If you’ve thought about starting an LLC, you’re at the right place.

Selecting an LLC entity structure is a wise choice. Not only are you protected from business-related lawsuits, but they are also easier to set up and more flexible than corporations.

Let’s not forget the multiple tax operations, ease of administration, and fewer ongoing reporting requirements.

Although every state has its own rules and procedures, you can follow a few basic steps to get your LLC up and running, no matter where you live.

The Easy Part of Starting an LLC

LLCs are often the go-to business structure for business owners and entrepreneurs, and it’s easy to see why.

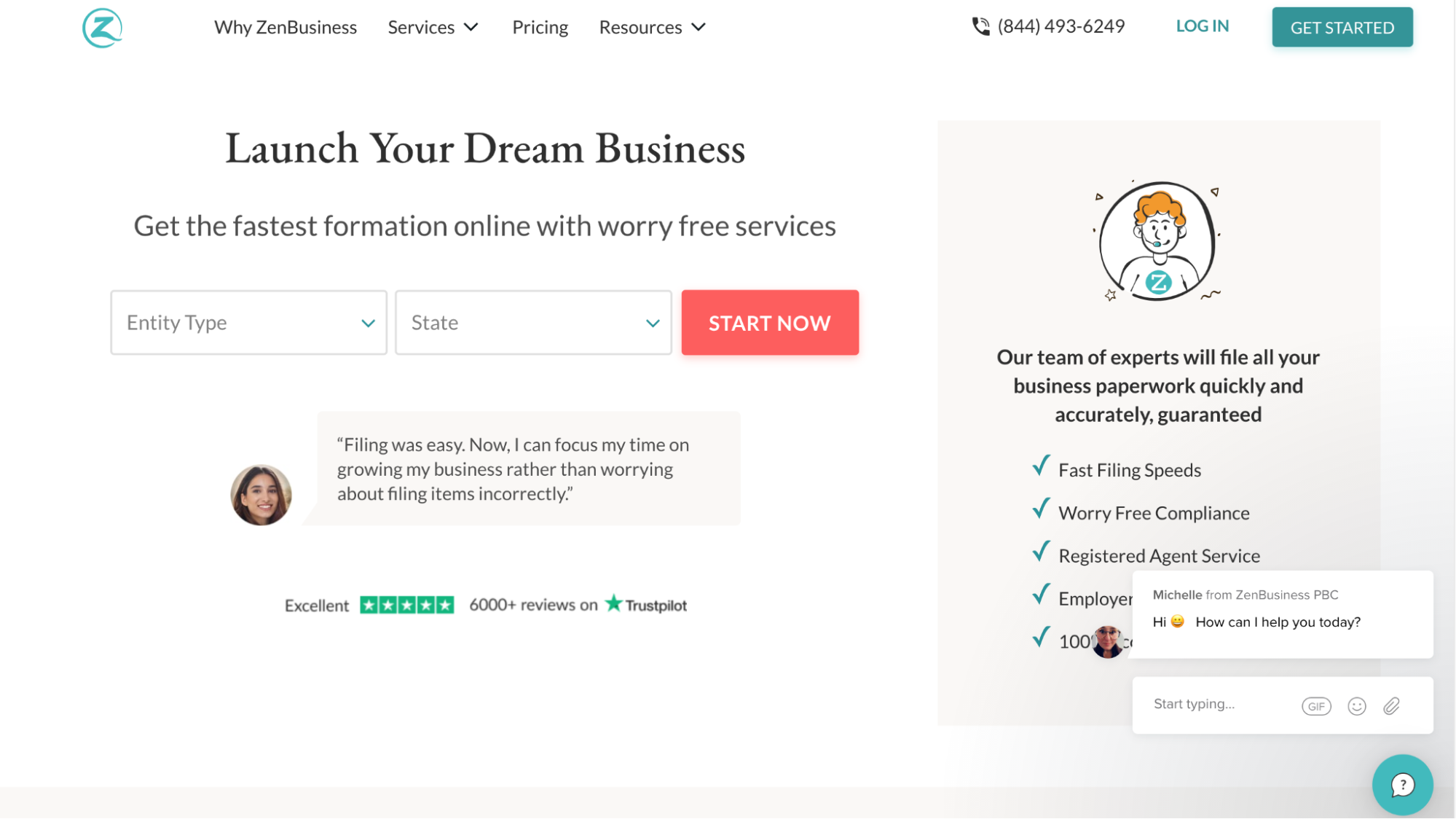

The business formation process is very straightforward and easy. While you can take matters into your own hands, you can also sign up with excellent LLC services like IncFile and ZenBusiness.

These services take care of everything, from company formation to document filing to handling other legalities. Like I said, everything! What’s more, some of them also offer post-incorporation support and lifetime customer care, so you’ll always have expert advice available at your beck and call as long as you remain a part of their clientele.

To see all of our top picks for the best LLC services on the market today, check out our buying guide.

While paperwork is expected considering we’re talking about forming a legal business entity, establishing and maintaining an LLC is simple and requires less paperwork than other corporate entities. And hiring a service will rid you of this obligation, too.

The Difficult Parts of Starting an LLC

Like two sides of a coin, there’s good and bad to everything.

You’ll definitely face some key challenges when creating an LLC, which you have to prepare for. Firstly, you have to be very careful when picking the state in which you want to create your LLC.

LLCs are formed according to state-wise rules and regulations, and hence, the formation and administrative fees depend on the state you choose. Making the wrong choice can cost you in terms of time, money, and effort.

Naming your LLC is another challenge.

Your company name can be anything you like—provided it isn’t already registered by other LLCs or organizations. Considering the number of businesses and LLCs already operating, not every name you want will be up for grabs. Also, every state has specific guidelines concerning LLC names, so that’s another factor to keep in mind.

Don’t panic, though. You can handle everything as long as you’re informed and know how to proceed. Keep reading as I detail the steps involved in forming an LLC.

Step 1: Choose Your Governing State

Every state has its own set of rules and regulations concerning LLC formation. Precisely why selecting a state is the first step to start an LLC.

Know Your State-Specific Laws

Your best bet is to start an LLC in a state where you live and plan to do business.

If your company exists physically abroad or has a physical presence (offices, sales reps, storefronts, etc.) in different states, you’ll have to register as a foreign LLC in those states (it is still considered a foreign LLC in other states within the US).

It’s also important to note that sometimes forming a new company in a state with business-friendly lawyers does have its benefits. However, be sure to check the extra paperwork and related fees before you take the plunge.

Once you choose a state, educate yourself in the state-specific rules to start an LLC there.

Step 2: Pick Your Company Name

While it may look simple, naming your business can be surprisingly challenging.

You have to come up with a unique company name for your new startup—something that cannot be confused with other registered LLCs and businesses. At the same time, it should represent your brand and meet the rules related to names allowed for an LLC for your state.

Yes, you read that right: every state has specific rules when it comes to LLC names.

Consider State Guidelines

Although the rules vary state by state, there are a few general guidelines you’ll need to follow when choosing your LLC name:

- Your company name must include the phrase “limited liability company“ or any of its abbreviations (LLC or L.L.C.).

- Your company name must not include words that could cause your customers to confuse your company with a government entity, such as Treasury, State Department, FBI, and so on.

- You’ll have to file additional paperwork to register a name that uses restricted words like University, Bank, Attorney, and so on. You may also need a licensed person, such as a doctor or a lawyer, to be a part of your LLC, depending on the name you choose.

Understand Legal Name vs. Brand Name Nuances

You can have the same legal business name and brand name, but it can also be separate.

You see, your legal name is the name of your business that’s listed on all your legal documents whereas, your brand name is the name of your company you plan to use for marketing purposes and one your customers will see and recognize.

For instance, Hewlett-Packard is the legal business name of a company. But they have chosen the abbreviation HP as their brand name.

If you want to use a different brand name, you’ll have to file a Doing Business As (DBA) form, depending on your state.

Check Name Availability

You should now have a list of potential names. But before you shortlist one, you’ll have to run a state- and federal-level search to check its availability.

Go through your state’s business name database, followed by checking the domain name/social media channel availability.

Even if you don’t want to create a website or a social presence right away, you should still do this. You really don’t want to use an irrelevant domain name simply because your business name domain was already registered.

Lastly, carry out a federal trademark search using the U.S. Trademark Electronic Search System to ascertain if someone else has already trademarked your business name.

Reserve Your Company Name

Though optional, I highly recommend reserving your chosen company name if it’s available and you don’t plan on filing your LLC documents right away.

Nearly every state lets owners reserve a name by filing the necessary forms and paying a fee. The reservation period length, renewal policies, and filing fees differ based on your state.

Step 3: Sort Out Your Paperwork

Naturally, incorporating a limited liability corporation will involve paperwork—lots of it. From Articles of Organization to an LLC operating agreement, you must be meticulous with every document and ensure they’re filed properly.

Enlist a Registered Agent

A registered agent is a third party—an individual or a business—whose job is to send and receive official correspondence, lawsuits, subpoenas, and other legal document filings on your behalf.

Most states have made it compulsory for owners to name a registered agent who is a resident of their current country of operation. New York is the exception.

You can hire a person who’s a state resident and over the age of 18 to serve as a registered agent or sign up with companies that provide registered agent services for a fee.

File Your LLC Documents

You have to file the Articles of Organization, also known as Certificate of Organization, to establish your company as an LLC and reserve your company name. Think of it as making your limited liability company official.

You can either file your forms directly with the Secretary of State or consider using an LLC filing service. Remember, LLC formation documents are state-dependent; therefore, some states require more forms and additional documents than others.

You can always hire an attorney to help you navigate the process if you face any difficulty.

Create an LLC Operating Agreement

An operating agreement is a legal document outlining the member roles and ownership structure of your LLC. It also specifies the financial and working relationships among company members.

You can consider the agreement as a roadmap that describes how your LLC will be run. Not every state law requires an operating agreement, but it’s still a vital document to help to clarify your company’s overall management structure.

Here’s a list of the main components of an operating agreement:

- Organization. This component deals with the company formation project and includes details, such as when the LLC was created, its members and board of directors, its ownership structure, etc.

- Management and Voting. This component explains the LLC’s management, the kind of authority every member has, how they’ll vote, and how votes will be allocated.

- Distributions. This component includes which LLC owners have given money to the company, how much, and how the company will raise additional cash. It can also specify ownership units in exchange for money.

- Capital Contributions. This component describes how the company will split the profits and business debts among members. It may also include physical property, cash, business assets, among others.

- Membership Changes. This component details the process for adding and removing members from the LLC. This situation can arise when you plan on expanding your business, and a member decides to leave. Bankruptcy or death can be other causes.

- Dissolution. This component specifies circumstances when the company will be dissolved. It also covers what happens to the business assets and more in the event of dissolution.

Step 4: Kickstart Your LLC Business

This is where the action begins!

At this point, you only have a few things left, after which you can officially start making money from your business.

Get an EIN From the IRS

An EIN, or Employer Identification Number, is a nine-digit Social Security number for your LLC required for tax purposes. It’s also known as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN).

You need an EIN to open a business bank account and hire employees. Once you obtain one, you can begin full-fledged operations. You have three options to get an EIN: through the IRS website, by email, or through fax. Doing it online will get you the EIN immediately.

Open Company Bank Accounts

You should separate your personal and business expenses from the very beginning. Otherwise, you may risk losing your LLC’s limited liability protection.

Moreover, opening a business bank account will help you manage and organize your business income and expenses better. Writing checks, building business credit, and making reports are other benefits that are all important for running a successful business.

Remember, every bank will have different requirements. While some will require an EIN, some may not. A business bank account is compulsory for multi-member LLCs, but even otherwise, it’s better to set up your company’s bank account just in case.

Start Your Business

You’re now finally ready to start doing business. Congratulations!

You’ve named and formed your LLC, and you have your EIN and bank account number. I recommend checking whether you need specific permits and licenses before conducting business.

Be sure to keep all your crucial company records up to date, including meeting minutes, financial records and contracts, income tax returns, and employment taxes. Trust me, this will keep you—and the tax authorities—very happy in the long run.