In early February 2025, President Trump and the leaders of neighboring Mexico and Canada settled on a deal for a one-month pause on 25% tariffs on goods originating from its cross-border neighbors—save for a 10% carveout for Canadian oil.

💰💸 Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💸

If a resolution isn’t reached by March 4, new car buyers will be stuck with higher sticker prices, as popular models from pickups to family cars sold in the U.S. come from factories in the Great White North and over the border in Mexico.

In addition, Trump recently revealed additional levies on critical car-building materials and is also considering imported auto tariffs of 25%.

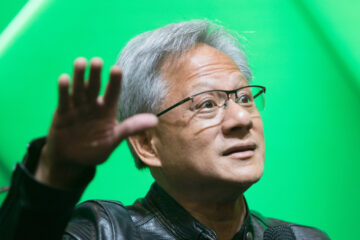

Stellantis Chairman John Elkann. During the automaker’s Feb. 26 earnings call, he expressed discontent with U.S. President Trump’s proposed Mexico, Canada tariffs.

Stefano Guidi/Getty Images

Stellantis chairman opposes tariffs on Mexican, Canadian imported cars

In remarks during Stellantis’s (STLA) earnings call on February 26, chairman John Elkann expressed his opposition to U.S. tariffs on imported vehicles from Canada and Mexico.

The interim head of the Chrysler, Dodge, Jeep, and Ram Trucks parent said that the automaker has been “very supportive of President Trump’s policy of boosting American manufacturing,” adding that it announced significant investments in U.S. manufacturing within “the first 100 hours” of the new administration.

But he sees any play with Canadian and Mexican production as a step too far.

“We fundamentally believe that the first Trump administration, as it negotiated the USMCA, was very cognizant of making sure that U.S. content was in the products we built in Canada and Mexico, which we believe should remain tariff-free,” Elkann said.

Related: Experts sound the alarm on car prices amid controversial policy

Stellantis’s North American manufacturing footprint stretches beyond U.S. borders

Elkann and Stellantis stand to lose a lot if tariffs on imports from Mexico take effect. In Mexico, Stellantis currently builds Ram’s heavy-duty pickup trucks, the Ram ProMaster commercial van, the Jeep Compass, and the electric Jeep Wagoneer S.

Over in Canada, it makes the Chrysler Pacifica, Voyager, and the Dodge Charger Daytona electric “muscle car.”

Already, Stellantis has made precautionary measures in light of the uncertainty in the trade environment, halting plans at a Brampton, Ontario, plant originally slated to build the new Jeep Compass.

Elkann did not leave his remarks about the tariffs as pure criticism. As a solution to help boost American manufacturing, the chairman suggested that Trump focus on imported vehicles that do not contain any American parts.

“[…]the real opportunity set for the administration in order to really boost jobs in America and manufacturing opportunities and investments is by closing the loophole that currently allows approximately 4 million vehicles into the country with any US content,” he said.

More Automotive:

The most reliable new hybrids in 2025New car buyers are in for good news about inflated pricesBMW’s newest Mini Cooper is a cool car for buyers on a budget

Elkann’s comments follow Ford, GM.

Elkann’s comments about the tariffs come after some of his Detroit rivals sound the alarm on the issue.

In recent remarks, General Motors (GM) CFO Paul Jacobson noted that the automaker wont feel the effects of temporary tariffs, but will have to weigh expensive decisions like relocating assembly plants if such tariffs persist.

Similarly, Ford (F) CEO Jim Farley warned that potential tariffs could “blow a hole in the U.S. industry” if imposed long term.

However, John Elkann’s remarks echo Farley’s concerns on Ford’s earnings call on February 5, when he argued for a comprehensive look at tariffs on its East Asian rivals.

“What doesn’t make sense to me is why are we having this conversation while Hyundai, Kia is importing 600,000 units into the U.S. with no incremental tariff. And why is Toyota able to import half a million vehicles in the U.S. with no incremental tariffs? I mean, there are millions of vehicles coming into our country that are not being applied to these,” Farley said.

“So if we’re going to have a tariff policy that lasts for a month or whatever it’s going to be years, it better be comprehensive for our industry. We can’t just cherry-pick one place or the other because this is a bonanza for our import competitors.”

Auto imports originating from Japan are subject to 2.5% duties, while there are no existing tariffs on cars imported from South Korea.

Stellantis NV is traded as STLA on the New York Stock Exchange.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast