Every small business that withholds income and payroll taxes from their employees‘ paychecks is obligated to report that withholding to the government.

Typically, you would use IRS Form 941 or the Employer’s Quarterly Federal Tax Return to file this information. But if your business is smaller and has a limited tax liability, you may be eligible to file a different IRS tax form: Form 944, also known as the Employer’s Annual Federal Tax Return.

Eligible employers can use Form 944 to file and pay federal income tax withheld from employees, along with Social Security and Medicare payments owed by employers and employees, only once a year instead of every quarter.

What is Form 944?

Form 944 is an IRS form that reports taxes, including state income tax (where applicable) and FICA taxes for Social Security and Medicare, that you withdraw from your employees’ paychecks.

The primary purpose of creating this form was for smaller businesses that have fewer employees and hence, less tax liability. Think of this form as an annual tax return. You can be eligible to file IRS Form 944 if your employment tax liability is $1000 or less–in other words, if you expect to pay $4000 or less in total employee wages for the year.

Moreover, Form 944 also requires information concerning the Additional Medicare Tax. While an employer isn’t required to pay this additional tax, it’s withheld from high-income employees and must be paid, along with the other employment taxes.

The Basics of Form 944

Now that you have a basic understanding of Form 944, let’s dive deeper to understand what needs to be done to fill the form accurately.

Determining Employer Eligibility

Form 944 eligibility cannot be self-assumed. You can’t just say you want to use it and have the IRS sign off.

First and foremost, you need a confirmation of your eligibility in writing by the IRS. It’s possible for the IRS to notify you that your business is either eligible or required to complete Form 944. Once you get the go-ahead, you cannot file Form 941 in its place unless you’ve requested and received the IRS’s permission to do so. That said, you may continue to submit Form 941 every quarter even if you’re eligible for Form 944.

If you haven’t received an IRS notification but believe your employment tax liability makes you eligible, you can contact the IRS by phone or email them to request this change. Be sure you make this request within the first few months of the year. If the IRS does change your file requirements, you should be receiving written notification from them soon enough.

Additionally, you can request to be eligible to complete IRS Form 944 if you’re a new employer. When filing Form SS-4 (this is the application you must fill to get an employer identification number or EIN), you can mention you think you’ll meet the Form 944 filing requirements.

The IRS will inform you about your employment tax filing requirements—whether you’ll file for IRS 944 or 941—when you’re issued your EIN.

Gathering All Payroll Data—And Doing It Accurately

You must collect all information you need ahead of time before you start filing Form 944.

As you now know, this form relates to payroll taxes, Social Security and Medicare taxes, and the federal income taxes that you’ve withheld from your employees’ paychecks. Make sure you have access to this information, along with the total compensation you’ve given to your employees throughout the year.

Even better if you use reliable accounting or payroll software for this purpose. You see, these systems make it easier to access the necessary financial data quickly. Plus, some solutions also generate a report specifically detailing all of the information you need for Form 944.

Knowing the Filing Right Dates

Your request to file Form 944 must be made in writing between January 1 and March 15 of the current year. Alternatively, you can also call 800-829-4933 between January 1 and April 1 of the current year.

As for filing, everything must be done by January 31 of the year after being reported. That said, you have until February 10 of the following year to file Form 944 if you made all the deposits on time and in full.

The amount of your tax liability determines the deadline by which you must pay your payroll taxes.

- Employment taxes for your business included on Form 944 can be payable when you file Form 944 if your total tax liability is less than $2500 for the year.

- If your total tax liability is $2500 or more for the year but less than $2005 for the quarter, you can pay deposits by the last day of the month after the end of the quarter.

- You can pay the fourth quarter’s tax liability with Form 944 if your fourth-quarter tax liability is less than $2500.

- If your total tax liability is over $2500 for a quarter, you must pay monthly or semi-weekly deposits depending on your schedule.

Note: Make sure you pay your payroll tax deposits using the IRS EFTPS system.

Social Security and Medicare Wages Calculation

You must calculate the appropriate Social Security wages and tips, Medicare wages and tips, and wages and tips subject to additional Medicare withholding in form 944.

Once you do this, multiply these expenses with the specific amounts mentioned on the form. These amounts reflect the percentage of wages and tips that get deducted for Social Security and Medicare tax.

You can make adjustments for sick pay or life insurance as specified on the IRS Form 944 instructions document, as well as any tax credit for performing or participating in research to get your final employment tax liability. Keep in mind you’ll have to report any deposits you’ve already made for the year too.

Calculating all wages and tips is more nuanced. I’ve only given you a gist of things to keep this guide brief.

Payroll taxes are complicated, and if you end up making any mistake, you’ll find yourself being penalized or fined. I highly recommend enlisting the help of a tax professional or outsourcing your payroll tasks if you face any difficulty when completing IRS Form 944.

5 Tools to Improve Filing Form 944

You can’t file Form 944 accurately if you don’t have the correct payroll information. For this purpose, you need a reliable accounting and payroll solution—preferably that can fine-tune all the needed data—that gives you uninterrupted access to all compensation-related information. Below is a list of the five best payroll software solutions.

OnPay

OnPay is a highly reliable and secure payroll service that comes packed with features and benefits. From unlimited monthly cycles to automated tax filing and payment to flexible periods and schedules, this tool gives you all—and more.

It offers specialized payroll solutions for businesses operating in specific industries with specific requirements. For example, if you’re running a restaurant, OnPay can easily handle the unique taxes and wage reporting systems. Plus, you also get HR benefits that can be incredibly useful for mixed workforces comprising W2 employees and independent contractors.

QuickBooks Payroll

Although more renowned for its accounting solutions, QuickBooks Payroll also has an excellent online payroll solution. While choosing this software is a given if you already use QuickBooks Accounting, you can give it a shot even if you don’t.

The software automates local, state, and federal tax calculation and payment every pay cycle. It has an Auto Payroll feature that can considerably reduce the time you take to run weekly payroll. However, one of its biggest USPs, in my opinion, is its tax penalty protection. QuickBooks will pay up to $25,000 if you get a tax penalty because of an error in your payroll.

Wave Payroll

Wave is another popular accounting software that offers a wide range of free accounting services. The payroll solution isn’t free, but it’s still one of the cheapest options on the market.

Since this is a cloud-based payroll service, you can log in to your account via the Wave website from any device. It also offers tax support services for 14 states in the United States. If you reside in any one of these states, Wave will pay and file your state and federal taxes when you run payroll. The employee portal functionality, where you can invite employees to create and manage their own accounts, is another plus.

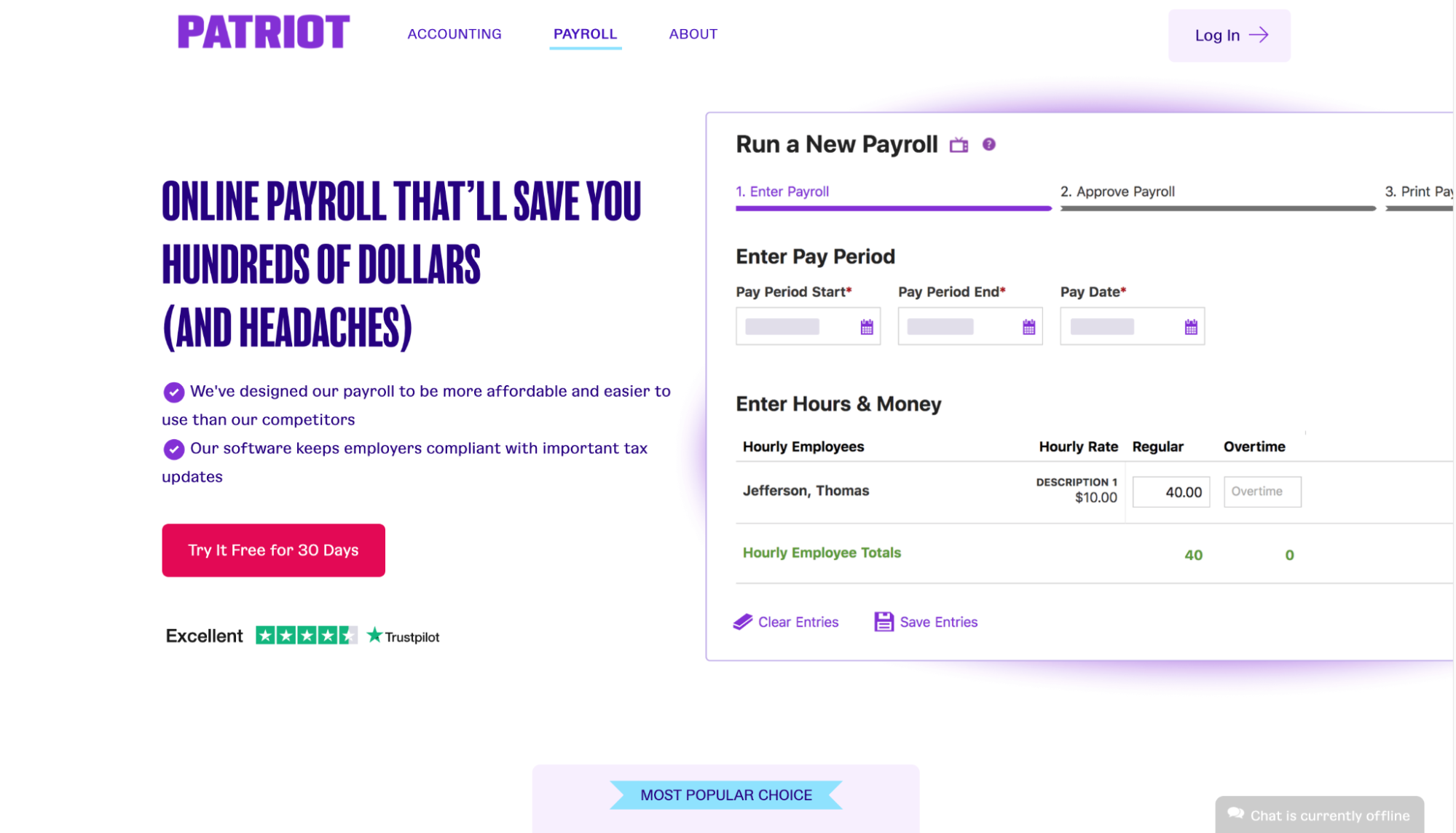

Patriot

Patriot is a flexible payroll software solution that lets you choose between full-service payroll and a more affordable DIY solution where you’re responsible for filing your own taxes.

You’re assured of unlimited payroll runs using any device, various payroll frequencies, and customizable hours, money, and deductions for both plans. Patriot also has an employee portal that employees can use to keep track of pay stubs, pay history, time off balances, and electronic W-2 information. Moreover, there’s no restriction on how you pay your employees. It allows payments via direct deposit or manual checks both.

Gusto

No payroll solution list can be complete without mentioning Gusto.

In addition to providing an unparalleled user experience, Gusto can calculate and file your taxes with little to no supervision from you. All your local, state, and federal taxes are automatically paid to the right government office for every payroll. Even the onboarding is super easy and straightforward customized according to the employer type.

5 Tricks for Filling and Filing Form 944 Correctly

Here are some of the best tips to help you minimize errors and frustrations when filing Form 944. Let’s take a look.

Hire a Reliable Accountant

A good accountant should do more than simply preparing financial statements and doing your taxes. They should be willing to work with you all year round to keep track of income and spending. They must regularly monitor your gross and net profit and make sure you don’t have a cash flow problem.

Start working with your accountant from day one—not just during the tax season. After all, good accounting is key for accurate data, which is key for filing Form 944 and avoiding expensive penalties and fines.

Store Your Paperwork All Year Long

It’s crucial to keep all tax-related paperwork throughout the year. You want to save every receipt related to your employees’ compensation. You see, having all your paperwork handy and organized will make the process a lot easier.

The IRS recommends keeping records for at least three years.

Keep Up With All Your Deadlines

When dealing with Form 944, not only do you need to pay the federal income taxes, state income tax taxes, and FICA taxes on time but also request the IRS to get their written approval to file this particular form instead of Form 941.

As you may realize, deadlines are vital here. If you don’t get the go-ahead from the IRS, you won’t have any other option other than filing Form 941.

Separate Your Business Expenses From Your Personal Expenses

The IRS may start looking at your personal accounts because of commingled money if they find your personal expenses mixed with your business expenses while auditing.

Precisely why you should make a point to get a separate bank account and credit card for your business, and only business expenses—in this case, paying your employees—through them.

Manage All Payroll-Related Activities Properly

If you face any difficulty filing Form 944, don’t hesitate to get in touch with a reputable company for assistance.

Many business owners hire a lesser-known and unreliable payroll service to save money. Don’t be one of them. These company owners end up on the hook as they realize far too late the service wasn’t remitting any payroll taxes for the company. The IRS will check every year to check whether you’ve paid your tax liability, so you really don’t want to mess this up.

What to Do Next

If you’re eligible for filing Form 944, you have to start collecting all the crucial information related to your employees’ compensation ASAP to avoid making any mistakes. Remember, any error can result in you getting heavily fined.

Fortunately, having the right software tools to keep track of onboarding, payroll, and time and attendance will make the process less intimidating and time-consuming. You can check out these Quick Sprout guides to set yourself up for success.