How do you figure out whether weekly, bi-weekly, semi-weekly—or even a combination of the three—would be the most optimal pay period schedule for your business?

Factors like employee preferences and labor laws are obvious considerations. But you also want a frequency that attracts and retains top performers and balances administrative costs with talent management goals.

Don’t worry, it isn’t as complicated as it sounds. Read on as I discuss the basics of pay periods, as well as tools and tips to help you improve your payroll.

What Are Pay Periods?

Pay periods are recurring lengths of time over which employee wages are calculated and paid.

The Fair Labor Standards Act (FLSA) has made it mandatory for businesses to pay employees on their “regular payday.“ But it hasn’t specified how often these paydays must come. States have taken matters into their own hands and set standards through payday frequency laws.

The most common pay periods are weekly, biweekly, semi-monthly, and monthly. While paying semi-monthly is still deemed acceptable, no state allows bi-monthly pay schedules at the moment.

How often you pay employees is a crucial decision because it directly affects recruiting and retention. It also means you should always be able to deliver paychecks consistently based on the schedule you select.

Missing payday, even by a day or two, can lead to employee resentment and opens you up to FLSA complaints. Additionally, penalties and fines related to wage violations are pretty steep.

The Basics of Pay Periods

Pay periods have several nuances. Once you understand them clearly, choosing the right schedule for your business will become considerably easier.

Four Pay Period Types

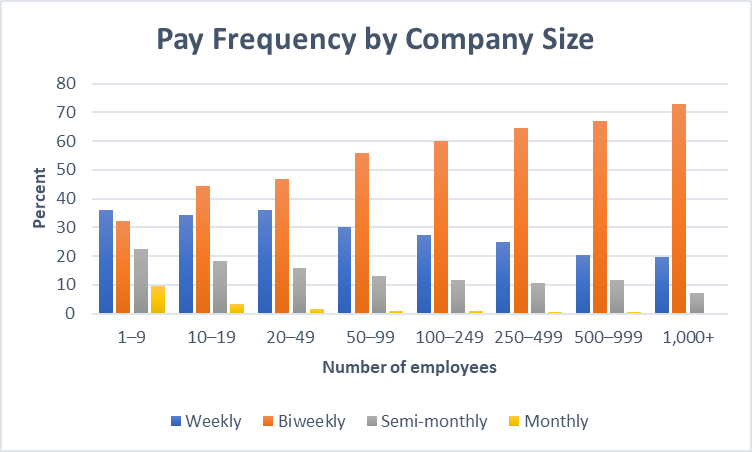

Image Source: U.S. Bureau of Labor Statistics

There are four types of pay periods: weekly, biweekly, semi-monthly, and monthly. The U.S. Bureau of Labor Statistics (BLS) found biweekly pay periods are the most popular, with 42% of employers paying on that schedule, followed by 34% paying weekly, 19% semi-monthly, and 5% monthly.

Let’s decode each of the above pay schedules below.

Weekly (52 Pay Periods Per Year)

Opting for a weekly pay period would involve you paying 52 paychecks in a year.

This is a good system for companies with hourly employees or lower-wage employees who don’t typically have a financial safety net for unexpected expenses. It’s why weekly pay is common in the construction, manufacturing, mining, and transportation industries.

Weekly payments are also the most costly and time-intensive pay schedule. Nevertheless, it may be worth your time considering the makeup of your workforce, your bookkeeping practices, and your recruiting goals.

Biweekly (26 Pay Periods Per Year)

Biweekly pay periods mean 26 paychecks each year.

This frequency works for hourly employees as well as salaried employees and is a clear favorite of growing companies. While 73% of large companies have a biweekly payment system, 32% of small businesses prefer it. This pay period is extremely popular in the education and health service industries.

Semi-Monthly (24 Pay Periods Per Year)

As you pay twice every month, a semi-monthly pay period will have you paying 24 paychecks in a year.

This is a very straightforward pay frequency, where the period runs from the 1st of the month through the 15th, and from the 16th through the end of the month. Salaried professions, such as information technology, finance, and professional services, are most likely to pay semi-monthly.

Keep in mind that these payments are challenging to administer as your pay periods no longer coincide with the workweek.

What would you do when your payday falls on a weekend? How would you calculate overtime based on a 40-hour workweek? These are questions you need to answer to make this pay frequency work.

However, following this schedule will save you from that occasional dilemma of needing to pay three paychecks in a month.

Monthly (12 Pay Periods Per Year)

A monthly pay period results in 12 paychecks in a year.

Although the least common across all business groups, monthly pay periods are the easiest and least expensive schedule to administer and suitable for salaried positions. You still have to plan and budget carefully when paying your employees, though.

Employment Law Applicability

You must consider federal and state laws when determining pay periods.

What makes things interesting is the states regulate pay period frequency, not the IRS. In California, the frequency of employee pay is regulated according to the calendar date and has different rules applying to different industries. On the other hand, some states have special provisions in place to protect specific types of employees. Rhode Island, for instance, gives child care workers the ability to choose how often they are paid.

Therefore, you must check with your state‘s department of labor to get more accurate information on pay regulations where you operate.

Gross Pay Calculation

Pay periods also affect an individual’s gross pay for a year. It’s why employers and employees must understand their pay schedules when calculating their total gross pay, as it factors into tax filings, deductions, and earnings expectations.

For salaried individuals, annual gross pay is simply their salary, but their monthly gross pay is that salary divided by 12. For hourly employees, gross pay is calculated by multiplying the number of hours they work by their hourly wage, plus any adjustments for overtime.

As you can see, there’s a clear distinction between salaried employees and hourly employees. While the former’s gross pay is consistent from one pay period to the next, the latter receives varied paychecks in different pay periods.

Overtime Considerations

According to the FLSA, overtime should be paid at 1.5 times the regular hourly rate for hours worked over 40 in a week. However, a few states have additional requirements.

Also, the Department of Labor has issued its final overtime rule to increase the minimum salary threshold for overtime exemption from $23,660 per year to $35,568 per year. Every employer will thus have to review their exempt employees and determine if they need a new threshold to ensure compliance.

If you have a higher number of non-exempt employees eligible to earn overtime, you should consider both factors when choosing your pay cycle. If you opt for a semi-monthly schedule, for example, you’ll have to pay on the 15th and the last day of the month, and every pay period will have a different number of days. Additionally, it’s also possible for the pay period to end in the middle of a workweek.

Because of this, your HR managers will find it more challenging to calculate overtime for hourly employees on this schedule.

Leap Year Exceptions

Some years will have an extra pay period depending on how you set up payroll and when the last pay period falls. This is known as the pay period leap year that only affects salaried employees, paid on a biweekly basis, resulting in a 27th pay period in a year.

Luckily, there are options for dealing with the extra pay period.

If you anticipate an extra pay period and provide fair notice, you can divide an individual annual salary by 27 instead of 26, or by 53 weeks instead of 52. However, if you don’t catch it in time, you’ll simply have to make adjustments for it. Many employers allow the extra pay period and take the loss in payroll.

5 Tools to Improve Pay Period Payments

Processing payroll can be expensive. You have to compensate for the time taken to calculate pay, and it doesn’t matter whether you hire someone to do it manually or use a sophisticated online payroll service.

However, when we consider accuracy and convenience, using a payroll service is a no-brainer. Below, we’ve compiled a list of the five best payroll services to streamline payroll based on your pay periods.

Gusto

Gusto is as user-friendly as an online payroll service can get. Nearly anyone can set up, manage, and pay workers.

Running payroll takes minutes and can be done on autopilot, assuming things aren’t changing every pay cycle. All you have to do is feed in the pay schedule and watch your employees get their dues on the assigned date. An unlimited payroll cycle allows you to issue payments whenever you want, so you aren’t locked into weekly or biweekly cycles.

This payroll solution can calculate and file your taxes. All the local, state, and federal taxes are automatically paid to the right government office every time you run payroll. What’s more, you get this benefit at no additional cost!

ADP Payroll

ADP Payroll is an all-in-one HR solution that takes care of most business activities, including hiring, time tracking, running background checks, and payment processing.

The software takes over once you finish entering your employees into the system and setting up their pay schedules and rates. Not only does this save time and money, but it also assures you of accurate and fast payroll and tax. Additionally, you can track your employees’ hours and manage their vacation days and PTO requests.

ADP Payroll has a mobile app that allows managers to approve payroll on the go. The facility to integrate with other apps is another benefit that can be helpful for your business.

OnPay

OnPay is another easy-to-use payroll service that offers options for handling employees and contractors.

You can use the software to pay both W-2 employees and 1099 contractors and eliminate common labor-intensive and expensive tasks related to payroll, such as taking out printable tax forms. This service runs payroll in all 50 states at no additional cost and can even work with the IRS on your behalf!

Employees have the option to self-service their own payroll. They can onboard themselves, access their account even after leaving the company, and change their personal information at any time. Employees can also manage voluntary deductions related to the employee benefits directly online.

QuickBooks Payroll

Although more renowned for its accounting solutions, QuickBooks’ payroll solution is steadily becoming popular among business owners for its customized solutions.

The service calculates and pays all your federal, state, and local taxes automatically every pay cycle. There’s also a tax penalty protection facility, where the company will pay up to $25,000 if there’s an error in your payroll causing you to get hit with a tax penalty.

All your bookkeeping records and reports are updated in real-time every pay cycle, making it easy for you to share information with your accountant. We highly recommend this online payroll service if you already use QuickBooks Online for your accounting needs.

Rippling

Rippling is a fully automatic payroll solution that makes paying your employees a breeze.

You can use this tool to pay all your employees and contractors regardless of their demographic. It syncs your HR data with your payroll, which eliminates the need for any manual labor. The service is also superfast, with every payroll run lasting for about 90 seconds only.

Tax compliance and tax filing are fully automated.

Rippling also comes with a comprehensive reporting solution to keep you up-to-date with all things related to your payroll. Like they say knowledge is power!

3 Tricks for Successful Pay Periods

Let’s take a look at the three best practices to set yourself up for payroll success.

Automate Your Payroll System ASAP

According to the American Payroll Association, error rates from manual payroll processes can cost you 1%-8% of your total payroll. However, if you automate your payroll system by setting up a payroll software program, these errors will reduce drastically.

Most of the time, system setup is a one-time process. You enter your employee details, set the pay period and rates, and you’re done! Easy peasy.

Prevent Time Theft

Time theft involves employees intentionally recording the hours incorrectly, taking overly long breaks, and spending work hours on non-work-related activities. Some of them may even use “buddy punching“ to check in to the system even when they’re absent.

Obviously, these practices are fraudulent and are disastrous for your business.

To prevent time theft, you should implement a checking system that automatically records an employee’s hours when they sign in or swipe their cards. Utilizing biometric sign-in hardware such as a fingerprint scanner is another good tip.

Perform Regular Process Audits

Irrespective of whether you have a manual time card system or a computerized one, it’s crucial to audit your processes at least once a year. Yes, even an automated system can produce errors.

Not catching process errors on time can end up costing you dearly. You may misclassify a new employee, forget to increase the pay of a recently promoted employee, or overpay an employee due to a math error—so many things can go wrong.

Precisely why you should double-check all your paperwork and processes to ensure everything is in optimal condition.

What to Do Next

Choosing the right pay periods—one that keeps your employees happy and ensures uninterrupted operations—is crucial. Once you get that sorted, you should focus on factors that streamline payroll processing, making it error-free and compliant.

Here are a few other guides that can streamline your payroll processes further: