Processing payroll is hardly the most exciting business task, but it is a crucial process nonetheless. For this reason, you need checks and balances to ensure that you process payroll correctly. Payroll reconciliation helps ensure that employees are paid accurately and on time. Furthermore, payroll reconciliation is crucial for tax purposes and compliance. We’ll take you through everything you need to know about reconciling payroll.

What is Payroll Reconciliation?

In finance, the term “reconciliation” refers to ensuring that two records of the same event match each other and are accurate. Therefore, payroll reconciliation means ensuring that the amount you’re planning to pay your employees exactly matches the payroll in your general ledger.

Payroll reconciliation is crucial for keeping accurate account records. You’ll need correct records when filing taxes, during audits, and when assessing the financial health of your organization.

Accurate payroll also ensures that you do not overpay or underpay your employees. The former may make it difficult to recoup your losses, while the latter may attract fines and penalties.

The Basics of Payroll Reconciliation

It is necessary to break down payroll reconciliation into a few key components to understand better what the process is all about. These are also the areas you’ll be digging into to perform the reconciliation.

Wages and Salaries

For most small businesses, reviewing wages and salaries is the easiest part of payroll reconciliation. This is especially true for salaried employees whose gross pay is consistent month to month. This step involves calculating the employee’s gross pay against the correct hourly pay rates for your business.

However, things can get more complicated for an organization with more than 50 employees. Also, you’ll need to consider internal promotions, new hires, raises, and other changes to compensation. No matter the changes, you’ll need to make sure that employee salaries and wages match what’s in your general ledger. You’ll also need to confirm that you have the correct salaries and wages in your payroll register before processing payroll.

Employee Working Hours

The most significant part of payroll is the employee working hours. Time management systems help make this process quick and easy. The system automatically records attendance directly to payroll. If you don’t use a time management system, you’ll have to manually compare the completed timesheets or time cards to the data in your payroll register during payroll reconciliation.

You also need to account for holiday pay, sick pay, and overtime. You may need the help of department managers when doing payroll across multiple departments.

Deductions and Taxes

Deductions and taxes are other areas where you must pay special attention. More so at the beginning of the New Year, when benefits are renewed and new tax policies kick in. At the very least, you’ll have to withhold social security, federal income tax, state income tax, and Medicare. Other deductions from your employees’ paychecks may include health insurance, local taxes, worker’s compensation insurance, retirement benefits, and wage garnishments such as child support.

Ensure that all this information is up-to-date in your payroll register. You must report each deduction separately rather than as a total amount. This step is necessary for filing business taxes and makes it easier to double-check your numbers.

Be sure to stay abreast of national and local changes to deductions and withholding. You may need the help of the finance team for this. For example, there may be changes to social security, federal and state taxes, and insurance that you may need to update in your payroll.

Additionally, you’ll need to account for payroll changes, such as employees who become eligible for Medicare or staff who update their withholding information.

3 Tools To Improve the Payroll Reconciliation Process

Payroll reconciliation doesn’t need to be a complicated process. Below are three tools to make the process simpler and quicker.

If you want to see more options for online payroll services, we have researched and reviewed available tools and found the top seven options on the market. See our top seven online payroll service providers to find the one best suited for your business.

1. QuickBooks Payroll

QuickBooks is a staple in accounting solutions, but the company also has a terrific online payroll service. QuickBooks Payroll lets you automatically reconcile payroll liabilities, including employer expenses and employee liability. You can reconcile your payroll across sub-categories, including Federal Income Tax, State Income Tax, Medicare Withholding, and Social Security Withholding.

QuickBooks Payroll also comes with additional crucial payroll features, including:

- Same-day direct deposit

- Tax penalty protection

- Auto taxes and forms

- Auto payroll

- Time tracking

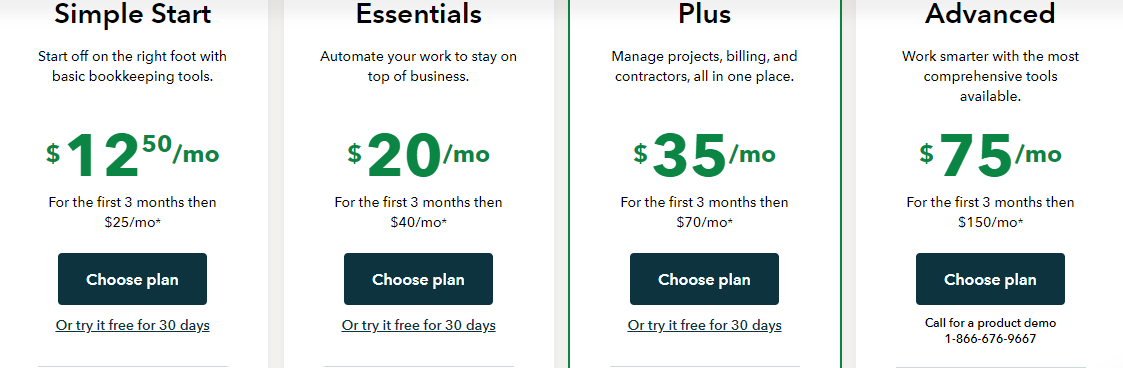

QuickBooks prices start at $12.50 per month for the first three months on the Simple Start plan. The price then goes up to $25 per month after the initial three months. The payroll service offers four other plans depending on the size of your business and the payroll capabilities you’re looking for.

2. A Payroll Register

It’s hard to imagine conducting payroll reconciliation without your payroll register on hand. The payroll register contains all the employee information you need to process payroll, including:

- Name

- Birthdate

- Employee number

- Social Security number

Ensure that your payroll register contains accurate records of your businesses’ payroll activity for each pay period, including:

- Pay rate

- Hours worked

- Regular hours

- Overtime hours

- Pay date

- Employee withholding

- Additional deductions such as retirement plans, health insurance, and wage garnishments

- Federal, local, and state income taxes

- Gross pay

- Net pay

Other than having your payroll register handy, you’ll also need to make sure it’s accurate.

3. A General Ledger

The payroll register and general ledger go hand-in-hand when processing payroll and performing payroll reconciliation. Your general ledger keeps a record of all your business financial data. This data includes every financial transaction, including payroll.

You’ll need to make a record in your general ledger every time your run payroll. This section of your general ledger is called payroll journal entries or simply ledger entries. You’ll record payroll details as either credit or debit. The employee’s total wages go into the debit column while the deductions go into the credit column.

9 Tricks for Accurate Payroll Reconciliation

Payroll reconciliation gets easier over time. Performing this crucial task every pay period ensures you won’t be overwhelmed during the quarterly and annual reconciliation. Here are a few excellent tips to incorporate into reconciliation to make it quick, efficient, and accurate.

1. Reconcile Payroll Before Payday

It’s much harder to fix payroll errors after you’ve paid employees. For this reason, be sure to reconcile your payroll at least two days before issuing checks. It’s also a good idea to compare your payroll to previous ones of a similar pay period. This is a quick way to detect errors. For example, suppose there is a significant difference between the current payroll and previous ones despite not making any substantial changes to your workforce. In that case, the cause might be an accounting error.

Additionally, you’ll need to reconcile your payroll quarterly using Form 941. To do this, review your payroll register for the quarter. Next, compare what you have in Form 941 and your payroll register. Be sure to fix any discrepancies between the two data sets.

Lastly, you’ll also need to reconcile your payroll at the end of the year when filing employee’s W-2s. The process is similar to reconciling your Form 941. Pull out your payroll register and check the year’s payroll figures. Compare these numbers to what you have in your Form 941. You’ll have four of these forms, one for each quarter. Finally, compare your 941s to all W-2 forms. Be sure to fix any discrepancies.

2. Examine Your Year-End Reconciliation Process

Year-end payroll reconciliation can be a tedious process, but it’s a necessary one. Consider scheduling a debriefing meeting at least once a year to examine your reconciliation process. The idea is to improve the process for the following year.

Examine the entire process to find out what you did right and what could be improved. This isn’t a blaming or fault-finding session. Get the team on board to understand that the purpose of these meetings is to enhance the payroll reconciliation process’s accuracy and efficiency.

Document any findings and include these in how you conduct future reconciliation.

3. Establish Payroll Reconciliation KPIs

Payroll key performance indicators (KPIs) will help you track improvements to your process after applying feedback and findings from the previous trick. Some helpful payroll KPIs you should consider monitoring include:

- Time to reconcile payroll errors

- Total errors as a percentage of total payroll payments

- Number of overtime hours worked by the payroll team

- Penalties and other extra costs resulting from payroll errors

- Total year-end reconciliation processing time

By tracking critical payroll reconciliation KPIs, you can justify adding payroll to your list of strategic business functions. This move should help to make payroll reconciliation even more efficient and accurate going forward.

4. Consider Automating Payroll

If you’re regularly scrambling to fix payroll errors during reconciliation, it’s probably because you are using manual systems. Automating the payroll process can help minimize mistakes and make the process quicker and more efficient.

Most of today’s payroll systems come with electronic timekeeping modules. You can log on every week to approve employee hours. Then, this information is transferred to the payroll processing module to complete the process.

Using an automated payroll system also helps keep employee data secure. These systems eliminate the need for physical files. If you must keep physical files, consider storing them in a secure and restricted location with an access card or physical keys.

5. Categorize Staff Appropriately

Most businesses hire a mix of employees and independent contractors. Both types of workers are paid differently and shouldn’t be treated the same. For example, you don’t have to pay contractors overtime wages or withhold employment taxes. Conversely, misclassifying an employee as a contractor might mean missed wages and missed taxes.

Be sure to classify your workers correctly. Sometimes, the line between employee and contractor can be blurred. You can always file Form SS-8 if you are unsure about how to classify staff. The IRS can then help you determine the worker’s status. Alternatively, refer to the six economic realities to help clear things up.

6. Run Reports Before Payroll

Another advantage of using an online payroll service like QuickBooks Payroll is its reporting feature. You can quickly generate reports that you can use to check against your payroll register. Some of the crucial reports to use include:

- Payroll register – This gives you a quick summary of all payroll information.

- Deductions summary – This gives you an overview of all deductions for each employee.

- Cash Requirements – Offers a complete picture of how much money your business needs to pay employees. This report breaks down this information into categories like salaries, deductions, and taxes.

Payroll reports also help with other aspects of your business, including withholding compliance, filing taxes, and tracking costs.

Be sure to check out our post on the best payroll services for your business. We break down seven terrific online payroll services that can completely transform the way you perform this crucial task.

7. Develop a Payroll Reconciliation Checklist

As you become more proficient at payroll reconciliation, it is absolutely worth developing a checklist to follow every pay period. An online payroll service is convenient to use. Still, it requires the payroll admin to keep track of various information and processes. A checklist helps you tackle the payroll reconciliation process methodically.

Some potential payroll reconciliation checklist items might include:

- Checking that all employee details are complete and up to date

- Confirming your organization’s details such as Name, Address, and ABN

- Ensuring that payroll accounts are linked correctly to each pay item

- Comparing the payroll summary report to the general ledger

Pay special attention to where most errors tend to occur. Then, develop checklist items to address these trouble areas.

It’s also worth collecting critical payroll information in one location. This information may include pay changes, a list of all new hires, changes in deductions, and other changes. You can refer to these details when performing payroll reconciliation to ensure that the payroll is accurate.

8. Train Payroll Employees

Training payroll employees is often neglected but is critical to ensuring effective payroll reconciliation. The payroll regulatory landscape is broad, complex, and constantly changing. Highly trained payroll employees can act as the first line of defense against errors.

Training your payroll staff also opens up their career prospects within your organization. You are less likely to lose competent staff to competitors if your employees can see themselves advancing within your organization.

There are plenty of payroll training courses and qualifications, including the American Payroll Association (APA).

9. Protect Your Payroll System

Lastly, you cannot reconcile payroll if you lose all your payroll information. Aside from common cybersecurity threats, additional looming threats can disrupt or destroy your payroll system. These threats include fires, floods, power outages, and human error.

A data loss event can lead to payroll delays and compliance issues. At the very least, you should have a backup and recovery plan for your payroll system. Train payroll administrators on data security best practices, backup schedules, and recovery. Also, consider creating robust data security, backup, and recovery plan for your on-site payroll system.