A limited liability company, or LLC, is one of the most simple business entities to set up and offers flexible tax requirements, making them a popular choice for future business owners in Colorado.

However, the process of actually delving into the paperwork and legal requirements can be understandably daunting, especially if you’ve never started an LLC before.

This is why I’ve done hours of research to find out exactly what you need to do to start your LLC in Colorado, so you don’t have to.

Instead, all you have to do is follow these simple steps.

The Easy Parts of Starting an LLC in Colorado

Above all else, choosing a name for your LLC is one of the easiest parts of the process. It can even be fun. Rather than dealing with complicated language and paperwork, coming up with a name for your business gives you the opportunity to get your creative juices flowing. It will also allow you to envision your ideal future for your business and even start formulating your brand identity.

There are some simple legal requirements to be aware of before you get too far in the naming process, though.

Colorado requires LLCs to include some kind of indication that it is an LLC in its formal name. Luckily, you have a little bit of choice when it comes to this, so you’ll still have room for customization. The state allows “LLC, L.L.C., ltd., limited liability co., ltd. liability company, ltd. liability co., or limited” to be options.

In addition, you must choose a name that cannot be confused with any government agency. For example, it is illegal to choose a name that involves “FBI” in any way. In the same vein, certain words must require additional legal paperwork, such as “doctor” or “lawyer.” You can find the list of all of these words here. Understandably, the government would like to make sure that customers are not going to businesses that are falsely advertising such important qualifications.

To begin to come up with your name, look around at some of your favorite stores or businesses for inspiration. Take notice of the brands that are particularly enticing or memorable to you, and then start brainstorming! You’ll have some choices for your future business name in no time.

The Difficult Parts of Starting an LLC in Colorado

The most difficult part of starting an LLC in Colorado is the large volume of paperwork and legal documentation you must get through to finalize the process.

There are many steps to this, with many different kinds of paperwork you must fill out. You have to apply for your name, get an EIN, and submit your Articles of Organization. This is all to get started, and doesn’t even address the taxes that you will soon have to learn about once your LLC is established.

I know this is overwhelming, and a ton of information to learn. Know that you don’t have to understand it all at once, or learn it all in one sitting. The best way to approach it is to just start with one task at a time.

Start with some of the smaller tasks, like applying for your LLC name and registering for an EIN. Then, once those are complete, start approaching some of the more in-depth tasks. Once you take the first step, the rest will seem much less daunting.

Step 1: Choose a Name

Although it may seem obvious, a business isn’t a business without a name! In order to apply for an EIN, get a business bank account, and start advertising, you need to have a name that is compliant with those legal requirements I outlined.

Brainstorm Names

If you’re not sure what you want the name of your business to be, get out a whiteboard or a piece of paper and start putting pen to paper. Although it’s easier said than done, try not to overthink it.

One of the best ways to start this process is to write as many words as you can think of that relate to your business. Let’s say that you want to start a coffee shop. Some possible words related to your business could be roaster, bean, cup, java, caffeine, cafe, and more.

Now that the words are flowing, come up with a few options for your name. Remember to keep it short, simple, and easy to recall. If you’re still having trouble, look online for some business name generators. There are plenty out there to use for free, which could be great sources of inspiration if you get stuck.

Name Availability

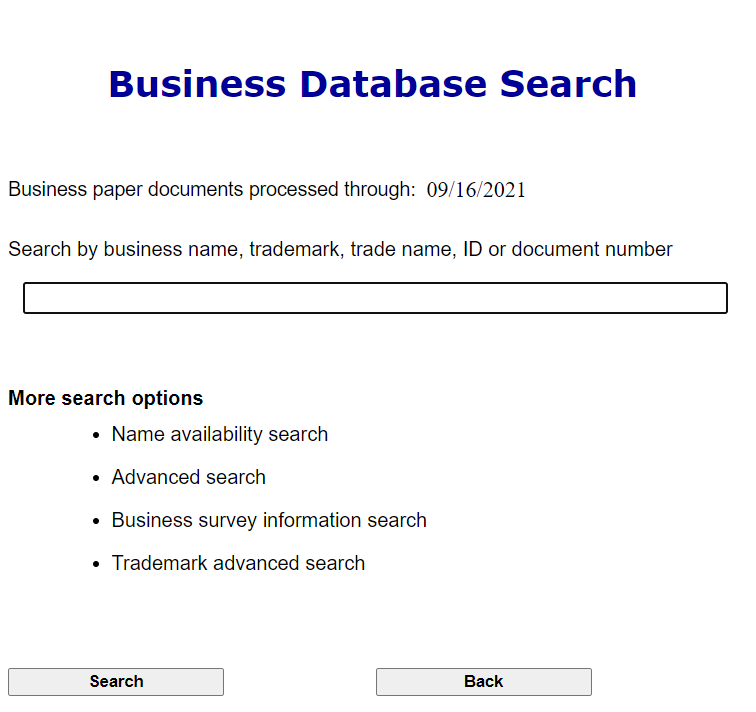

Once you come up with a few names that you like, make sure to check to see if they are available. In order to prevent confusion, Colorado requires that every business has a unique name. You can check to make sure yours is still free by going to the Business Database Search on the Colorado Secretary of State website and plugging in the names you are considering.

If, on the off chance, that all of your business names have already been taken, consider switching around the order of the words. For example, if you wanted to own a coffee shop called Kate’s Coffee Roasters, consider shifting it to Coffee Roasting by Kate.

In the same vein, check to see if there is a domain name available for your business. While this isn’t legally required, I would highly recommend it. In this day and age, having a website is more important than ever. It’s one of the best ways to connect with your audience, build your credibility, and even allow customers to purchase products. To check to see if the name you want is available, the easiest way is to look it up on GoDaddy’s domain name search.

It could also be worthwhile to see if your business name is available on various social media platforms, like Instagram, Facebook, Twitter, and Tiktok. Brand continuity is important, so it would be best to have the same name on each of these.

If you’re not sure you want to commit to a name just yet, you also have the option of submitting a Statement of Revision to reserve it for up to 120 days. However, this does require a filing fee of $25.

Apply for an EIN

Although this won’t be a part of your business’s actual name, an EIN is still vital to your business’s identity. Think of your LLC as a baby. First, you have to give it a name. Next, you need to make sure it has a social security number and a birth certificate. That’s what an EIN does.

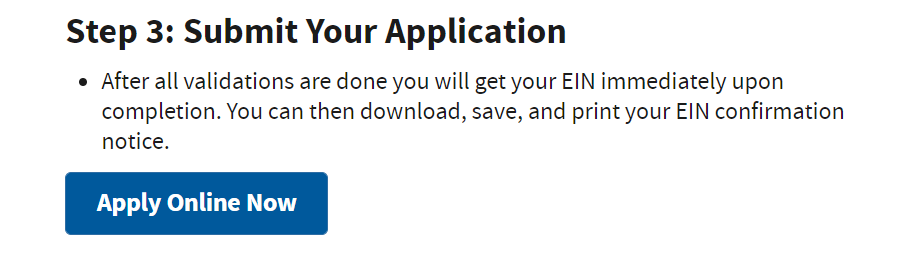

Your EIN is basically proof to the government that your business exists. It is also required to open a business bank account, apply for a business license, file your tax returns, and even apply for traditional loans. It should be one of the very first things you do as you create your LLC.

Click here to apply for one in just a few minutes.

Step 2: Choose a Registered Agent

All LLCs in Colorado are required to have a registered agent, so you’ll want to start the process of finding one as soon as possible.

Understand the requirements of a registered agent

The main duty of a registered agent is to accept any legal mail on behalf of your business. Essentially, your registered agent will be the main point of contact between your business and the Colorado Secretary of State office.

It is required that your registered agent is available during normal business hours in the event that Service of Process (SOP) arrives. SOP includes the delivery of all legal documents, such as subpoenas, complaints, and summons. If your registered agent is not available, there could be legal complications.

Consider your options

Due to the legal requirements, there are a few options to consider when it comes to selecting your registered agent.

First, you can choose to be your own registered agent. While this is one of the easier options to choose at the beginning, be aware that there are some risks involved with it. For example, if you ever get an SOP and you are not present, such as being on vacation, this would allow a court case to start. It would be the same if a friend, family member, or employee was your registered agent.

If you don’t want to worry about this, you can hire a Colorado-based registered agent company to do it for you. This way, someone will always be available through the company to collect any SOPs. However, the one drawback to this option is the cost. Hiring a registered agent company can cost anywhere between $50 and $500 per year.

Step 3: File your Articles of Organization

It is also required by law to file a document called the Articles of Organization with the Colorado Secretary of State. The exact guidelines can be found online, but we will review a few of the main sections here.

Publish your addresses

One of the main pieces that you will need to include are addresses – and you’ll need to specifically clarify what addresses should be used in various scenarios. First, you’ll need to decide what your principal office address will be. This will be the main address for your business. Keep in mind that this information will be published online, so if you choose your home address it will be public.

From there, you’ll need to publish your shipping address, which can be the same as your principal office address. You’ll also need to include your Registered Agent’s office address, which must be located in Colorado, and their mailing address. Finally, every individual involved with filing the Articles of Organization will also lead to list an address for themselves.

Obtain Registered Agent Consent

Your Registered Agent must provide you with a few pieces of information for your Articles of Organization. Like I mentioned before, they will need to provide a business address as well as a mailing address. The business address must be located in Colorado.

Finally, they must explicitly consent to accept this responsibility for your business within the Articles of Organization.

Determine management

Part of this document also includes a description of your LLC’s management system. The Colorado Secretary of State outline for the Articles of Organization gives applicants two options to choose from.

First, you can select that your LLC will be run by people who are specifically chosen to be managers. Essentially, this means that not every member of your LLC will be participating in daily management duties, only a select few. They will be the ones who make daily decisions for the business.

The other option would be to choose a member-managed LLC. In this type, every member of the business would have managerial duties. All members would participate in the decision-making process. In addition, it says that “Where there is a dispute, the vote of a majority generally rules, while certain extraordinary actions require unanimous consent.” Think hard about how you want the structure of what your business will be.

Step 4: Develop your Operating Agreement

Colorado does not currently require an operating agreement, but there are many benefits to creating one. Essentially, this document will legally outline a business’s rules, regulations, and processes – both financial and otherwise.

Formulate your Agreement

Before you start the writing process, you’ll need to think about what you need to include in your agreement. Most operating agreements include the following information.

- The names and addresses of each member in the company

- The purpose of your business

- The roles of each employee and how they will be evaluated

- How ownership is distributed

- How profit is distributed

- How members of the business will be added and let go of

- How you would approach dissolving or transferring the company

I would recommend copying these questions into a blank document and filling them all out before beginning the process of creating your first draft and subsequently filing them with the Colorado Secretary of State.

Write the Operating Agreement

There are many different templates to use when it comes to writing the operating agreement. However, there is no required formatting, as long as it is legible.

In addition, don’t forget to have all of the members of your LLC read and sign the document. Everyone should know what the standards and processes of your business are from the beginning.

Step 5: Educate yourself on annual LLC requirements

While all the legal requirements to register your business have been covered already, it is still important to think about what is coming for your LLC in the future.

Annual Report

LLCs in Colorado must file a report every year. This report will contain any updates involving your business address, mailing address, registered agent’s address, and any filing individuals’ addresses.

Essentially, this is required just to ensure that any parties who need to contact you can find your information with ease.

The annual report can be filed anytime within a three-month window every year. For example, if you establish your business on January 15, you will have to file your taxes between January 1st and April 1st of the following year.

It also costs $10, and you can submit it here.

Yearly Taxes

It is essential to keep on your taxes in order to maintain your legality and credibility. There are three main types of taxes you may need to file.

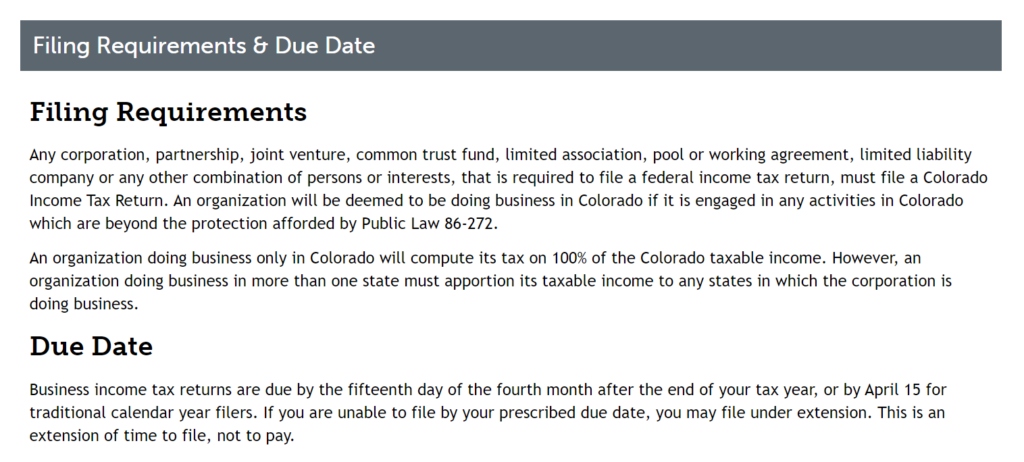

The first is the business income tax. If you are operating your business solely in Colorado, then 100% of your income will be taxed. If you are doing business in more than one state, then your taxes must be divided appropriately.

Second, if your LLC has employees, you will have to pay a different kind of taxes. These are called withholding taxes. Essentially, you will take a portion out of your employees’ paychecks and send it straight to the government.

Finally, the last is sales taxes. More than likely, you will have customers from Colorado purchasing your products. This means that you will have to collect a sales tax, and then send that money to Colorado either every month, quarter, or year.

There are a few other kinds of taxes that are less common, such as excise and fuel taxes and severance taxes. You can learn more about them on the Colorado tax website.