Stocks plummeted on Friday after the US unemployment rate rose to a nearly three-year high of 4.3% in July, raising concerns about a weakening labor market and the potential risk of a recession.

Related: Jobs report cements case for bigger Fed interest rate cut

The S&P 500 is down 2.2%, heading toward its worst performance in almost two years. The Nasdaq Composite dropped 2.6%, the Dow Jones Industrial Average lost 2%, and the Russell 2000 Index is down 3.4%.

Former Fed economist Claudia Sahm, who created the “Sahm rule” indicator, said that while the US is not in a recession yet, “we’re not headed in a good direction,” according to Bloomberg.

Intel shares lost nearly 30% in morning trading. Amazon plunged 10%. Apple added 2.8% after earnings.

Amazon shoppers are looking for bargains, maybe jobs too.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

Clorox Co (CLX) +6.8% GoDaddy Inc (GDDY) +6.1% Marketaxess Holdings Inc (MKTX) +5.3% Resmed Inc (RMD) +3.8% Cboe Global Markets Inc (CBOE) +3.8%

The worst-performing five S&P 500 stocks with the largest midday drop are:

Intel Corp (INTC) -27.4% Prudential Financial Inc (PRU) -10.4% Synopsys Inc (SNPS) -10.1% Amazon.com Inc (AMZN) -9.6% Jabil Inc. (JBL) -8.9%

Stocks also worth noting with significant moves include:

Tesla (TSLA) -4%Apple (AAPL) +2.8%Nvidia (NVDA) -3.5%Snap (SNAP) -26.7%Booking (BKNG) -8.2%

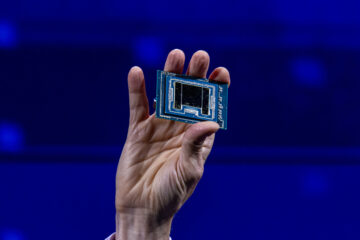

Intel crushed after brutal earnings and layoff

Intel shares slumped 27% midday after the company announced a significant earnings miss for the second quarter.

The chip company reported revenue of $12.83 billion in the June quarter, down 1% from a year earlier and missing the estimated $12.93 billion. It also reported an income loss of $1.6 billion.

Related: Analysts revamp Intel stock price targets on post-earnings collapse

“Our revenues have not grown as expected — and we’ve yet to fully benefit from powerful trends, like AI. Our costs are too high, our margins are too low,” Gelsinger said in a memo.

As part of its $10 billion cost-cutting program, it plans to lay off over 15% of its workforce by the end of 2025. “This is the biggest restructuring of Intel, I’d say, since the memory microprocessor decision four decades ago,” Intel CEO Pat Gelsinger told Yahoo Finance.

Intel stock is down 55% year to date.

Amazon plunges following revenue miss

Amazon stocks saw a 10% tumble during morning trading following its earnings report on Thursday.

The e-commerce giant posted an EPS of $1.26, up from the $1.03 forecast. The revenue of $147.98 billion added 10% but missed the expected $148.68 billion.

Related: The Fed’s biggest problem isn’t inflation anymore

Amazon now expects revenue for the September quarter to be $154 billion to $158.5 billion, which fell short of consensus estimates of $158.24 billion. The company said consumers are careful about the money they spend and “continue to trade down on price,” a sign that the economy remains under pressure even as the inflation cools.

Amazon stock is up 11% year to date.

Apple stock trades higher after earnings beat

Apple shares rose 2.8% midday following its upbeat earnings.

Related: Apple earnings top forecasts, iPhone sales slip ahead of AI launch

The tech giant reported its fiscal third-quarter earnings after Thursday’s closing bell. Earnings per share came in at $1.40, surpassing the estimated $1.35. Revenue was reported at $85.78 billion, exceeding the projected $84.53 billion.

More Tech Stocks:

Analyst revisits Nvidia stock price target after Blackwell checksCathie Wood unloads shares of rebounding tech titanBig tech company files Chapter 7 bankruptcy, closes abruptly

Its iPhone sales, which account for nearly half of the total revenue, was $39.30 billion, slightly above the estimated $38.81 billion but declined 1% year over year.

Apple has ramped up its investment in artificial intelligence. “We’ve redeployed a lot of people on to AI that were working on other things,” CEO Tim Cook said, “certainly embedded in our results this quarter is an increase year over year in the amount we’re spending for AI and Apple intelligence.”

Related: Veteran fund manager sees world of pain coming for stocks