Running payroll affects employee morale and reflects on an organization’s financial stability and reputation. And while there shouldn’t be any room for error, several things can go wrong.

You may input numbers incorrectly, forget to remove a terminated employee from your payroll, or fail to add an employer’s recent pay raise. Carrying out a payroll audit will help identify and eliminate these problems, alerting you to mishaps earlier.

In this guide, I’ll show you how to conduct a successful payroll audit and discuss a few payroll best practices to keep everything in top shape.

What Is a Payroll Audit?

Generally speaking, audits are done to confirm that dollar amounts are correct and procedures are completed correctly.

A payroll audit analyzes a company’s payroll processes to verify their relevance and ensure accuracy and compliance. The process involves looking into specific aspects like a business’s active employees, wages, pay rates, and tax withholdings.

Generally, payroll audits are internal. This means that it’s either you or someone in your business who conducts them. But I recommend getting external help, too, if possible, to get an unbiased opinion.

The Basics of Payroll Auditing

Your payroll determines how straightforward your payroll audit will be. For instance, if you have ten employees, auditing will be a relatively simple affair. But for a multi-branch enterprise with thousands of workers in different locales, including independent contractors or seasonal workers, things will be more complex and time-consuming.

Regardless of the complexity, you should try to implement and execute an efficient procedure that helps you identify and eliminate payroll-related errors. Below is an overview of the basics of payroll auditing.

Verify Employees on Your Payroll

Turnover and employee attrition happen all year round. Therefore, it’s essential to ensure that only those employees who have actually worked during that pay period receive paychecks.

Go through your payroll and review all the employees on it. This list should match your current employment records. If you find any employee who doesn’t work for you anymore, remove them right away.

You should also review any employees who are temporarily not working due to FMLA, maternity, adoption, paternity, or sick leave. The impact of these considerations on current and future payroll should be accounted for and properly documented.

As for independent contractors and external vendors, confirm the contract periods for every entity to make sure you pay them only the owed amount.

Check Pay Rates and Time Categories for Every Employee

Analyze the pay rates listed in your company’s existing payroll system, ensuring it’s correct for every employee for specific pay periods, including their base salary, tax deductions, withholding, overtime rates, and other applicable fees.

Additionally, promotions, bonuses, and salary increases can happen anytime throughout the year. So if any employee receives a raise or a promotion during the audit period, you should adjust their pay rate immediately to reflect the changes.

Time categories are another consideration when paying employees.

Several businesses give employees specific categories of payroll time, such as paid leave and sick leave. Your job is to label these hours correctly based on the applicable payroll time label, like vacation, bereavement leave, and sick leave. Once that’s done, verify and compare pay rates against employee attendance records.

Pay attention to overtime hours, sick leave, and vacation days when going through employee records to avoid overcompensation and underpayment.

Reconcile All Your Payroll Records

Compare your payroll records to your company’s general ledger so that every payroll expense recorded in the general ledger matches your payroll audit findings.

Reconciling payroll records with company bank statements is also important. Check whether your company‘s bank account total matches with your internal ledgers. Any change should reflect internally as well as in your bank records. I highly recommend having a separate payroll bank account to simplify bank record reconciliation.

Check Employment Tax Accuracy

Confirming accurate tax withholding and limiting is another crucial aspect of a payroll audit. This way, you won’t find yourself paying excessive fines and fees and avoid costly mistakes.

Ensure you withhold the correct amount of taxes from every employee’s wages, including Social Security, Medicare taxes, and federal income taxes. You may also have to withhold state and local income tax, so keep an eye out for that.

You should also verify the accuracy of your payroll reports, such as the IRS Form 941. All wages and tax withholding amounts listed on your payroll reports should always match their old records.

5 Tools to Improve Payroll Audit

I’m a firm believer in keeping things simple. Precisely why I encourage business owners to opt for efficient and modern payroll solutions to make payroll and payroll auditing easy and accurate.

Leveraging technology minimizes the manual work required to perform a payroll audit and makes it less time-consuming. With this in mind, let’s take a look at some of the best payroll software you can try.

1. ADP

ADP is the go-to option for companies looking for an all-in-one solution. It offers everything from hiring to background checks to payment processing. Even its lowest-priced plan offers full-service payroll, a self-service employee portal, direct deposit, and reporting features.

The software also offers tons of app integrations. Partnering with benefit providers allows ADP users (both employees and HR departments) access to many valuable perks like product discounts via LifeMart and integration with outsourced HR and a time clock software.

2. Gusto

Gusto can fully automate your payroll, thanks to its wide range of features. Its offerings include the ability to administer health insurance, free direct deposit, and the automatic filing of local, state, and federal taxes.

This efficient payroll solution also offers the incredibly time-saving employee self-onboarding feature. Because of this, new hires can enter their personal information directly after logging into Gusto and will be reported to the government automatically. Plus, every pay stub gets emailed directly to every employee.

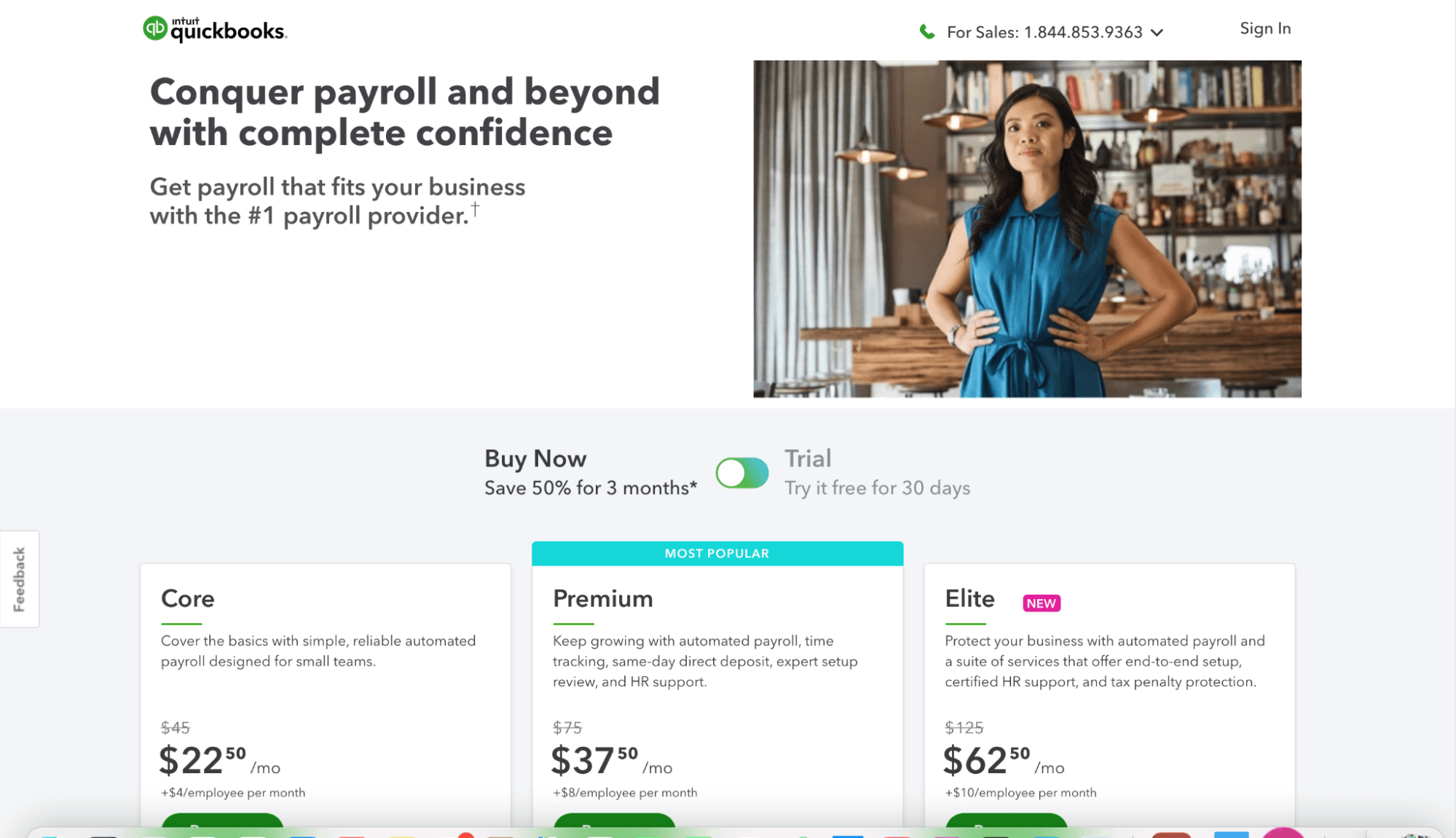

3. QuickBooks Payroll

I highly recommend Intuit QuickBooks for those who are already using QuickBooks for accounting. But even if you’re not, this payroll software is still an excellent option for those who prefer full-service software or need help setting up payroll, thanks to its highly efficient team that will walk you through setting up tax filing and tax payments.

All local, state, and federal taxes are calculated and paid automatically every tax season. You can also run Auto Payroll to make running payroll faster. Another interesting feature of QuickBooks is its tax penalty protection. QuickBooks will pay up to $25,000 if there’s an error in your payroll, causing you to get hit with a tax penalty.

4. OnPay

OnPay is a cloud-based platform that offers phone, email, and live chat support primarily designed for smaller businesses.

It comes with automatic payroll deductions, payroll tax payments, and guaranteed accurate and timely tax filings and payments. Think of it as the ultimate payroll software that will keep small business owners on top of their payroll.

OnPay is also perfect if you’re looking for a specialized payroll solution for businesses operating in specific industries with unique means. So if you run a restaurant, nonprofit, church, or a farm, you know what to get.

5. Rippling

Technically, Rippling is an HR software with payroll as an add-on feature. Still, many users prefer it because of its high affordability and robust software integration facilities. Its ability to integrate with over 500+ apps, many you may already be using, is one of the main reasons why the software is on this list.

It can automatically sync all your data to run payroll, making the whole process faster and easier. You can also manage your benefits, compliance, and other related aspects in one modern platform.

5 Tricks for Payroll Audit

Let’s take a look at how you can make payroll and payroll audits more effective.

1. Adopt Advanced Payroll Software

Doing payroll manually or using outdated payroll software tools are the most common causes for inefficiencies in payroll. So if you do either of the two, it’s high time you upgrade.

Good payroll management software will not only help you improve payroll efficiency, but it’ll also automate repetitive and monotonous processes and help you identify errors early on. Additionally, several software solutions offer excellent customer support to make running payroll even easier. It’s a win-win situation for you.

2. Practice System Transparency

You must establish a pay policy and put it in writing if you want to prevent accidental time theft, underpaid taxes, misclassification of employees, and other payroll errors.

The policy should lay out how employees are classified and how wages, salaries, promotions, and raises are calculated. How the payment process works, when changes to payroll come into effect, and how the company deals with payroll mistakes should also be mentioned. The idea here is to include every aspect to make payroll as transparent as possible.

Once done, make sure every employee has a copy of it or access to it through the employee portal.

3. Stay up to Date With the Latest Rules and Regulations

Federal and state labor regulations and IRS tax tables change from year to year. Precisely why you should ensure your knowledge of these regulations is always up to date.

The best way to do this is by downloading the latest tax tables from the IRS website. If you use payroll software, set up the settings to update automatically every year to keep you in compliance. Also, pay attention to any government regulation changes, namely, income tax withholding, child support withholding, state unemployment taxes, and different benefit calculation and taxation.

4. Make Auditing a Routine Practice

Try to carry out a payroll audit at least once a year if you want to cut down your time and money losses. This stands true for those with a computerized system, too, as even automated ones can produce errors.

You may overpay an employee because of a math error, incorrectly classify a new employee‘s tax status, or forget another’s pay raise. It’s why you must double-check all your paperwork and processes to make sure everything functions as it should be.

5. Analyze Results to Make Improvements

Take stock of your payroll audit findings by analyzing the results and making well-thought-out recommendations focused on improving current processes and developing new strategies to make payroll efficient and accurate. It’s due to this that experts encourage getting an outsourced payroll provider instead of an internal auditor.

An internal auditor may find it difficult to look objectively upon the processes since their own departments or colleagues often develop them. Contrarily, an external auditor has a more objective viewpoint and can make recommendations unimpeded by internal bias.

Nevertheless, whatever you do, make sure you fast-track your company’s payroll development, helping it achieve greater accuracy, compliance, and efficiency in a shorter timescale.

What to Do Next

While not every payroll error will cause the IRS to come knocking on your door, you should still make an active effort to ensure all your corrective actions are right and can genuinely help rectify mistakes.

Of course, the best way to avoid payroll-related errors is through a routine and thorough payroll audit. You must also be aware of the number of employees on your payroll, their pay rates, and time schedules, as well as know the ever-changing regulations, rules, and legislation.

To help you ensure this, here are a few other guides that can streamline your payroll processes further: