We’ve all seen it on HGTV before: a beautiful couple bursts into a new town, finds a house that needs some work in a nice neighborhood, makes it as Instagram-worthy as possible, then sells it for a profit – all in the span of an hour.

It seems like the perfect way to make money, and in a lot of ways, it is.

Flipping houses is rewarding, and has the potential for a huge return on investment, but not without hard work.

I’m here to teach you where to start – from showing you where to find inspiration to making sure your business can operate legally.

With a little work, research, and grit, you’ll be ready to start your own house flipping business before the next season of Property Brothers comes out.

The Easy Parts of Starting a House Flipping Business

One of the best parts about starting a house flipping business is that there are incredible opportunities for a high ROI.

With other businesses, this isn’t always the case. You may invest a ton of time and money into creating a product, only to find out that there isn’t as large of an audience for it as you thought. Or, you may have to make hundreds of sales to see a significant profit. With house flipping, this isn’t the case. People are always buying houses, and there are many tried and true ways to increase the value of a house. Most successful flippers can expect to see a minimum profit of at least 10% of the sales price.

Not only that, but you can analyze the housing market to determine the best times and places to buy. Unlike other businesses, there is a ton of easily accessible data about the current state of the market and how to best optimize it.

Finally, while real estate markets differ from city to city and region to region, you can start a house flipping business just about anywhere. People buy houses in every city and county in the US.

The Difficult Parts of Starting a House Flipping Business

Buying your first property isn’t as simple as finding a house with potential and putting in an offer.

To run a house flipping business, it is essential to get a good grasp on the nitty-gritty financial details. There are a ton of different factors that go into this, from understanding investment property loans to thinking critically about how to manage your finances.

You’ll want to make sure that you can afford to invest a chunk of money into buying properties, as well as have enough money to sustain yourself while you’re renovating. Not only that, but you’ll need to ensure that with all of your work, you get an ROI that is with your time.

As a brand new business, you likely won’t be eligible for a traditional bank loan. The bank will most likely need to see that you have a consistent pattern of buying and selling over time for you to be eligible. Instead, when you’re just starting off, you can try a few different options.

First, you could opt for a hard-money loan. Hard-money loans come from private funding from investors or individuals. Unlike more traditional bank loans, your credit score and income do not play as large of a role.

Essentially, the house you purchase would serve as collateral and could be seized by your investors if you don’t pay back your loan. These loans are some of the easiest to obtain, but this convenience comes at a price. They are typically more short-term, typically ranging anywhere from 6 months to 5 years to pay it back, and usually also have higher interest rates.

Another option is a home equity loan, otherwise known as a HELOC. These are frequently considered to be a “second mortgage.” Essentially, you can take some of the money you have put towards paying off your home and use it to finance your loan for the house you are planning to flip. However, to get this, it is essential to have a low debt-to-income ratio, as well as great credit.

This is a more affordable option since the loans for these typically have low-interest rates, but you will need to be cautious when potentially choosing this option. If you are unable to make payments, you could be putting your personal home at risk.

Finally, you could opt for a loan from your friends or family. This can be an excellent choice for beginner house flippers. They are less formal, which can be nice, but it is also important to quickly establish the terms of the loan before getting too far along in the buying process.

Take some time to think about which loan would work best for you and move on from there. Remember, it is also possible to use “combination financing” meaning that you choose multiple options to finance your business.

Step 1: Establish a Vision

Begin by researching the many different ways people approach house flipping businesses, and then lay out exactly how you want yours to look.

Seek Inspiration from Experts

House flipping has been on the rise in the last few years, meaning that there are plenty of individuals and teams to gain wisdom from. As you start your business, take time every week to learn from your fellow house-flippers. One of the most time-conducive ways to do this is to listen to podcasts – whether on your drive to your day job or while you’re cooking dinner. This will help you find community, get advice, and keep up with the latest trends in the business.

Some of the most popular house flipping podcasts include:

- 7 Figure Flipping with Bill Allen

- The Flip Talk Podcast

- Investing in Real Estate

- Flipping Houses for Rookies

- BiggerPockets Business Podcast

If you need a break but still want to get inspired, a few episodes of HGTV house flipping shows never hurt anyone. However, your own house flip will sadly not start and end within the span of an hour.

Write a Business Plan

Before you launch into the house flipping process, you’ll want to spend some time devising a business plan. A business plan is a detailed document that consists of many different elements, including your company name and description, mission statement, budget, market analysis, and more.

The process of creating this document will be an excellent way to steer your business as you establish yourself and start to grow. Not only that, but if you’re ever feeling lost along the way, you can come back to your business plan to refocus and start hitting milestones again.

If this feels overwhelming, fear not! The Quick Sprout team has devised a step-by-step guide to help you write your business plan.

Step 2: Research

If you’re reading this post, you already have a head start on this! However, there are a few extra steps you’ll have to take.

Look at national trends

This is one step that you’ll want to repeat over time. National trends in the housing market can be incredibly informative about what your next move as a house flipper should be. For example, right now, prices for houses have gone up exponentially. This means that it may be more expensive to find a house to purchase, but that the improvements you make could have an even higher ROI than normal. Some great resources for consistent housing updates include Wall Street Journal’s real estate section and Business Insider.

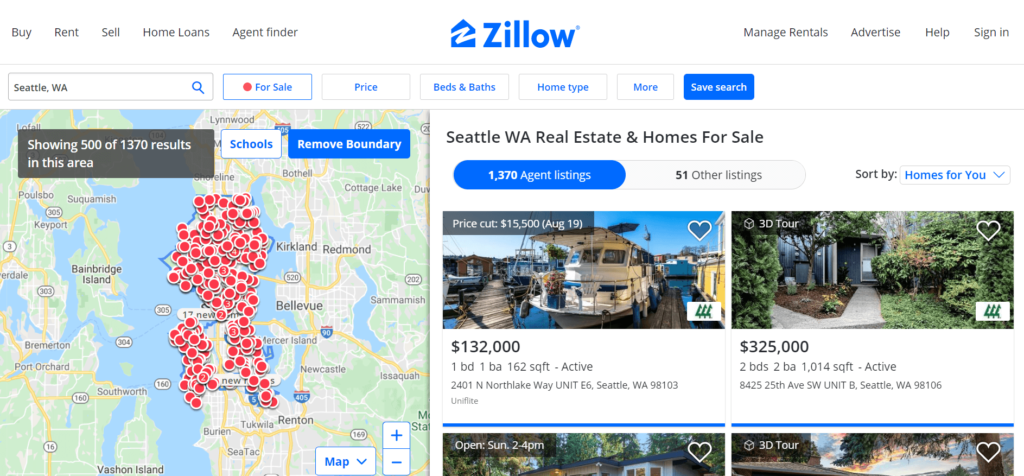

Learn about property potential

Now, take the previous step and localize. Set aside some time to investigate what the property scene looks like in your region, state, and county. Try going on Zillow, Trulia, and Redfin to see what houses are selling for in the neighborhoods around you. This will help you get more familiar with what you have to work with and get the gears turning when it comes time to find potential properties.

Read about popular renovations

Above all else, the goal of flipping houses is to provide value for your customers and to get as much ROI as you can. Do some quick Googling to find out what renovations will increase the value of your property the most. Plus, think about what you have looked for when it comes to purchasing houses of your own. It’s hard to go wrong with installing wooden floors and updating the kitchen and bathrooms.

Then, take it a step further and brush up on your handyman skills by doing practice projects in your own home.

Step 3: Legality

Before you officially launch your business, there are several steps to take to establish your legality.

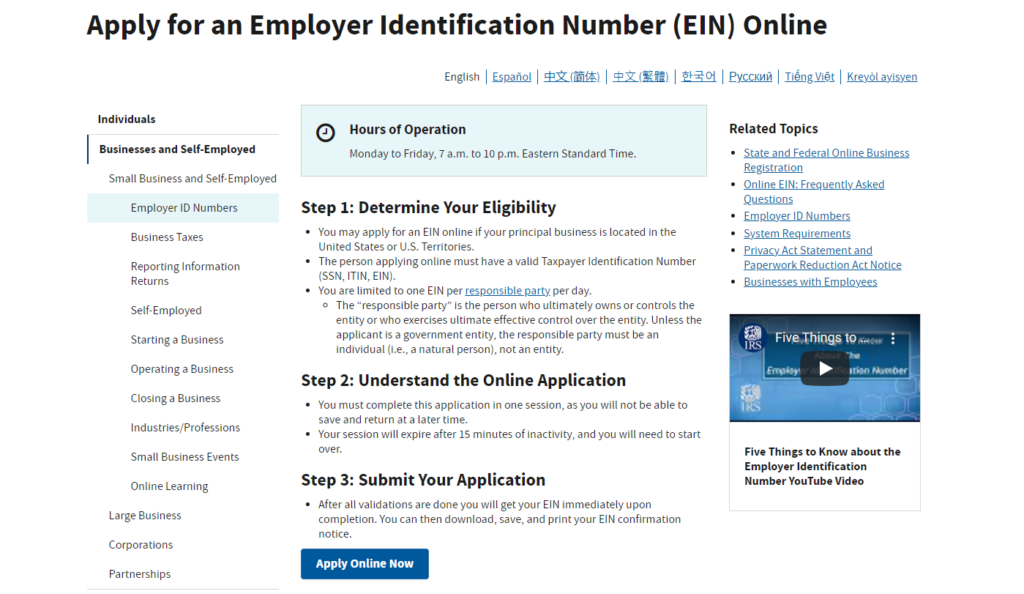

Apply for an EIN

An employee identification number, also called an EIN, is essentially a social security number for your business. This ensures that the government is aware that your business exists. It’s required to open a business bank account, apply for a business license, file your tax returns, and even apply for traditional loans.

Luckily, it only takes a few minutes to apply on the IRS website

Choose a business entity

To legally operate your business, you’ll need to choose a business entity, as well as register it in the state where you are planning to conduct business. The best choice for most people who are operating house flipping businesses is an LLC, or a Limited Liability Company.

To put it simply, LLCs draw a line between your business assets and your personal assets. This means that if you run into any legal or financial troubles, there is a much lower chance that your possessions can be seized for collateral. In addition, LLCs are easy to register online and are more flexible when it comes to taxes.

Other options include registering as a sole proprietorship or a corporation. A sole proprietorship is even easier to set up than an LLC and does not require registration. Instead, owners will have to file their taxes on their personal tax returns. Unfortunately, this does not offer liability protection. The other option, a corporation, does offer liability protection, but is much more expensive to establish, and has other requirements, such as having annual meetings and a board of directors.

Obtain licenses and permits

These will change based on the state you are operating out of, so make sure to research the specific requirements for you. Most of this information can be found by speaking with your local chamber of commerce, or even just a quick Google search. You can expect to need several permits, since construction is essential to flipping houses.

Step 4: Understand your financing

It’s big and it’s ugly, but it’s necessary. Before you launch into your business, you’ll need to make sure that you can afford it, as well as protect your assets.

Consider meeting with your accountant (or hire one!)

Anytime you start a new business, a good accountant will be an important ally.

As I discussed previously, house flipping businesses involve moving around a lot of cash – from getting loans to purchasing equipment to hiring professionals to actually selling the homes. An accountant can work with you in order to determine your budget, as well as help you plan for the future.

Get insured

One of the best ways to make sure that you can responsibly retain your finances no matter the situation is getting the correct insurance. There are a variety of insurance options that could be beneficial to purchase.

General liability insurance: If you don’t get any other insurance, make sure to get this one. General liability insurance covers bodily injury, property damage, medical payments, legal defense and judgment, and more. This is the most common insurance that business owners invest in across the board.

Commercial property insurance: This type of insurance can help to cover equipment costs. If there was a natural disaster and you lost your whole collection of machinery, you would be able to file a claim to receive financial help in order to replace it.

Commercial auto insurance: If you have a car or truck you use primarily for business, it could be worth it to invest in commercial auto insurance. Between using cars to pick up supplies and haul furniture, it can be an essential part of your business, which means that it should get insured.

Step 5: Make connections

There are so many factors that go into flipping houses, from buying to fixing them to selling them again. To best succeed, you’ll have to gather your forces and build an Avengers-worthy team.

Real Estate Agent

You will want to spend some real time and energy when it comes to finding a real estate agent you love. Odds are, you’ll be working with them extensively, and ideally over multiple projects.

A trusted real estate agent can help you choose the right location to flip a house. They will be able to expertly evaluate neighborhoods and analyze what the expected resale value of the properties will likely be. Not only that, but they’ll help you to actually buy and sell the property.

Contractors

For those who want to have a house flipping business, but not do all of the on-site construction, this is for you. It could be valuable to hire a general contractor to lead the project, especially if you are flipping multiple homes at once.

Hiring a contractor would likely escalate the cost of doing business, though. The contractor would probably mark up prices in order for them to ensure that they are also profiting off of this partnership.

The bottom line: If you can renovate the house alone or with a small team, do it, but if not, help isn’t far – for a fee.

Legal counsel

When it comes to real estate, there is no shortage of opportunities for issues in legality to arise. Having trusted legal counsel will help to navigate the many documents and contracts you will have to look through, as well as ensure that your properties meet the legal standards for the area.

By investing in this team, you’ll be able to get credible opinions as you move through every facet of the buying and selling process.