Starting a business can be an extremely challenging process when selecting a business structure that doesn’t mesh well with the size and type of business.

The LLC (limited liability company) business structure is a popular and easy-to-operate choice for small businesses in Arizona with one or a few employees.

LLCs don’t have a lot of complex rules that business owners have to follow, which is great for a small business.

Many times, the new business owner in Arizona can handle the process of filing for an LLC without having to hire experts.

The Easy Parts of Starting an LLC in Arizona

The Arizona Corporation Commission (ACC) oversees the process of managing LLCs in the state. It also offers advice to those seeking to start businesses.

The ACC makes the steps required to file as an LLC in Arizona a relatively straightforward process. Business owners can perform some work online and some through printed forms.

Low Fees for Filing

Arizona’s fees for filing an LLC are below average compared to other states. This is helpful for a small business watching every expense.

Additionally, Arizona does not require the LLC to apply for a state business license or file an annual report. In some states, the LLC must use these items, both of which can generate additional expenses.

Hiring an Entity to Help With Filing

Multiple business entities exist in the state of Arizona that can help new business owners complete the forms required for starting an LLC. These entities are available for hire. Many are the same entities that business owners can hire to serve as statutory agents, which we’ll discuss later.

Businesses may pay anywhere from a few hundred to several hundred dollars per year for the full services of this type of entity.

Simple Business Structure

When starting an LLC in Arizona, new business owners will appreciate the simplicity of this business structure versus some other options, such as corporations.

LLCs don’t have to follow many rules in Arizona regarding ownership structure and regular filing of reports. Once the business files its Articles of Organization with the state, it doesn’t have ongoing obligations. This leaves the business owner more time to focus on the company.

Simple Taxation Requirements

The taxation requirements on an LLC are far simpler than a corporation. LLCs do not pay taxes themselves. This differs from a corporation, where the business must pay income taxes.

The profits of the LLC migrate directly to the owners. The owners then report this money on their personal income tax statements. This is far easier than trying to work through business tax law at the federal and state of Arizona levels.

The Difficult Parts of Starting an LLC in Arizona

Some businesses will find that the LLC’s structure doesn’t work for them. Additionally, Arizona has a few complexities in creating LLCs that may make this business structure less than ideal for some businesses.

Printing Forms

Although those looking to start an LLC in Arizona can fill out quite a few of the necessary forms online, some only have a printed option. This slows down the overall process. It can be frustrating to have to print and mail some forms while the state allows the digital filing of others.

Finding a Statutory Agent

In Arizona, the statutory agent (called the registered agent in most other states) must submit and sign a form indicating that the person or entity agrees to serve as the agent. Many other states don’t require this extra form and don’t require a separate signature.

Taxing Employee Benefits

If your LLC hires employees and provides benefits to those employees, the employees must count the value of these benefits as income for taxation purposes. This differs from a corporation, where the majority of employee benefits are not taxable.

This can be confusing for employees. It also may hinder the LLC’s ability to hire people, as potential employees may balk at paying taxes on benefits.

Step 1: Determine the Type of LLC

Arizona officially recognizes two types of LLCs. Business owners will need to select the right option for their particular needs.

Both types of LLCs provide the same primary benefit of allowing business owners to separate their personal financial and legal dealings from the business’s financial and legal dealings. Should the LLC default on a loan or become the subject of a lawsuit, the business owner’s personal assets are not part of the settlement.

The two types of LLCs simply differ in the kind of business models they support.

LLC

The majority of people looking to start a limited liability company in Arizona will select a general LLC structure. The LLC works for almost any kind of business and nearly every kind of market.

PLLC

A PLLC is short for Professional LLC. In Arizona, licensed professionals may want to structure their business as PLLCs instead of LLCs. Some professions that may select a PLLC structure include doctors, dentists, lawyers, CPAs, and veterinarians.

The benefit of a PLLC is that if one owner becomes the subject of a malpractice or personal lawsuit related to work, the other owners aren’t liable for any settlement.

When attempting to file as a PLLC, every member of the LLC’s ownership group will need to hold the correct professional license. Some people will need permission from their professional boards in Arizona to operate a business as a PLLC.

Those filing as a PLLC do not need to fill out any additional forms for the Arizona Corporation Commission. However, they will need to add a bit of extra information on the standard Articles of Organization form to qualify as a PLLC.

Step 2: Select a Name for the LLC

Selecting just the right name for your small business in Arizona requires some thought. Remember that it must follow the ACC’s guidelines and rules for naming LLCs. Business owners can’t just assume they can pick any name they want.

Picking a Unique Name

Arizona requires each LLC registered in the state to have a unique name. It assigns these names on a first-come, first-served basis. So you may believe you have the perfect name for your business, but if someone else files it with the ACC a day before you do, you are out of luck.

If you select a name that another business already owns and submit that name as part of your LLC filing, the state may reject your filing. You likely will not receive a refund of your filing fee.

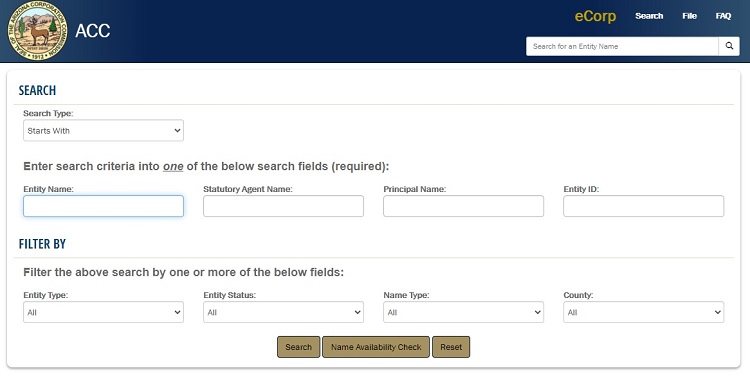

Fortunately, business owners looking to start a new LLC have an option for searching already-taken business names. The ACC Business Name Database contains a list of all current business names registered in the state.

New business owners can search this database as many times as they want for free. They can search for current business names that are an exact match for the search terms. They also can search for current names that contain a word that matches the search term. Use this resource to make sure your LLC’s name is unique.

Using the Correct Naming Convention

In Arizona, new LLCs must include “LLC” or “Limited Liability Company” somewhere in the company’s name. The state does allow some slight variations from the primary phrase or acronym, such as “L.L.C.” or “Limited Liability Co.”

PLLCs need to include the phrase “Professional LLC” or the acronym “PLLC” somewhere in the name.

Submitting a name that does not follow this rule will result in the ACC denying the application.

Reserving a Name

The ACC does allow potential business owners to reserve a name for up to 120 days before filing the forms required to become an LLC or PLLC.

This feature might be helpful if the business owner has a great idea for a name but isn’t ready to file as an LLC yet. The business owner can have the name reserved while putting together the work required to start the business, such as securing a website domain name that matches the desired business name.

The owner may complete the process of reserving a name by filling out a form online for $45 or by filling out paperwork and using postal mail for $10. The online process reserves the name for you immediately.

If the business owner eventually decides not to use the reserved business name, it becomes available for someone else to select after 120 days. However, the person who reserved it will not receive a refund of the reservation fee.

Step 3: Select a Statutory Agent

All LLCs or PLLCs in Arizona must have a statutory agent. This person or entity serves as the legal representative for the LLC when dealing with the receipt of legal documents. If you are familiar with starting an LLC outside of Arizona, other states commonly use “registered agent” for this purpose.

The statutory agent’s name and contact information will be part of the public record in Arizona. This allows people or government officials who need to submit legal forms to the LLC to have a clear point of contact. This person might receive things like:

- Notice of a lawsuit

- Tax-related documents and forms

- Legal documents

- Correspondence from the government dealing with legal matters

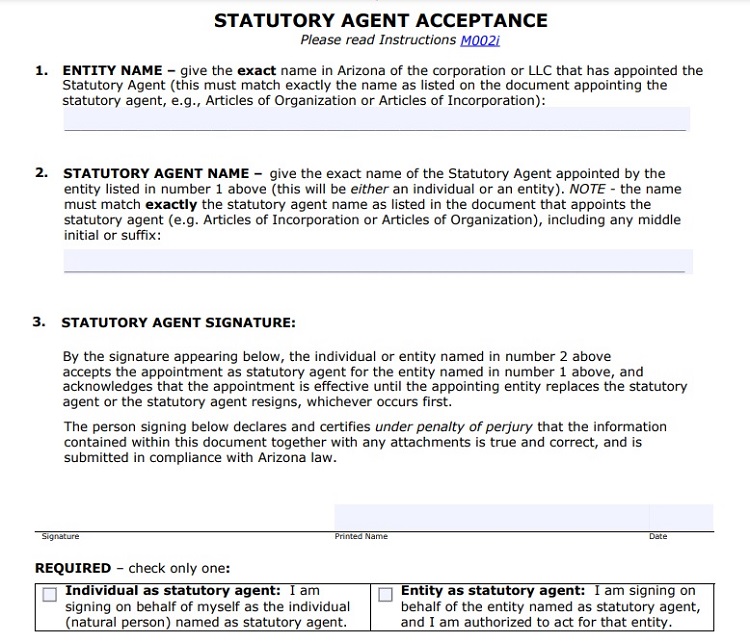

Prospective agents must sign the Statutory Agent Acceptance form to officially accept becoming the agent for the LLC. The LLC submits this form along with the Articles of Organization (that we’ll discuss in Step 4).

LLCs have a couple of options for selecting a statutory agent.

Selecting an Individual

A single person can serve as a statutory agent for the LLC. This person must be a full-time Arizona resident and must have an address in the state.

The business owner can serve as their own statutory agent if desired. The owner also has the option of assigning another employee in the business to serve as the agent.

The agent needs to be available most of the time at the listed address during normal business hours. If the business owner rarely or part-time is in the office, selecting another person or entity to serve as the statutory agent would be better.

Selecting an Entity

In the state of Arizona, an LLC has the option of hiring an entity that will serve as a statutory agent for the LLC. This type of entity likely is a business that serves as an agent for multiple companies.

By using an entity, the LLC owner doesn’t have to list their address as the public contact point for the LLC. Instead, the entity will list its physical address. The physical address for the statutory agent does not have to match the address of the business.

The LLC may pay anywhere from $50 to $200 annually to hire an entity to serve as the statutory agent.

Step 4: Complete the Articles of Organization

Arizona requires LLCs to file Articles of Organization as the primary means of creating the LLC. Business owners can file these forms for $50.

The filing must include a cover sheet from the ACC. This explains whether the business owner desires expedited processing of the Articles of Organization. It contains contact information and payment information as well. Expedited processing for the Articles of Organization can run from $35 to $400.

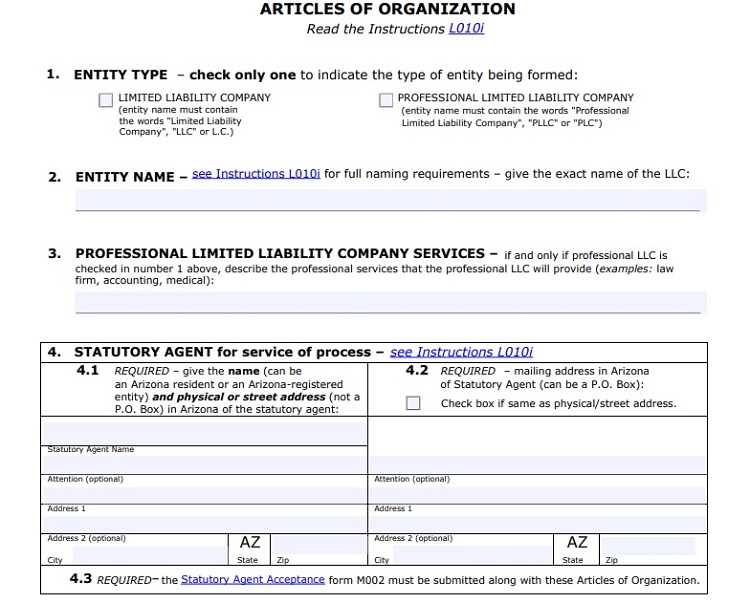

The Articles of Organization form consists of multiple sections.

Entity Type

Business owners will start by clarifying whether they will be filing the form as an LLC or PLLC.

For a PLLC, the business owner must add a description of the type of professional services the business will provide.

Business Name

After searching for and finding an available business name (as described in Step 2), the LLC will formally request the name from the ACC through the Articles of Organization form. It is vital to list the name exactly as the business owner wants it to appear officially with the state.

Statutory Agent Information

The Articles of Organization include a section where the LLC will list the contact information for the statutory agent. This section is different from the Statutory Agent Acceptance form (as discussed in Step 3). The LLC will also need to submit that acceptance form with the Articles of Organization.

Type of Management

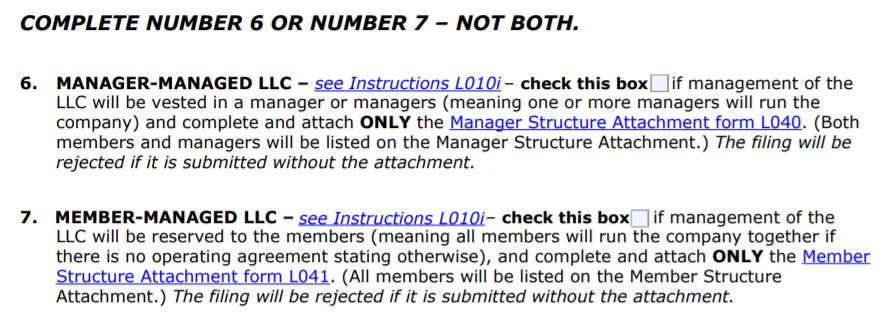

An LLC in Arizona can either use a manager-operated structure or a member-managed structure.

In a manager-operated structure, the owners of the LLC will hire someone to manage the business for them. In the member-managed structure, those who own the LLC also manage the day-to-day aspects of running it.

The business owner must check which management type they will use and include a separate document containing additional information. The form is known as the Manager Structure Attachment Form L040 (manager-managed) or L041 (member-managed).

Step 5: Final Tasks

To finalize the process of starting an LLC in Arizona, the business owner may need to complete a couple more steps after the ACC accepts the Articles of Organization.

Complete the Publication Requirement

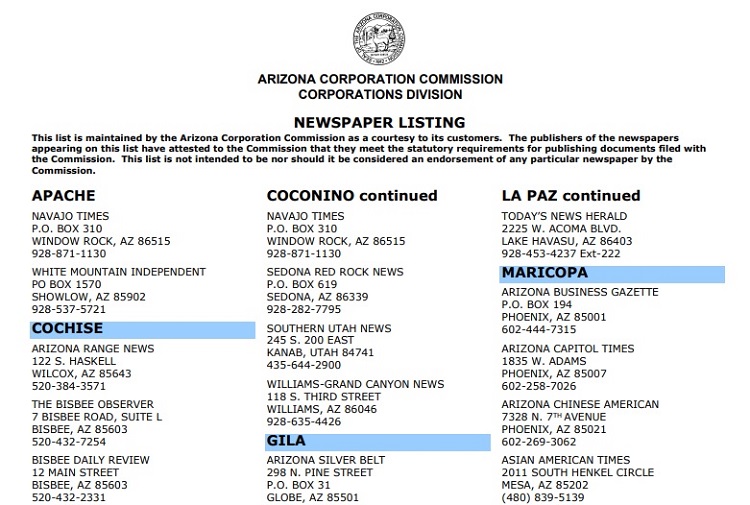

In certain counties in Arizona, the newly formed LLC must publish a Notice of LLC Formation in a local newspaper for three consecutive weeks. The newspaper must be in the same county as the LLC’s primary address.

This notice must contain the name and address of the business and the contact information for the statutory agent.

The ACC maintains a list of approved newspapers in each Arizona county where the publication requirement exists, as well as a list of counties that don’t require this publication notice. The cost for publishing it typically runs between $60 and $200.

The LLC must complete this process within 60 days of receiving approval from the ACC. Failure to complete it in time could result in the dissolution of the LLC.

Create an Operating Agreement

The state of Arizona does not require LLCs to file an operating agreement with the ACC. However, the business may want to have this legal document available. It spells out how the company plans to operate and the relationship among the owners of the LLC.

An operating agreement also discusses important things like voting rules and responsibilities, profit distribution, the power and duties of owners, the procedures for buying out a member or bringing a new one in, and more.

Once all members sign it, the operating agreement acts as a contract. While not required by Arizona, it is highly recommended for every LLC, as it protects the company’s LLC status and even protects your business from having to default to the state’s rules governing LLCs.