As I’m sure you’ve figured out by now, building a website takes lots of hard work. This is even more so the case for those of you who are creating an ecommerce site.

In addition to your website design, architecture, and all of the standard website elements, you also need to figure out how you’re going to accept payments online.

If you’ve never done this before and you’re just starting some preliminary research, there’s a good chance that you’ll come across two names; PayPal and Stripe. These are both industry leaders in the online payment processing industry.

Both platforms will essentially let your customers buy products or services from your ecommerce shop, but the way that these services are provided are different from platform to platform.

So what’s the difference between PayPal and Stripe? Is PayPal or Stripe better for accepting payments online? These are questions that I hear all of the time when I’m consulting with ecommerce companies.

Truthfully, you probably can’t go wrong with either one. But with that said, I want to give you as much information as possible about each platform so you can decide which one is right for your ecommerce business.

Basics of payment gateways

Before we continue, I want to make sure you understand exactly how PayPal and Stripe work. There are two terms you need to know:

- Payment gateway

- Payment service provider

Payment gateways give ecommerce sites the capability to accept payments online. These gateways are like a middleman between a business payment processor and credit card network. PayPal and Stripe both have payment gateways, which you’ll need if you’re planning to authorize online payments.

A payment service provider (or PSP for short) on the other hand is a bit more involved. PayPal and Stripe are both PSPs as well. They link businesses with merchant accounts by providing the technology required to process online payments, as well as other forms of payment.

PayPal and Stripe group all of their merchants into one account, as opposed to each business having a dedicated account.

Basically, both of these platforms have everything you need to authorize payments as an ecommerce website.

PayPal for ecommerce

Even if you have no prior experience with running an ecommerce website, PayPal is definitely a name that you’ve heard before.

The company has always been known for payment processing. They have the reputation for being a safe and secure way for PayPal users to buy from merchants using a PayPal balance as well as a debit or credit account linked to their PayPal profile.

But PayPal offers much more features and services to accommodate ecommerce shops. So the days of PayPal only being suitable for things like eBay or other P2P payment situations are long behind us. Now they have a variety of plans for launching a business, whether you want to sell online, in person, or both.

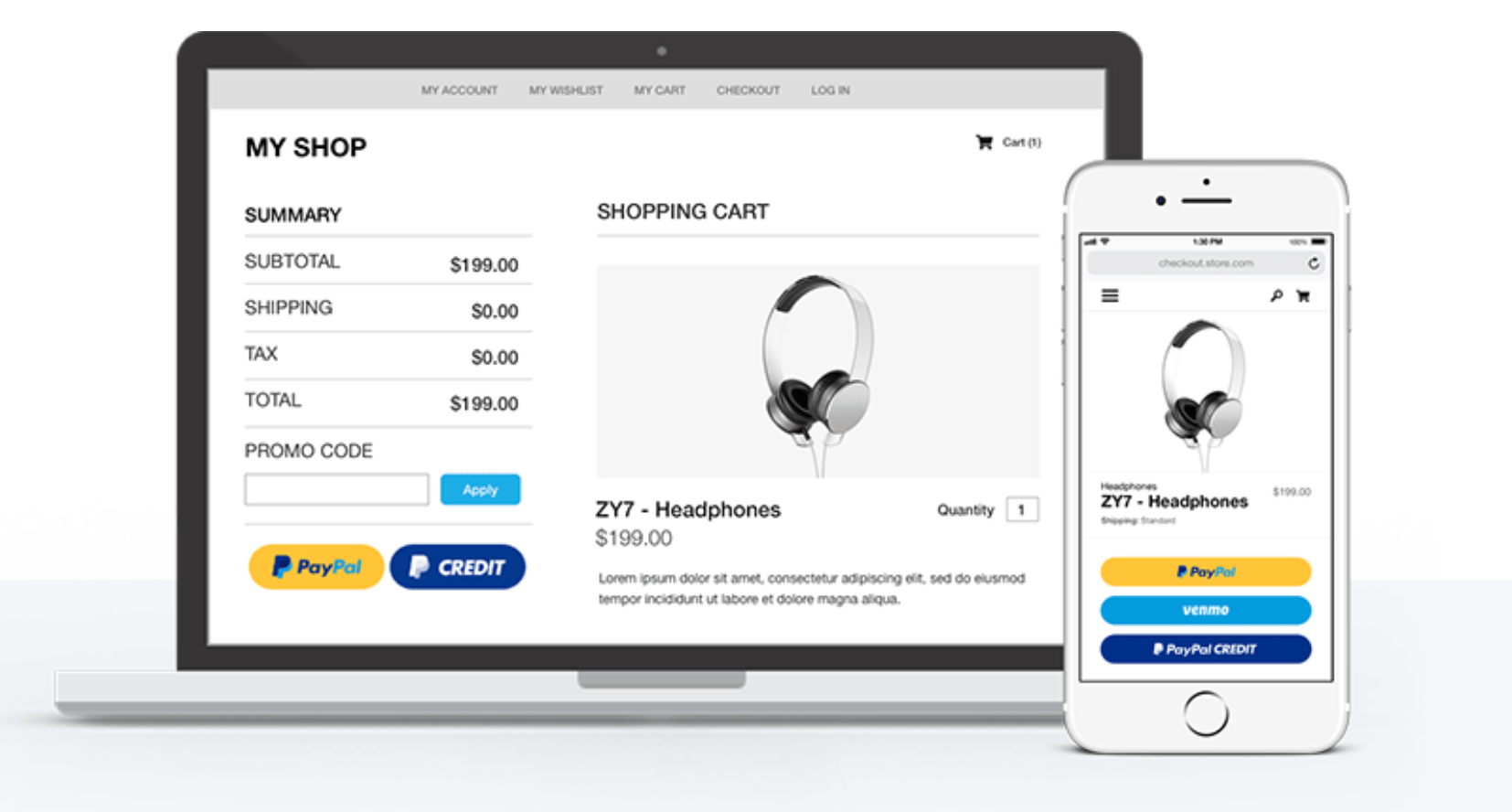

You’ll be able to accept payments from credit cards, debit cards, PayPal credits, PayPal accounts, and Venmo as well.

With PayPal, you can design your own shopping cart. They have customizable solutions that are fully scalable for growing businesses.

PayPal offers three main plans for you to choose from. I’ll cover each one in greater detail below.

PayPal Checkout

For those of you who already have an existing payment processor that you’re using to accept credit cards on your ecommerce site, PayPal Checkout might be a good option for you to consider.

Basically, you can just add the PayPal button to your current payments page with this supplemental plan. It’s easy to integrate with your existing ecommerce platform. Once the button is added, your customers will be able to use PayPal, PayPal credits, or Venmo to buy from your online store.

Conversion rates are up to 82% higher when PayPal Checkout is added to ecommerce sites. That’s because shoppers can complete the purchase in just a click or two, if they have PayPal on their phones or if they’re already logged into PayPal on their computers.

There is no setup fee or monthly fee for this plan. PayPal charges merchants 2.9% + $0.30 per transaction in the United States.

PayPal Payments Standard

The PayPal Payments Standard plan is made for merchants who don’t have an existing payment processor or want to switch providers.

In addition to the PayPal payment options, you’ll also be able to accept Visa, Mastercard, American Express, and Discover cards. Adding the button to your website is as simple as copying and pasting some code. The checkout pages will be hosted by PayPal.

This plan will cost you 2.9% + $0.30 per US transaction. There are no monthly fees or setup fees for the Payments Standard plan.

PayPal Payments Pro

Payments Pro is the top-tier plan offered by PayPal. It allows you to create a fully customizable checkout experience on your ecommerce site.

Unlike the Payments Standard plan, website visitors won’t have to leave your site to complete the checkout process. It also has a mobile-optimized checkout process and easy shopping cart integration. Payments Pro gives you a virtual terminal, which makes it possible to accept payments over the phone as well.

With the added features, this plan costs $30 per month, plus the standard 2.9% + $0.30 per transaction.

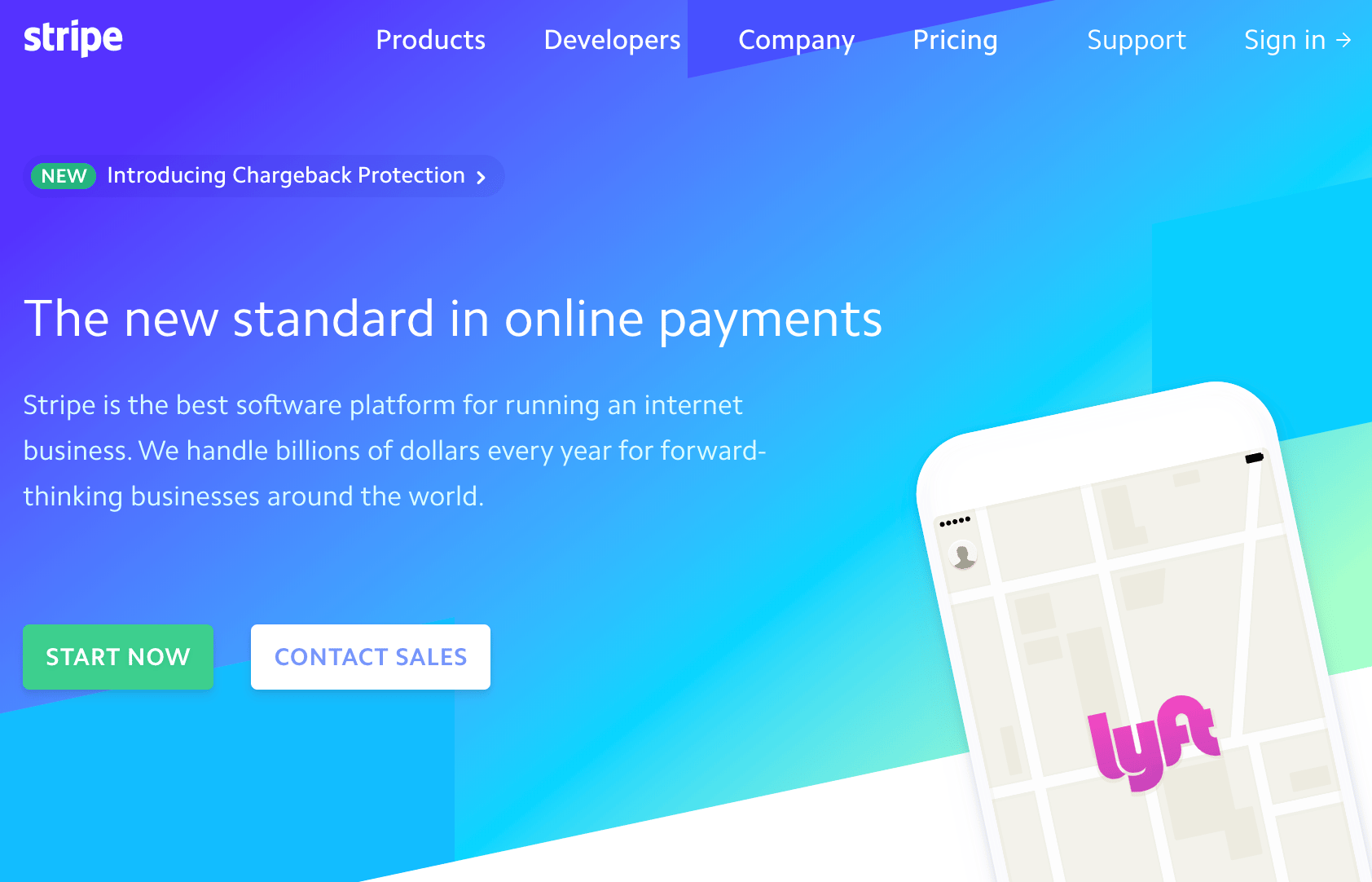

Stripe for ecommerce

Unlike PayPal, Stripe doesn’t have their services segmented into tiered plans. Stripe’s payment processing will be the same, regardless of what features you’re taking advantage of.

With that said, depending on which tools you want to use, it will cost more. But the nice part about this is that you’re only going to be charged for the features that you actually want, as opposed to paying for a plan that includes tools you don’t need.

You can easily add Stripe to your ecommerce site with just one simple integration.

Once that happens, the platform makes it easy for you to accept payments, process them, settle, and reconcile. You’ll be able to process credit cards and ACH transfers both online and via mobile app payments. In fact, big mobile app brands like Lyft are already using Stripe.

Stripe lets you build a checkout process from scratch, or select one of their pre-built templates.

The platform has features for invoicing and setting up recurring payments for subscriptions as well. Let’s take a look at some of those add-on features I was talking about earlier.

Connect

Stripe Connect is made so that marketplaces and platforms can accept money and pay it out to third parties. It supports ecommerce sites, crowdfunding, on-demand businesses, and travel or event platforms.

Take advantage of Stripe’s UI components that are pre-built, or use their tools to create and customize everything on your own.

Sigma

Sigma helps businesses analyze data from stripe using SQL. It can help improve the efficiency of business operations, finance departments, data teams, and product management.

It’s a great way for you to get to know your business better with data. Then you can make necessary adjustments based on your findings. Pricing for Stripe Sigma varies based on the volume of monthly charges.

Atlas

Stripe Atlas is made for those of you who are starting an online business from scratch. The startup toolkit guides you through the process of forming a company, establishing IP ownership, filling out the right documents, and getting a tax ID number from the IRS.

Atlas also sets you up with a new bank account and debit card for your business.

There is a $500 one-time fee for using this service. Services like bank account maintenance, tax filing, and registered agents are not included in the setup fee. These are all billed individually at an annual rate.

Radar

Radar is Stripe’s fraud detection, prevention, and management tool. It’s designed to analyze your data and stop potential fraud cases before they are processed.

They take data from your checkout flows, payments, and financial partners to determine irregularities. Stripe’s partnership with major credit card companies and banks make it possible for them to identify fraudulent charges before you need to make a dispute.

Issuing

Stripe Issuing is made for ecommerce businesses that want to create, distribute, and manage both physical and virtual cards for in-house purposes.

You can use these cards for things like employee expense accounts. It’s supported by Google Pay and Apple Pay as well. It’s also worth noting that Stripe Issuing is a beta program that’s only being offered in the United States.

Terminal

For years, Stripe was better known for its online payment processing. But now they offer Stripe Terminal, which is a POS system for in-person payments.

This is a great option for those of you who have physical store locations in addition to your ecommerce shop. You can get everything you need both online and in-store from the same provider.

PayPal and Stripe compared

As you can see from everything that we’ve covered so far, these two payment service providers are very different from each other. But with that said, they have some things in common as well.

Deciding between PayPal and Stripe will mostly come down to personal preference and exactly what you’re looking for. Let’s take a look at some specific features to see how each platform stacks up against the other.

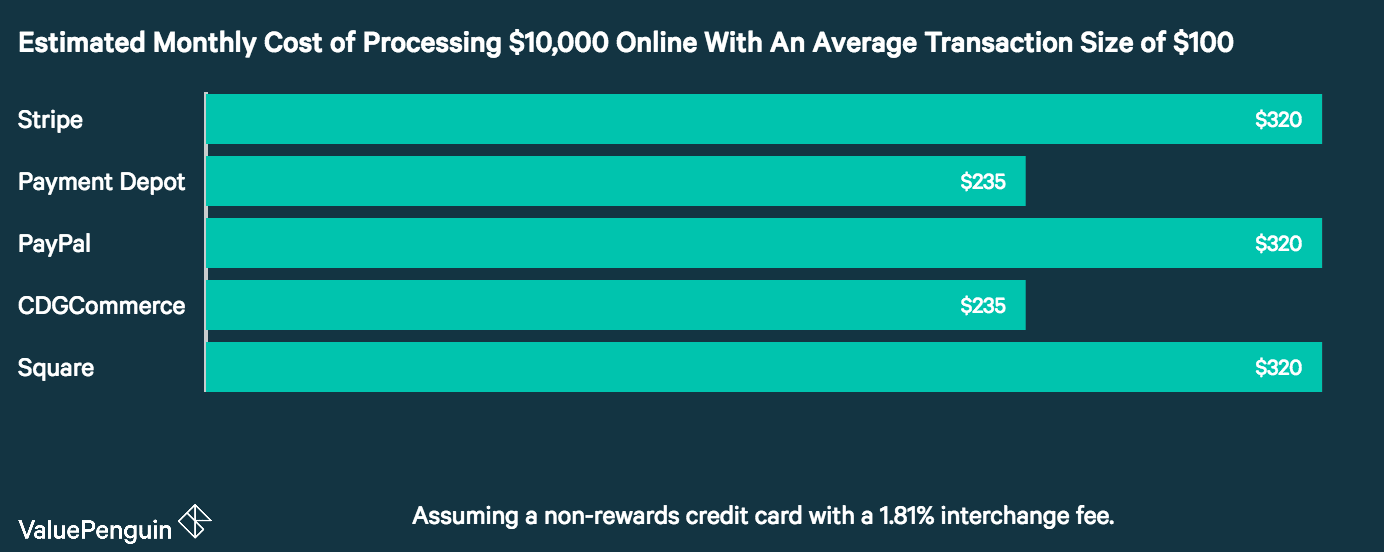

Price

The pricing for PayPal is very straightforward. Only the Payments Pro plan has a monthly fee, while all three plans charge 2.9% + $0.30 per transaction.

Stripe also charges 2.9% + $0.30 per transaction. But they do have custom pricing packages for things like volume discounts and multi-product discounts, which can be useful for those of you who want to take advantage of the products we looked at earlier.

According to research Value Penguin, Stripe is more expensive than PayPal.

It can be argued that Stripe has more to offer, which might justify that higher amount. But when you compare the cost per transaction rates head to head, both services are even.

Support

Both PayPal and Stripe offer excellent customer service and technical support options. They each have their own variation of a help center, with different tools, guides, FAQ, and resources needed to troubleshoot on your own.

You can also get help using:

- Live chat

- Phone

- Social media

Based on all of this, I don’t think that I can definitively say that one platform has better support than the other, so this category is a tie.

Ease of use

Stripe and PayPal are both easy to use. But with that said, Stripe is definitely more developer-friendly, meaning it could present more of a challenge to ecommerce store owners who don’t have that type of technical knowledge.

PayPal is as simple as copying and pasting some code to get set up, which is about as straightforward as it gets. So I’d say PayPal is better for beginners, while Stripe has more customizable options for developers.

Contracts

Both PayPal and Stripe offer pay as you go contracts. So you won’t get locked into anything long term and can cancel at any time. You also won’t be charged a cancellation fee by either service if you decide to do so.

This category is another tie.

Reputation

PayPal always had a reputation for its P2P payments through third-party platforms like eBay. Although now they’re taking aim at providing more services for ecommerce sites. Stripe has always been known for ecommerce solutions, but not offers POS solutions as well.

Both of these companies have the tools, services, and resources you need to run an ecommerce shop. They both have exceptional online reviews as well.

PayPal is the most popular digital wallet in the United States and is the most popular mobile payment method in North America. There are more than 277 million PayPal users worldwide.

Based on these numbers, I’d have to give the edge to PayPal in terms of reputation. But by no means am I saying that Stripe doesn’t have an excellent reputation as well.

Conclusion

If you have an ecommerce shop and you’re trying to figure out the best payment service provider, both PayPal and Stripe are top options to consider.

At the end of the day, it’s going to come down to personal preference. Based on the information I gave you above, you can decide which plan meets your needs the most.

I can’t definitively give an edge to one platform over the other. I’d strongly recommend both options.

For those of you who still aren’t sold on PayPal or Stripe, you can review my guide on the best payment methods for your ecommerce site to find some alternative solutions.