Epic.

It’s a word used to describe a lengthy narrative poem, typically about the extraordinary deeds of extraordinary characters.

The Illiad, The Odyssey, Beowulf are all examples of epic tales.

Related: Analysts reset Tesla stock price target ahead of Elon Musk’s ‘Master Plan 4’

And now we have one more on the horizon.

Tesla (TSLA) Chief Executive Elon Musk is working on the latest version of his master plan and he promises it’s going to be a big deal.

“Working on the Tesla Master Plan 4,” Musk said on his X social-media platform. “It will be epic.”

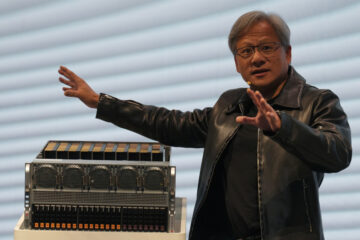

Elon Musk at Tesla’s former headquarters in San Carlos, Calif., on Nov. 28, 2006. (Photo by Joanne Ho-Young Lee/MediaNews Group/The Mercury News via Getty Images)

MediaNews Group/The Mercury News via Getty Images/Getty Images

What will Elon’s epic be?

A year ago, Master Plan 3 outlined “a proposed path to reach a sustainable global energy economy through end-use electrification and sustainable electricity generation and storage.”

“In an electrified economy with sustainably generated energy, most of the upstream losses associated with mining, refining and burning fuels to create electricity are eliminated, as are the downstream losses associated with nonelectric end uses,” the proposal said.

“Some industrial processes will require more energy input (producing green hydrogen, for example), and some mining and refining activity needs to increase (related to metals for batteries, solar panels, wind turbines, etc.),” the plan read.

‘Expect something else,’ analyst says

Morgan Stanley analyst Adam Jonas told investors that while Tesla would still make cars, they should prepare for “something else.”

The analyst expects Master Plan 4 to be underpinned by Tesla’s commercial ambitions in AI, robotics, and advanced computing.

Social-media speculation about Part Four has been running high.

“Robots, flying cars, and autonomy?” one person suggested. “Whatever it is, it will be awesome because Tesla has the best engineers in the world working for them.”

Related: Cathie Wood unveils surprising Tesla stock price target

“Let me guess,” another post read. “Tesla will own transportation, labor, and energy. Starlink will own telecommunications. X will own peer-to-peer information exchange. All of these are somehow intertwined, and we’re gonna put it all on Mars. You’re welcome.”

“Can we get an x phone elon?” another poster asked. “I want to ditch my iPhone and Samsung.”

Over on Reddit, one commenter described the plan as “How to cash out of the company while running it into the ground so he can pocket billions while looking like a saint.”

Ives: Musk pay approval removes ‘overhang’ on stock

Tesla shares have lost ground over the past 12 months. A year ago, Tesla shares were selling for $308. At last check, they were going for about $185.

Musk racked up a win recently when shareholders voted overwhelmingly to support the long-delayed compensation package, agreed in 2018 but rejected by a Delaware judge last year, that will pay Musk around $55.8 billion.

“This removes a $20-$25 overhang on the stock … that has weighed on [the] shares since the head-scratching Delaware ruling set this Twilight Zone soap opera on earlier this year,” Wedbush analyst Dan Ives said in a June 13 research note.

Related: Stellantis’ newest AI-powered gizmo aims for Tesla’s golden goose

Investors also backed Musk’s plans to reincorporate the group in Texas, where it moved its headquarters in 2021, and abandon its registration in Delaware.

Ives, who has an outperform rating and $275 price target on Tesla shares, said “an overwhelming retail presence voting green light for both proposals was key to approval despite some large shareholders voting no.”

“In addition, based on all of our discussions over the past month, large shareholders at the end of the day knew that voting no would risk Musk potentially eventually leaving as CEO and the risk far overweighed the reward in voting no on this proposal despite some obvious frustration with Musk,” he said.

However, the legal battle over Musk’s compensation isn’t quite over.

Analyst: Robotaxi day ‘key historical moment’

Tesla said in a court filing that a Delaware judge should recognize the vote by Tesla shareholders in favor of the pay package and reverse her January ruling that voided the compensation, Reuters reported.

Shareholder attorneys said the vote to ratify Musk’s pay has no legal effect and the only way for Tesla to challenge the January ruling is to appeal to the Delaware Supreme Court.

More Tesla:

Analysts reset Tesla stock outlooks after Musk’s $56 billion winCathie Wood unveils surprising Tesla stock price targetAnalyst predicts Tesla’s Elon Musk may create Apple rival

The shareholder attorneys said that before Tesla can appeal, Chancellor Kathaleen McCormick has to determine the legal fee that the company should be ordered to pay them for winning the case.

They had previously asked for 29 million Tesla shares, which are valued at more than $5 billion.

But on Friday they said Tesla could as an alternative pay at least $1.1 billion in cash, which would be justified by the court’s precedent, although they described that as “unfairly low.”

Tesla is scheduled to unveil its robotaxi on Aug. 8 and Musk has said the vehicle will have “no mirrors, no pedals, no steering wheel.”

“This vehicle must be designed as a clean robotaxi. We’re going to take that risk,” he said, according to Musk biographer Walter Isaacson. “It’s my fault if it f–ks up. But we are not going to design some sort of amphibian frog that’s a halfway car. We are all in on autonomy.”

Ives said that “Musk has been very optimistic at the shareholder meeting so far around autonomous, new models coming (we believe early 2025 a Model 2.5 hits the road), and it appears validation around Musk’s strategic vision with [Full Self Driving] and [the Optimus robot] is starting to take hold with some early positive signs.”

“We believe the August 8th robotaxi day will be a key historical moment for the Tesla story that we see as a near-term catalyst,” he added.

A (very) longtime booster of autonomous vehicles, Musk told analysts during the company’s earnings call in April that “if somebody doesn’t believe Tesla is going to solve autonomy, I think they should not be an investor in the company.”

Related: Veteran fund manager picks favorite stocks for 2024