If you’re starting an LLC in Ohio, you’ve come to the right place.

Running a business is a tall task, but you need to handle the legal formalities with the state before you can operate.

The idea of filling out complicated forms, managing tax compliance, and applying for business licenses can be intimidating for an entrepreneur.

Fortunately, this guide simplifies the LLC registration process in Ohio.

Just follow the tips and steps described in this guide, and you’ll be up and running with ease.

The Easy Parts of Starting an LLC in Ohio

There are a lot of advantages to starting an LLC in Ohio. If you’re currently operating as a sole proprietor, the LLC formation gives you added liability protection for your business. You can shield your personal assets if the company gets sued or owes money to creditors.

Many entrepreneurs forming an LLC in Ohio worry about the documentation and filing requirements. But this process is hassle-free if you use an online formation service.

ZenBusiness is an excellent option for anyone starting an LLC in Ohio.

With platforms like ZenBusiness, you don’t have to worry about filling out complicated paperwork or filing formation documents with the Ohio secretary of state office. You just need to provide some basic information about your company and what you’ll be doing—ZenBusiness will take care of the rest.

Simplicity and accuracy are two of the main reasons why this service is so helpful.

If you file your Ohio LLC formation paperwork on your own, it’s much more susceptible to errors and mistakes. This will cause delays in the formation process and could push your start date back for months. ZenBusiness ensures that your documents are filed quickly and accurately so you can get to work immediately.

The formation plans offered by ZenBusiness are affordable as well. There are three options to choose from—$49, $199, and $299, plus state filing fees.

At first glance, it might seem cheaper to start an LLC in Ohio on your own. But using a formation service is well worth the marginal cost.

The Difficult Parts of Starting an LLC in Ohio

While forming an LLC in Ohio definitely has its fair share of advantages, there are a few drawbacks to consider as well.

Ohio has a commercial activity tax (CAT). This is an annual fee imposed on Ohio businesses, including LLCs, with taxable gross receipts of $150,000 or more in a calendar year.

Failing to comply with this tax law could result in a penalty of up to 10% of the tax due. In some cases, the state could even revoke your ability to operate. So it’s important to stay on top of this tax law.

Depending on your industry, you’ll also need to apply for business licenses and permits and keep everything up to date for compliance purposes.

The legal aspects of starting an LLC in Ohio are just the beginning. Once the state officially recognizes you as an LLC, you still need to run a profitable business.

Securing office space, finding customers, paying bills, buying equipment, hiring employees—the list goes on and on. Running a business isn’t easy. You’ll learn this quickly if you’re a first-time Ohio business owner.

Step 1 – Name Your Ohio LLC

The first thing you need to do is finalize your name. Depending on your situation, this step is easier said than done.

Some of you might already have a great name in mind. Others will need to do a bit of brainstorming to find a unique name that’s brandable for your Ohio LLC. Take your time as you’re going through this process, as your business name will stick with you for a long time.

Search the Ohio Secretary of State Business Name Database

Once you’ve landed a name you like, you need to make sure that it’s available. If another business in Ohio has already registered that name, you’ll need to come up with something else.

Navigate to the Ohio business name database on the secretary of state website. This will help you find active business names, canceled business names, and dead business names in Ohio.

The database isn’t the most user-friendly tool on the web. But you don’t want to register a name too similar to another business.

It’s also worth noting that Ohio law requires you to put one of the following in your name:

- Limited Liability Company

- Limited

- LLC

- L.L.C.

- Ltd.

I recommend using ZenBusiness to help with this process.

All plans come with a name availability search. The ZenBusiness formation experts will search the Ohio database on your behalf to verify the name’s availability. If your requested name is unavailable, you’ll be contacted to come up with an alternative name before the formation process continues.

If you’re struggling to find a name for your Ohio LLC, ZenBusiness has tools to inspire you, where you enter keywords related to your business to get a quick list of potential names.

Reserve Your Name

The best way to secure your name is to file your LLC formation documents immediately. But some of you might not be ready to proceed with that just yet.

If you’re in love with your name and want to make sure nobody else registers it before you complete the formation process, you can reserve that name directly with the Ohio secretary of state. Just fill out Form 534B. The application can be filed online or submitted by mail.

There’s a $39 fee associated with the application, and you can reserve the name for 180 days. This should give you plenty of time to get everything in order to file your formation documents.

Alternatively, you can use the ZenBusiness name reservation service.

If you plan on using ZenBusiness to form your LLC, using them for the name reservation makes sense. Then you’ll already have your account set up, and it will streamline the formation process when you’re ready to proceed.

Register a Trade Name (Optional)

You can always register your LLC name with the state but do business using another name. This is commonly known as a DBA (“doing business as”), but the Ohio secretary of state office refers to this as a “trade name” or “fictitious name.”

Some of you might not love the name you settled on previously. While that might be your official name with the state, you can come up with something more creative and brandable down the road.

For example, let’s say your Ohio business name is “Crown Holdings, LLC.” You could always register a trade name like “John’s Hardware Store” and use that name to conduct business.

Another reason a company might want to have a trade name is if you filed as a specific name, such as “John’s Taco Stand,” and want to have a more broad trade name, like “John’s Restaurant.”

You can download forms 524A from the Ohio secretary of state website or fill out an application online to register a trade name. There’s a $25 application fee associated with this form. Or you can use ZenBusiness to register a DBA.

Step 2 – Appoint a Registered Agent

Every LLC in Ohio is required to name a registered agent or statutory agent.

The agent can be a natural person who is a resident of Ohio. Alternatively, certain corporations, businesses, and professional associations can be registered agents in Ohio.

Here are some other quick rules to know about Ohio registered agents to comply with state laws:

- If the statutory agent is a person, they must reside in Ohio.

- If the agent is a business, the company must be allowed to conduct business in Ohio.

- Ohio registered agents must have a physical street address—PO boxes are not allowed.

- The agent must be available in person during regular business hours to receive service of process or official government correspondence on behalf of your business.

Your registered agent does not need to have the same address as your LLC. Technically, you could be your own registered agent, but we advise against that.

Most business owners don’t want to be available in person during all normal business hours. Plus, it could be embarrassing if you receive lawsuit paperwork in front of customers or employees. Even if you’re operating an LLC from your home, you probably don’t want your address to become available in the state public records.

Registered agents can receive requests for things like permits, annual reports, and tax forms. So you don’t want to trust this responsibility to just anyone.

Fortunately, you can use ZenBusiness as the registered agent for your LLC in Ohio.

There are two different packages to choose from—$99 or $149 per year. Both plans include the standard registered agent service, online document access, and expert support. The $149 package comes with worry-free compliance, which is well worth the extra $50 per year.

This extra feature sends you updates and alerts to ensure you won’t miss any deadlines. It also covers your annual report filing and two amendments per year so you can remain in good standing with the state.

If you sign up for a ZenBusiness LLC formation package, you’ll get 25% off the registered agent service in your first year. These are both services that you’ll need, so it’s a great deal if you bundle them together.

Step 3 – Draft and File Your LLC Formation Paperwork

Now it’s time to officially file your LLC formation paperwork with the Ohio secretary of state. This is what you’ll need to legally register your LLC as a business entity in Ohio.

Articles of Organization

The initial article of organization paperwork from the Ohio secretary of state is Form 533A, and there’s a $99 filing fee.

Instead of filling out the paperwork yourself, you can use ZenBusiness to do it for you. You just need to answer some questions about your business, and the service will fill out the articles of organization and file everything on your behalf.

The articles of organization will include information like:

- Name of the LLC

- Business address (principal place of business)

- Company’s purpose

- Registered agent information

- Member names and contact information (owners)

- LLC effective date

Standard filing times come with the entry-level Starter ZenBusiness formation package ($49 plus state fees). But the Pro and Premium packages come with expedited and rush filing speeds. These start at $199 and $299, respectively.

So if you want to start your Ohio LLC ASAP, ZenBusiness can make that happen.

Operating Agreement

While you won’t be required to file an operating agreement with the state, this is a crucial part of the LLC formation process.

Operating agreements are legally binding forms that outline the rules, regulations, and provisions of members. All ZenBusienss formation packages come with an operating agreement template, which really makes your life easier.

Your operating agreement should outline:

- LLC member information

- Board of directors

- Ownership structure

- Management and voting rights

- Membership distributions

- Capital contributions of each member

- Provisions for membership changes

- Dissolution

Creating a sound operating agreement is highly advisable for an LLC operating in Ohio. This is especially true for partnerships and multi-member LLCs.

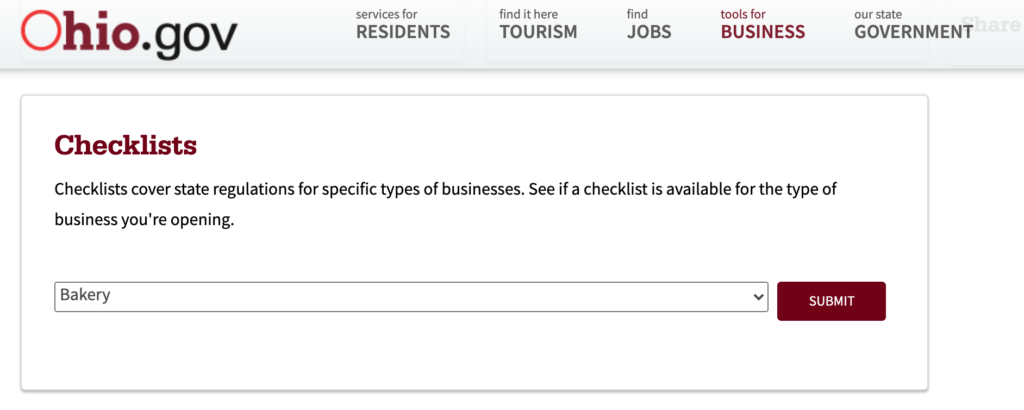

Step 4 – Obtain Any Required Ohio Business Licenses

Next, you need to get any business licenses required by the state of Ohio. If you’re selling tangible personal items or taxable services, you’ll need a vendor’s license from the Ohio Department of Taxation.

The Ohio Secretary of State office has a checklist for businesses in every industry. This list will let you know about any licenses you need to obtain for compliance.

For example, let’s say you’re starting a bakery.

The checklist would tell you to contact the local health department for license and inspection information. You’d also need to contact the Ohio Department of Agriculture’s Division of Food Safety for permit information. The checklist even has information on Ohio bakery laws, sanitary regulations, food labeling safety, and more.

The permits required for a bakery would look very different from the permits or licenses needed for an accountant. So make sure you obtain the necessary licensing.

Step 5 – Comply With Ohio Tax Requirements For LLCs

Unlike many states, Ohio doesn’t require LLCs to file annual reports. But there are still tax requirements that you need to consider to remain in good standing with the state.

Examples include:

- Ohio Commercial Activity Tax (CAT)

- State business taxes

- State employer taxes

- Sales tax

You’ll also need to account for federal income taxes and self-employment taxes. By default, LLC taxes pass through to each member’s individual tax returns.

If you’re using ZenBusiness as your registered agent, they can send you reminders about upcoming tax deadlines so you won’t miss a payment or filing. This service is only available if you sign up for the plan that includes worry-free compliance.