan. Rewards include flexibility and saving a ton of money on overhead!

Step 1 – Choose Your Business Entity Type

Not all businesses are the same in the eyes of the state, the federal government, and the IRS. When you’re launching a remote startup, the first thing you need to do is determine which type of business entity is right for you.

Generally speaking, these are your options:

- LLC

- Corporation

- Nonprofit

There are other business types and subcategories out there, but most fall within these three general entity types.

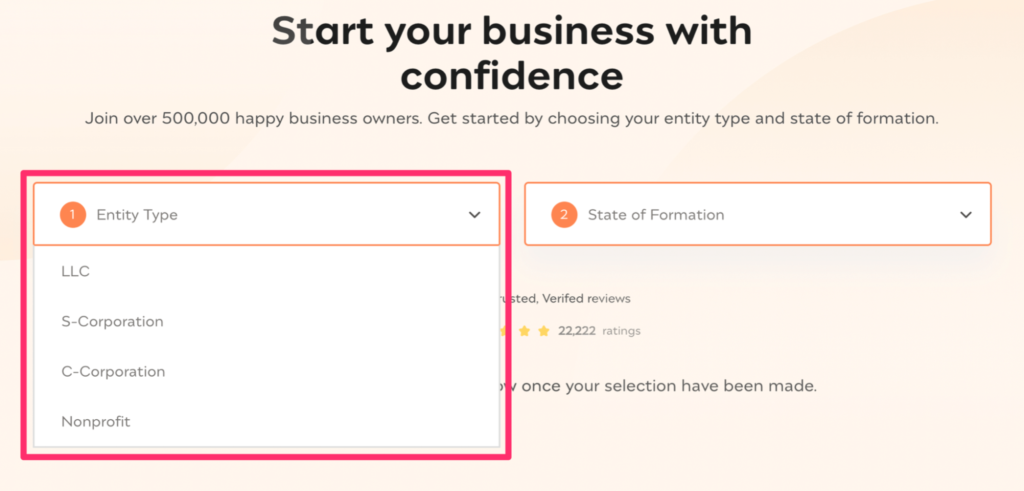

If you head over to Incfile and click Start My Business, the first step is choosing an entity and selecting your state.

Once you answer these two questions, it will present you with state-specific information and pricing. For example, the fees associated with starting an LLC in California won’t be the same as creating a corporation in Florida.

I’ll give you a basic overview of each entity type below to help you decide what’s right for your remote business:

LLC (Limited Liability Company)

An LLC will likely be the best option for most of you. According to Incfile, over 80% of small businesses are registered as LLCs.

This entity type offers flexible ownership options and provides owners with liability protection—hence the name. By forming an LLC for your remote business, you can separate your personal assets from the company ones.

LLCs also have the luxury of choosing how they get taxed. By default, single-member LLCs are taxed as sole proprietorships, and multi-member LLCs are taxed as partnerships. However, you can choose to be taxed as a C corp or S corp instead.

Consult with an accountant to determine which tax structure is right for your remote business. You can change this at a later time by filing straightforward paperwork with the IRS.

Corporation

Corporations typically fall into two main categories—C corporations and S corporations. The most significant differences between these two entities are the taxation and ownership structure.

Similar to an LLC, S-corps provide pass-through taxes. This means that taxes aren’t assessed at the entity level but rather on shareholders’ individual tax returns.

With C-corps, the business and owners are taxed separately. While you’re technically getting taxed twice here, the corporate tax income is usually lower on personal returns. Again, it’s always in your best interest to speak with an accountant or tax attorney as you’re making these decisions.

C corporations are better for companies that want to raise money from outside investors. Nearly all publicly traded companies are C corps.

Nonprofit

Nonprofits are a subcategory of corporations, but they’re usually categorized separately because of the unique requirements. To qualify as a nonprofit, the principal purpose of the company must be for public benefit.

If you qualify for nonprofit status with the IRS, your company may be exempt from sales taxes, federal income taxes, and property taxes.

Forming a nonprofit can offer liability protection to directors, officers, and employees.

Step 2 – Register Your Business With The State

Even if you’re operating remotely, you still need to register the company with the state that you’re operating in.

While there are some exceptions, the vast majority of you will be registering your business in the state where you live.

For the purposes of this tutorial, I’m going to walk you through this process by registering an LLC in California using Incfile. But the steps will be similar regardless of the entity type and formation service that you’re using.

Select a Formation Package

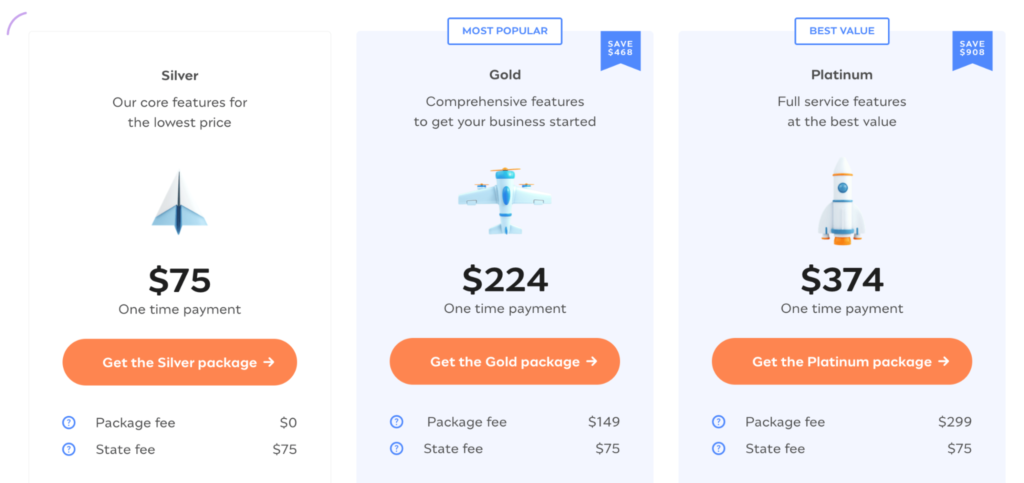

Incfile, like most business formation services, offers tiered packages for registering a new business. Here’s what those fees look like for an LLC in California:

The cool part about Incfile is the base package, Silver is 100% free. You get the core features of Incfile and only pay the state filing fees (not any Incfile fees).

The Silver package also comes with unlimited name searches, articles of organization filing, and a free year of registered agent services. But there are other requirements you’ll need to handle on your own.

The Gold package includes an EIN, IRS Form 2553, an operating agreement, an online dashboard, and unlimited support. And the Platinum level has all of those features plus expedited filing and a domain name with a business email included.

I recommend you go with the Gold package and let Incfile handle everything on your behalf.

Obtain an EIN

Every business needs an EIN (employer identification number). This is a nine-digit unique number assigned by the IRS that identifies your business for tax purposes. Think of it as the business-equivalent of a social security number.

EINs are required for business banking, tax returns, payroll, working with vendors, and so much more.

You can apply for EIN directly with the IRS for free. But it’s much easier to get one from your incorporation service. You can add this service to Incfile’s Silver package for $70 or get it for free with the Gold or Platinum plans.

Prepare and File Additional Forms

Depending on the entity type you’ve selected, additional forms need to be filed with the state. This includes things like:

- Articles of Organization

- IRS Form 2553

- Operating Agreement for LLCs

- Corporate Bylaws for Corporations

- Corporation Organizational Meeting Minutes

If you’re using a business formation service, make sure to select a plan that includes all of the necessary forms for your entity type.

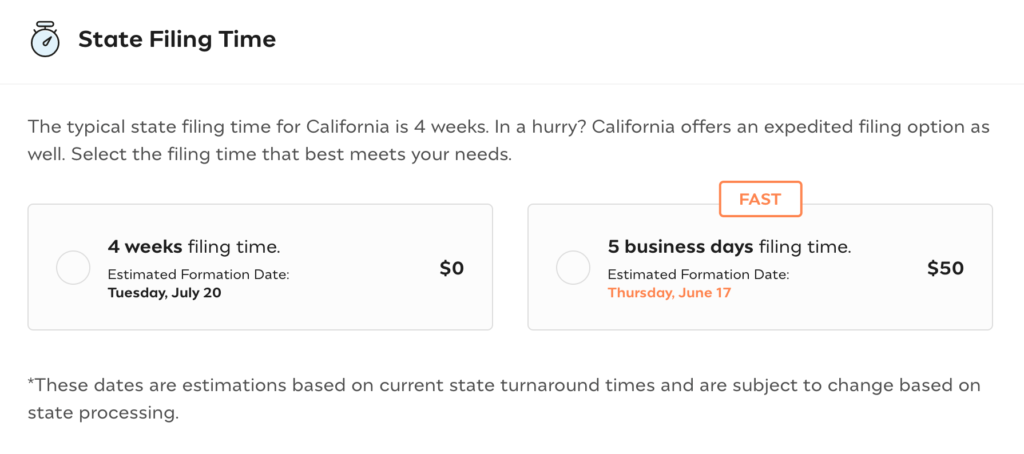

Most formation services also allow you to expedite the filing process for an additional fee.

As you can see from the example above, the average filing time for LLCs in California is four weeks. But you can pay an extra $50 to get it done in five business days. The fees and filing time estimates vary from state to state.

Name Your Remote Business

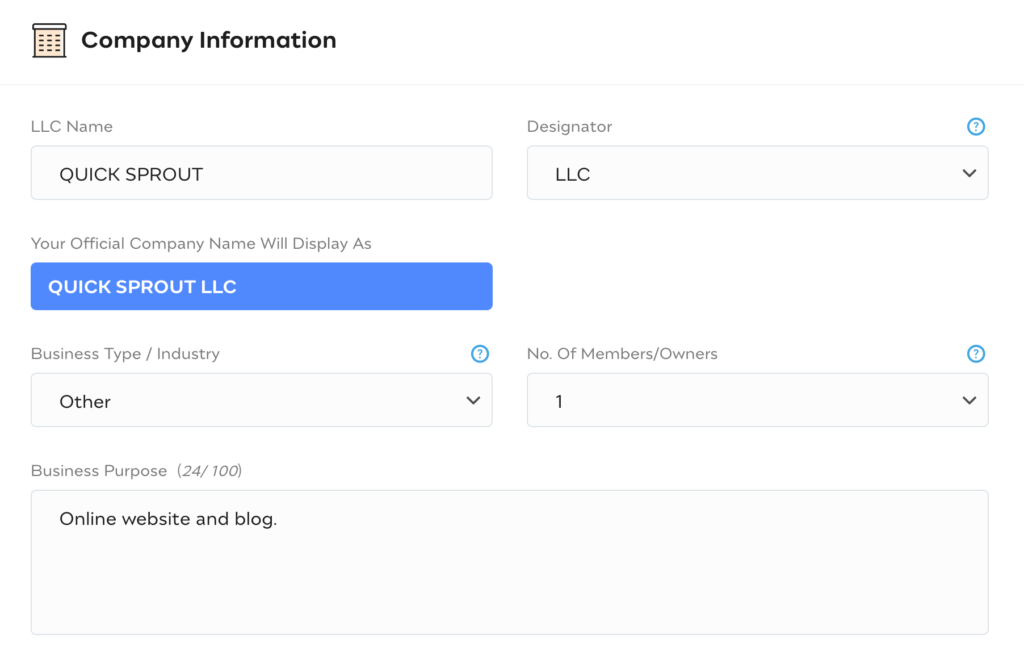

Now is your opportunity to name the business and provide additional company information.

This step is fairly straightforward. Just fill out the form fields as prompted.

You have the option to choose a designator as well. If I wanted to name my LLC “Quick Sprout,” then my designator options would be:

- Quick Sprout LLC

- Quick Sprout L.L.C.

- Quick Sprout Limited Liability CO.

- Quick Sprout LTD. Liability Company

- Quick Sprout Limited Liability Company

You’ll also need to provide some basic information about the purpose of your business.

The form will also ask you to select a management method. For LLCs, you’ll have the option to choose between member-managed and manager-managed. 99% of the time, you’re going to choose member-managed, especially for a remote business.

Member-managed means the “members,” or owners, of the LLC are running the day-to-day business. Manager-managed is when designated managers or appointees like a board of directors run day-to-day operations.

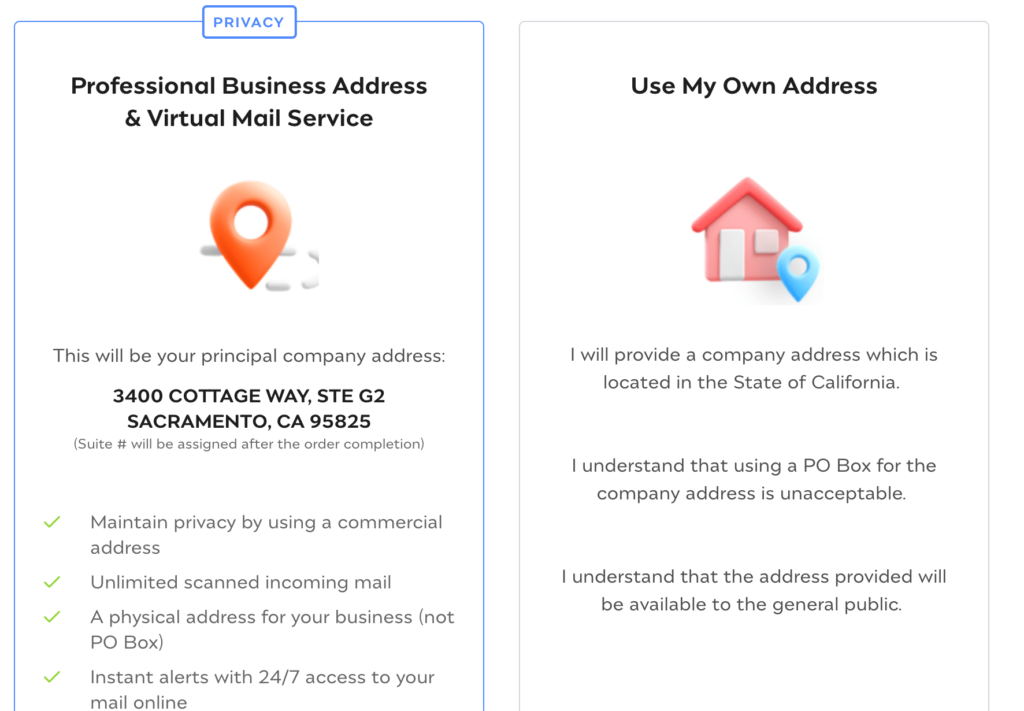

Provide a Business Address

Even if your business is remote, you still need to have an address on file with the state.

In most states, you can’t use a PO Box, and the address will become public record. So I advise against using your home address here. Fortunately, Incfile offers a professional business address and virtual mail service.

It’s just $29 per month, and you can cancel it at any time. But this is worth the price of keeping your personal address out of the public records.

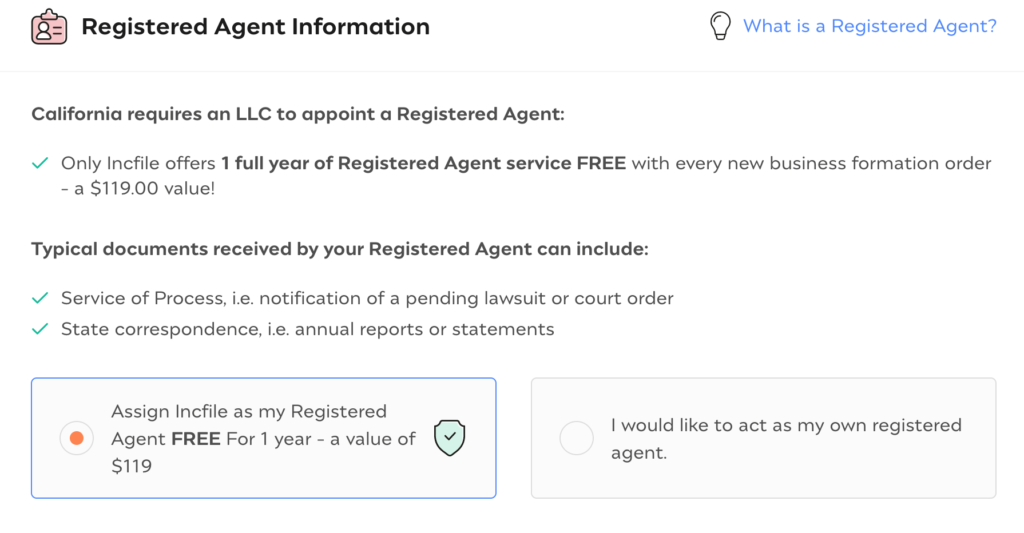

Step 3 – Obtain a Registered Agent

Every business, including remote companies, needs to have a registered agent. Registered agents are available during business hours to handle government correspondence on behalf of your company.

For example, let’s say your business gets sued. Your registered agent will accept court orders and summons on your behalf at their address so that nobody will be knocking on your front door.

While you do have the option, I strongly discourage acting as your own registered agent. It kind of defeats the purpose of operating remotely, as you’ll be forced to be available during all business hours at your business address.

Incfile offers free registered agent services for one year with the Gold and Platinum plans.

The service automatically renews at the regular price of $119 per year.

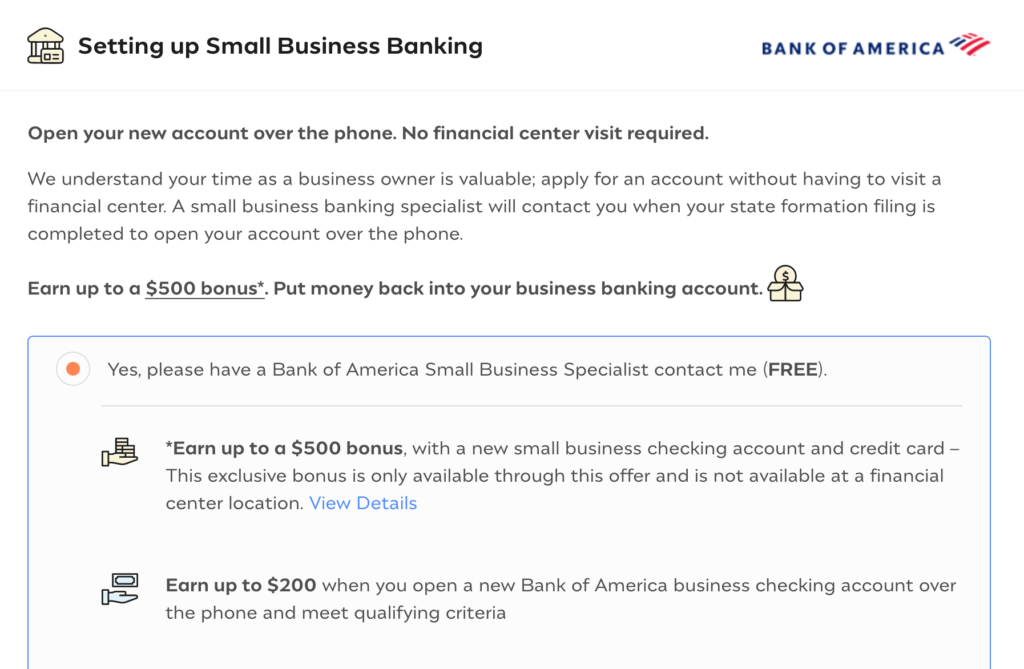

Step 4 – Open a Business Bank Account

Next, you need to set up a separate bank account for your business.

You’ll need to have an EIN for this step in many cases, which you’ll have by now if you’re going through these steps in the right order.

Many business formation services, including Incfile, have deals with banks to get you set up during the formation process.

Here’s an example that includes a $500 bonus (terms apply) with Bank of America through Incfile:

You can always skip this and get a bank account on your own. Check out our guides on the best online business banking solutions and best business checking accounts to help you narrow down your options.

Step 5 – Secure Your Domain and Create a Website

This step is essential for all businesses, but it’s especially crucial for remote companies. For most of you, your website will be the driving force behind a remote operation.

Even if you’re not quite ready to launch the site today, you’ll want to secure the domain as soon as you’ve registered a business name with the state.

Your website name doesn’t have to be the same as your business name, but many people mirror these two for simplicity. It all depends on your branding strategy.

Some business formation services will offer services for domain registration, but this is an upsell that you can skip. Instead, go straight to a domain registrar. These guides will steer you in the right direction: